Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 20, 2023

US Weekly Economic Commentary: ‘Couple years out’

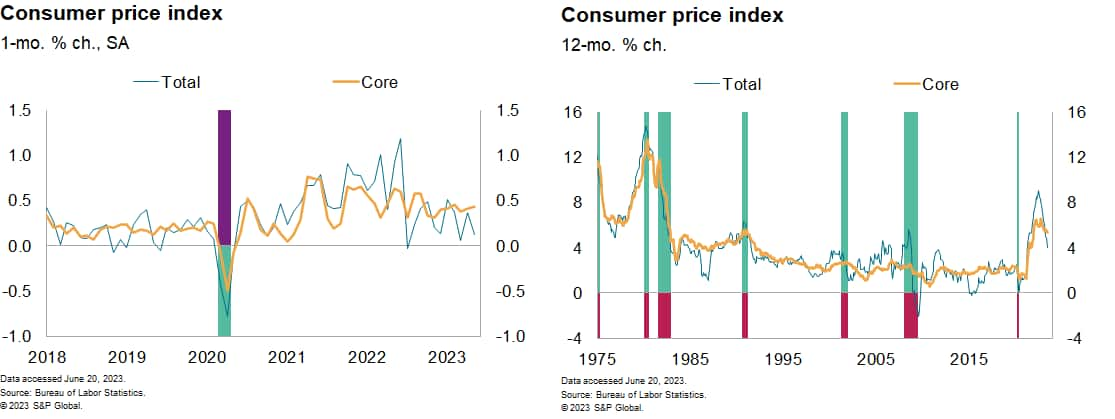

In May, the prices of nonfuel imports and nonagricultural exports continued to slip. The producer price index, dragged down by sharp drops in the prices of food and energy, declined 0.3%. The consumer price index (CPI), restrained by a steep decline in the price of gasoline, rose just 0.1%. However, the core CPI — which excludes the volatile prices of food and energy that are little influenced by monetary policy in the near term — rose 0.4% for the third consecutive month, and the fifth time in the last six months.

The price of core goods jumped 0.6% for the second consecutive month, and has accelerated sharply since November. This suggests that disinflation driven by healing supply chains may have run its course, even as tight labor markets continue to pressure labor costs economywide. Rents continued surging. Bottom line: Disinflation has stalled, with inflation remaining unacceptably above the Fed's long-term 2% objective.

As expected, on June 14, the Federal Open Market Committee announced it was maintaining its policy rate in the range of 5 - 5.25% while it assesses both the effects of the monetary tightening to date and the potential for a further tightening of credit conditions following the collapse of Silicon Valley Bank in March.

The Committee retained a tightening bias, and both the announcement and Chair Powell's subsequent remarks to the media strongly suggested that a further increase in rates is to be expected. This was reinforced by the Committee's updated Summary of Economic Projection which showed, for 2023, an upward revision to GDP growth, a downward revision to the unemployment rate, an upward revision to the core inflation rate and — most importantly — significant upward revisions to the "appropriate" path of the policy rate all the way through 2025.

Furthermore, Chair Powell strongly discouraged the notion of an early reversal of policy, suggesting it is a "couple years out." Investors (finally!) seemed to accept the message. By the end of the week, the timing of first cut in rates fully priced into markets had shifted from the second half of this year to the first quarter of next year.

This week's economic releases:

- Existing home sales (June 22): We estimate existing home sales slipped in May to an annual rate of 4,180 thousand. This would be the third consecutive decline following a jump in sales in February. While volatile in recent months, the estimated level of sales in May would remain well below levels from early 2022, prior to sharp increases in mortgage rates.

- Leading Economic Index (June 22): If the Conference Board's Leading Economic Index dipped in May, this would continue a run of declines that began in April of last year and would suggest an elevated risk of recession in the near term.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-couple-years-out-fed-rate-cuts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-couple-years-out-fed-rate-cuts.html&text=US+Weekly+Economic+Commentary%3a+%e2%80%98Couple+years+out%e2%80%99+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-couple-years-out-fed-rate-cuts.html","enabled":true},{"name":"email","url":"?subject=US Weekly Economic Commentary: ‘Couple years out’ | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-couple-years-out-fed-rate-cuts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Weekly+Economic+Commentary%3a+%e2%80%98Couple+years+out%e2%80%99+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-couple-years-out-fed-rate-cuts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}