Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 17, 2023

US Weekly Economic Commentary: Some good news on inflation

While last week was relatively light for data releases with direct implications for our GDP tracking, there were several noteworthy releases on inflation.

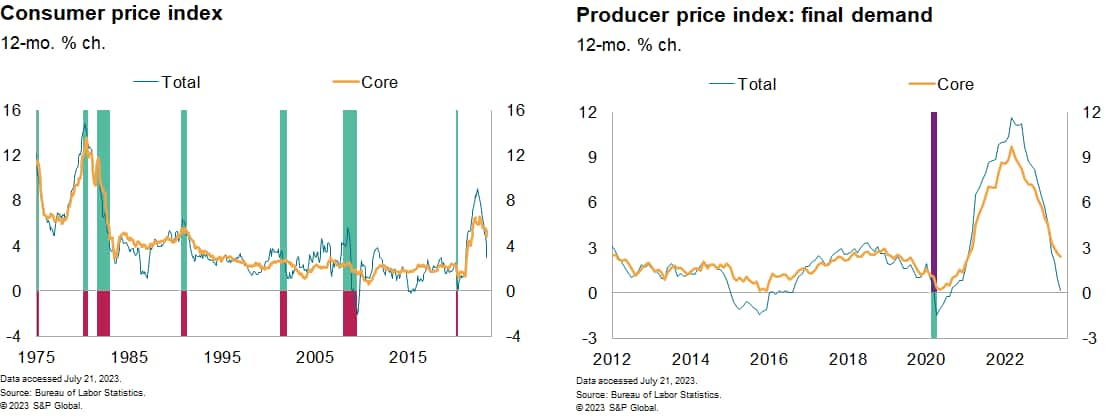

Consumer prices continued to moderate through June, with the 12-month change in the headline consumer price index easing to 3.0%, the lowest reading since March 2021 and well below the recent peak of 9.1% last June. The recent softening in the headline index in part reflects the softening in energy prices relative to peak prices last summer (the CPI for energy is down 16.7% from last June).

Excluding the effects of changes in food and energy prices, "core" consumer prices are also easing, although at a slower pace: The 12-month change in this measure dropped 0.5 percentage point in June to 4.8%, the lowest reading since October 2021. Based on our processing of the CPI data for June, we estimate that the core price index for personal consumption expenditures rose 0.2% in June and that its 12-month change edged down 0.1 percentage point to 4.5%.

Producer prices also continued to moderate through June, as did the prices of imports and exports. Short-term inflation expectations in the University of Michigan Consumer Sentiment Survey ticked higher in July, although they remain well below the peak early last year. Long-term inflation expectations also edged higher and remain within the range they have fluctuated within for the past 18 months.

A cool Fed

The Federal Open Market Committee (FOMC) will meet in a little under two weeks' time with their next policy decision to be announced July 26. The blackout period for communication from participants prior to that meeting began July 15, meaning they will not have had much time to communicate how they are reacting to this week's inflation data.

Although the news was generally good on the inflation front this week, policymakers have emphasized throughout this tightening cycle the importance of not overreacting to a single month's worth of data. This very sentiment has been expressed by those on the Committee we have heard from in the past couple days — President Mary Daly of the San Francisco Fed and Governor Christopher Waller. They will be wary of easing off the brake prematurely, as allowing inflation to re-emerge would ultimately require an even more punitive policy response than would otherwise be necessary.

We expect the FOMC to raise its policy rate by another 25 basis points at the upcoming July meeting, then skip again in September before hiking one last time by another 25 basis points in November, bringing the funds rate to a range of 5.50-5.75%. Rate cuts are unlikely to occur until late spring of 2024.

This week's economic releases:

- Retail and food services sales (July 18): We estimate total retail and food services sales rose 0.4% in June, while excluding motor vehicles and parts dealers, sales rose 0.1%.

- Industrial production (July 18): We estimate vehicle assemblies declined to 11.0 million units in June from 11.4 million units in May.

- New residential construction (July 19): We estimate the annualized pace of housing starts declined in June to 1,470 thousand units. This would only partially reverse the surge in May and would be consistent with the view that housing activity has reached a bottom.

- Existing home sales (July 20): We estimate existing home sales declined in June to an annual rate of 4,163 thousand units. This would be the third decline in the last four months following a jump in sales in February. While volatile in recent months, the estimated level of sales in May would be close to recent averages and would remain well below levels from early 2022, prior to sharp increases in mortgage rates.

- Leading Economic Index (July 21): A decline in the Conference Board's Leading Economic Index in June would continue a run that began in April of last year and would suggest an elevated risk of recession in the near term.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-some-good-news-on-inflation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-some-good-news-on-inflation.html&text=US+Weekly+Economic+Commentary%3a+Some+good+news+on+inflation++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-some-good-news-on-inflation.html","enabled":true},{"name":"email","url":"?subject=US Weekly Economic Commentary: Some good news on inflation | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-some-good-news-on-inflation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Weekly+Economic+Commentary%3a+Some+good+news+on+inflation++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-some-good-news-on-inflation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}