Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 26, 2023

Key US states emerge in domestic reshoring of semiconductor manufacturing

The COVID-19 pandemic laid bare the vulnerabilities of the global semiconductor supply chain and sparked a domestic reshoring effort that has led to dozens of new microchip development projects in the United States. These projects are creating jobs and investment on a large scale.

The passage of the CHIPS and Science Act in 2022 has accelerated this investment. The law provides $52.7 billion directly for semiconductor research, development, and manufacturing, as well as a 25% tax credit for related capital expenses. Since 2020, more than 60 high-profile projects have been announced in the United States, with individual company estimates totaling $215 billion in new investment and more than 47,000 new industry jobs. These new projects so far are mostly concentrated in established semiconductor hubs in Arizona and Texas, although ample land — a key component for semiconductor facilities — plus state incentives have drawn sizable investments to less traditional locations.

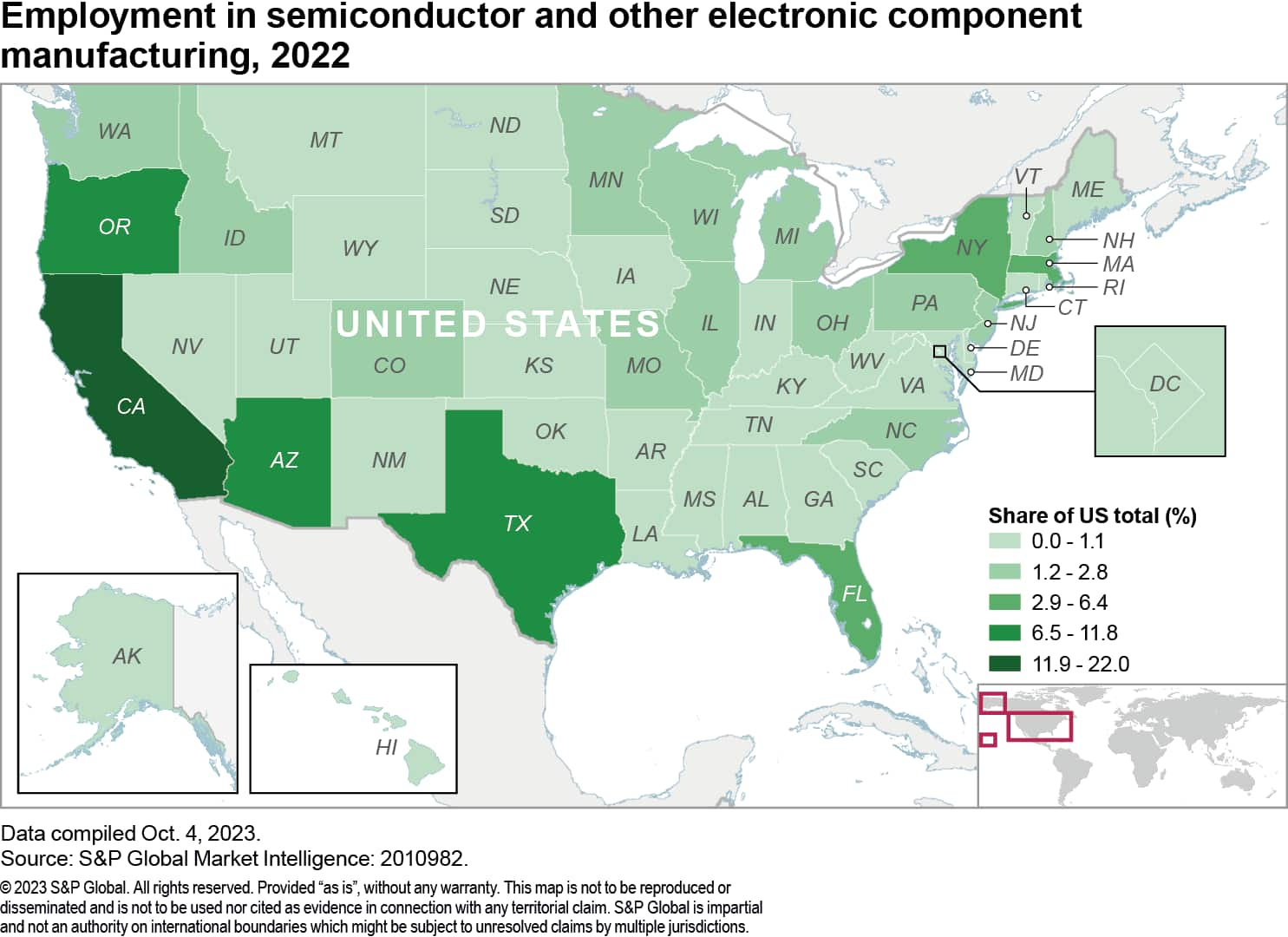

Four states — California, Texas, Oregon, and Arizona — account for nearly half of total semiconductor manufacturing employment in the US. With their considerable ecosystems already in place, as well as a substantial amount of available land, Arizona and Texas combined account for more than half of the total dollars announced and 35% of the expected jobs. California and Oregon have drawn considerably less investment over the past three years because of their higher costs of doing business (both regulatory and financial) and less available land relative to Texas and Arizona. The two states have received only about 3% of total investment dollars and 7% of the expected jobs.

Outside of those four states, investments in the domestic semiconductor industry have been spread across several areas without prominent existing chip ecosystems, with New York so far seeing the largest inflows. The Midwest has also drawn several large projects, with a combined $26 billion going to new developments in Indiana, Kansas and Ohio that are expected to bring 7,600 new jobs to the region. One asset these locations have in common is the vast plots of open land required for these large projects. At least two of the recently announced developments will be located on sites of more than 1,000 acres, while another calls for a 1 million-square-foot headquarters and production facility.

