Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 21, 2023

US Weekly Economic Commentary: Odds of more Fed tightening

A series of strong economic reports over the past week led us to significantly revise up our forecast of GDP growth in the third quarter. A surprisingly strong retail sales report for July was responsible for most of the upward revision as consumers continue to spend freely, apparently feeling financially secure in a tight labor market.

Adding to households' sense of financial security, real wages have been growing again for roughly the past year, following a two-year decline related to COVID-driven mix changes in the workforce and surging prices. Over the past couple of weeks, as signs of this strength emerged, financial conditions have worsened, in the form of rising interest rates and slumping stock values. That is likely to provide a new headwind that will slow growth of consumer spending in the near term. Nevertheless, the US economy carries significant momentum into the second half of this year.

Given that momentum, the currently tight labor markets, and inflation that is still too high, it is very likely we will see one or more Fed rate hikes in this cycle. While there has been welcome news in the form of declining inflation — in July, the core CPI on a three-month change basis (annualized) slowed to 3.1%, down from 5.1% over the three months ended April — inflation remains too high relative to the Fed's 2% target.

With the labor market still very tight, and with growth of GDP and employment unlikely to allow any meaningful easing in labor market conditions anytime soon, the Fed will need to engineer a sufficient tightening of financial conditions to squeeze growth and inflation lower. To the extent financial markets (through lower stock prices and higher rates) and/or banks (through more restrictive lending) do the Fed's work for it, additional rate increases may be limited. The Fed's policy making body, the Federal Open Market Committee (FOMC), meets next in September, and we expect no hike at that meeting but do expect another hike at the November meeting of the FOMC. The takeaways from the minutes from the July meeting of the FOMC were consistent with this view. Odds are tilted toward higher, as opposed to lower, rates relative to our forecast.

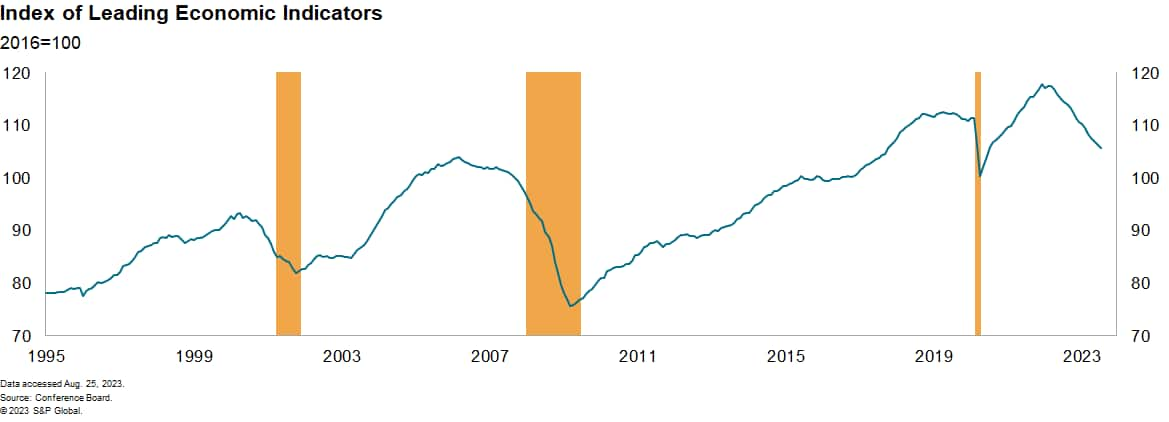

While recession risks have eased, they have not disappeared. The Leading Economic Index (LEI) from the Conference Board fell for the 16th consecutive month in July. This string of declines historically has been associated with a recession, and the Conference Board is calling for a shallow recession starting in the fourth quarter. Given the momentum evident in the economy as of July, it would take a sharp worsening in financial conditions to see the economy enter a recession as early as the fourth quarter. But it could still happen.

This week's economic releases:

- Existing home sales (Aug. 22): We estimate that existing home sales declined in July to an annual rate of 4,142 thousand units, which would extend a run of recent declines. Elevated mortgage rates have weighed on existing home sales, keeping the supply of existing homes for sale tight and boosting new home construction.

- New home sales (Aug. 23): We estimate new home sales were unchanged in July at an annual rate of 697 thousand units. Elevated mortgage rates may soon weigh on new home construction, too; the National Association of Homebuilders have become less optimistic recently and have cited rising mortgage rates as a concern.

- Durable goods orders (Aug. 24): We estimate orders for nondefense capital goods excluding aircraft were unchanged in July.

Learn more about our economic forecasts and insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-odds-of-more-fed-tightening.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-odds-of-more-fed-tightening.html&text=US+Weekly+Economic+Commentary%3a+Odds+of+more+Fed+tightening+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-odds-of-more-fed-tightening.html","enabled":true},{"name":"email","url":"?subject=US Weekly Economic Commentary: Odds of more Fed tightening | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-odds-of-more-fed-tightening.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Weekly+Economic+Commentary%3a+Odds+of+more+Fed+tightening+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-odds-of-more-fed-tightening.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}