Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 25, 2023

US Weekly Economic Commentary: Consumer resilience keeps economy growing

On balance, the takeaway from a relatively full calendar of data this past week is that the US economy continued to hum along in the second quarter and near the US's "potential" growth rate — the pace that can be sustained from the supply side of the economy.

The resilience of the economy and what that means for employment, wages, and inflation going forward suggests to us that two more Fed rate hikes will be needed to wrestle inflation back to the Fed's 2% target quickly enough to satisfy Fed policy makers. We expect the first of those hikes at next week's meeting of the Federal Open Market Committee.

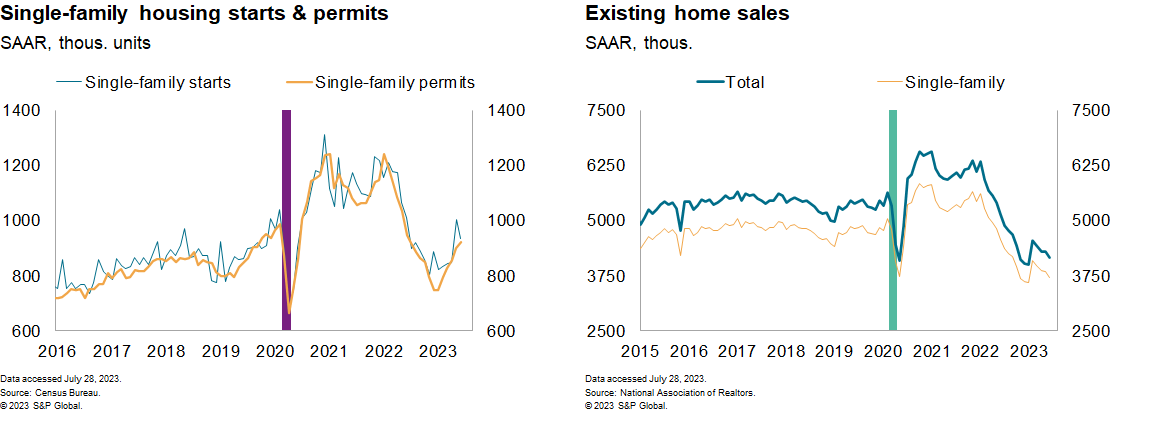

Several indicators on the health of the housing sector painted a mixed picture. Homebuilders' expectations in July edged higher, and why not? Home prices are rising again, and materials prices are well below recent peaks. Similar sentiment likely drove a solid 2.2% increase in single-family housing permits in June. Multi-family permits on the other hand plunged nearly 13%, and both single- and multi-family starts fell in June. Existing home sales (annualized) slipped in June to a level 2.2 million (34.3%) lower than 17 months ago.

While it appeared that the housing sector, which had weakened over most of last year, had put in a bottom over recent months, the subsequent sharp rise in mortgage rates is likely to take a toll. The 30-year conventional mortgage rate registered 6.78% in the latest week, up from an average of 6.27% in January. We expect the overall slowing in the economy and the higher level of rates to result in slumping home construction over the next few quarters.

This week's economic releases:

- New home sales (July 26): We estimate the annualized pace of new home sales declined in June to 717 thousand units from 763 thousand units. This would leave new home sales in line with a firming trend. While mortgage rates remain elevated and affordability remains low, new home sales and construction have been propped up recently by a paucity of existing homes for sale.

- Durable goods orders (July 27): An increase in manufacturers' orders for durable goods in June would be the fourth consecutive monthly increase and would leave orders in line with a firming trend. We estimate that prices for manufactured durable goods have been firming as well in recent months, but not as much as nominal orders. We estimate that orders for nondefense capital goods excluding aircraft slipped 0.3% in June.

- Nominal goods deficit (July 27): We estimate the nominal goods deficit narrowed in June to $91.0 billion from $91.9 billion in May.

- Q2 GDP estimate (July 27): We estimate that GDP advanced at a 1.7% annual rate in the second quarter. This would represent a material improvement over expectations from just two months ago, when GDP was forecast to be roughly flat in the second quarter. The US economy has remained resilient.

- Employment cost index (July 28): While the unemployment rate remains low, the job openings rate has declined from its peak, implying less upward pressure on wages from employers seeking to fill open positions.

- Personal income and outlays (July 28): We estimate nominal personal income rose 0.5% in June, while nominal personal consumption expenditures (PCE) rose 0.4%. A solid increase in personal income was portended by the June employment report, which included increases in both the index of aggregate weekly hours (0.4%) and average hourly earnings (0.4%). We also estimate that the core PCE price index rose only 0.2% in June. This would be the lowest reading in several months.

Learn more about our economic insights and analysis

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-consumer-resilience-economy-grow.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-consumer-resilience-economy-grow.html&text=US+Weekly+Economic+Commentary%3a+Consumer+resilience+keeps+economy+growing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-consumer-resilience-economy-grow.html","enabled":true},{"name":"email","url":"?subject=US Weekly Economic Commentary: Consumer resilience keeps economy growing | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-consumer-resilience-economy-grow.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Weekly+Economic+Commentary%3a+Consumer+resilience+keeps+economy+growing+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-consumer-resilience-economy-grow.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}