State incentive programs have been key to attracting projects to locations both new and established. Signed into law shortly after the federal CHIPS Act, New York's Green CHIPS law provides for up to $10 billion in tax credits for semiconductor facilities that would create at least 500 jobs. Similarly, Ohio's offer of $2.1 billion in grants and tax credits contributed to winning a multi-billion-dollar project in Columbus. Not to be outdone, Texas recently passed its own $1.4 billion CHIPS Act of to encourage economic development related to semiconductors and further cement its status as a prime domestic chip hub.

In addition to state incentive programs, the US CHIPS and Science Act included a provision to create at least 20 new Tech Hubs across the country, which has the potential to draw further semiconductor investment to less traditional locations. The act authorizes $10 billion to invest in these yet-to-be-determined hubs, with promoting geographic diversity one of the stated goals of the program. According to the Economic Development Agency, no fewer than one-third of the hubs will be in small and rural communities, and at least one hub will be headquartered in a low population state (defined as a state without an urbanized area with a population greater than 250,000).

Over the life of the CHIPS and Science Act, emerging locations will continue to draw moderate investment due to a combination of abundant land, state incentives, and federal encouragement, while Arizona and Texas stand to further solidify their status as domestic semiconductor hubs, leveraging their sizable industry bases and incentive programs of their own. Indeed, recent announcements make it clear that these two established ecosystems in particular will continue to be central to the industry for the foreseeable future.

Learn more about our economic data and insights

Read about the US electric vehicle manufacturing race

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-states-win-domestic-reshoring-semiconductor-manufacturing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-states-win-domestic-reshoring-semiconductor-manufacturing.html&text=Key+US+states+emerge+in+domestic+reshoring+of+semiconductor+manufacturing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-states-win-domestic-reshoring-semiconductor-manufacturing.html","enabled":true},{"name":"email","url":"?subject=Key US states emerge in domestic reshoring of semiconductor manufacturing | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-states-win-domestic-reshoring-semiconductor-manufacturing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Key+US+states+emerge+in+domestic+reshoring+of+semiconductor+manufacturing+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-states-win-domestic-reshoring-semiconductor-manufacturing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}