Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 17, 2022

US Weekly Economic Commentary: Inflation pressure

Inflation remains high, keeping pressure on the Federal Reserve to raise interest rates forcefully.

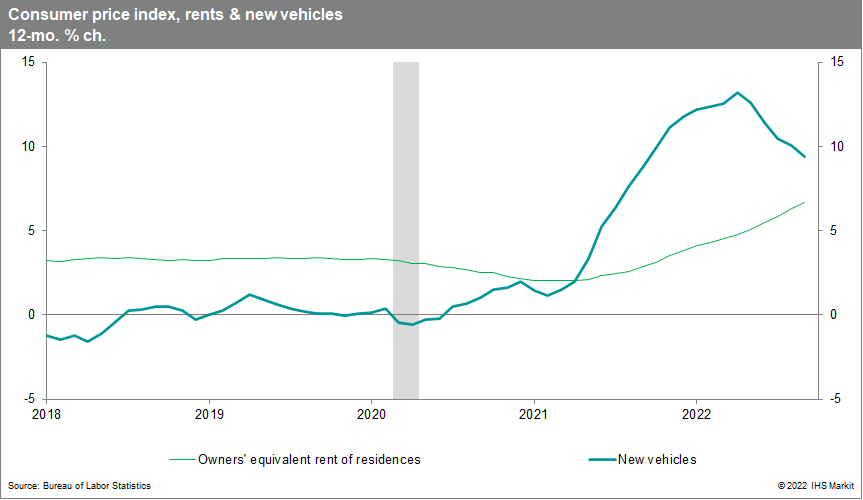

In twelve-month changes, overall Consumer Price Index (CPI) inflation was 8.2% in September and core CPI inflation rose to a four-decade high of 6.6%. Based on detailed data in the CPI, we estimate that the core personal consumption expenditures (PCE) price index rose 5.1% over the 12 months through September.

Rent inflation, which has large weights in both CPI and PCE inflation, averaged approximately 9% over the last three months, more than double the pre-pandemic norm. New agreements reflect a softening in rents, foreshadowing a reduction next year in rent inflation in the CPI, which is based on average rents (both new and existing agreements). That will contribute to an eventual reduction in core inflation.

The disinflationary impulse from lower rent inflation is a few quarters into the future and, by itself, will not be sufficient to support a full reduction of inflation to the Fed's 2% target. The Fed will be forced to raise interest rates to support tight financial conditions and a softening in demand in pursuit of lower inflation. The Federal Open Market Committee (FOMC) will respond on Nov. 2 with another super-sized rate hike of 75 basis points, bringing the target for the federal funds rate to a range of 3¾% to 4%.

Additional rate increases at subsequent meetings in December and early next year are virtually assured. We expect that declines in core inflation and indications of softening in labor markets will prompt the Fed first to slow and then to pause rate hikes next spring after lifting the target funds rate to a range of 4½% to 4¾%.

Mild recession likely

Decisions on interest rates will be influenced by incoming data on inflation and other developments pertaining to the inflation outlook, so there are risks to the forecast for Fed interest-rate policy. The likelihood of a recession sparked by Fed tightening will not be enough to keep the Fed from continuing to raise interest rates as it strives to lower inflation to its 2% target.

We expect the US to fall into a mild recession beginning in the fourth quarter, when we expect GDP to contract at a 1.0% annual rate. This would follow (our estimate of) a 2.4% increase in the third quarter when a large increase of net exports contributed approximately 3.0 percentage points to GDP growth.

We expect a substantially smaller growth contribution from net exports in the fourth quarter, alongside declines in residential and business investment and meager growth of real consumer spending. We project that GDP will continue to decline during the first half of next year, resulting in a cumulative decline over 3 quarters of 1.1%.

This week's US economic releases:

- Industrial production (Oct. 18): We estimate 10.6 million units for vehicle assemblies.

- New residential construction (Oct. 19): We estimate 1,480 thousand units for housing starts in September, down from 1,575 thousand units in August. This would leave starts in line with what has been a weakening trend this year, as soaring mortgage rates have weighed on residential construction activity. We estimate 1,570 thousand units for housing permits in September, up slightly from 1,542 thousand units in August.

- Existing home sales (Oct. 20): We estimate 4,640 thousand units in September, down from 4,800 thousand units in August. This would continue a weakening trend, as is evident in several other housing market indicators.

- Leading economic index (Oct. 20): A decline would mark the seventh consecutive monthly drop and would be consistent with our view that the US economy is about to tip into recession.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economiccommentary-inflation-pressure.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economiccommentary-inflation-pressure.html&text=US+Weekly+Economic+Commentary%3a+Inflation+pressure%c2%a0+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economiccommentary-inflation-pressure.html","enabled":true},{"name":"email","url":"?subject=US Weekly Economic Commentary: Inflation pressure | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economiccommentary-inflation-pressure.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Weekly+Economic+Commentary%3a+Inflation+pressure%c2%a0+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economiccommentary-inflation-pressure.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}