Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 06, 2023

US stagflation risks rise as service sector falters alongside manufacturing downturn

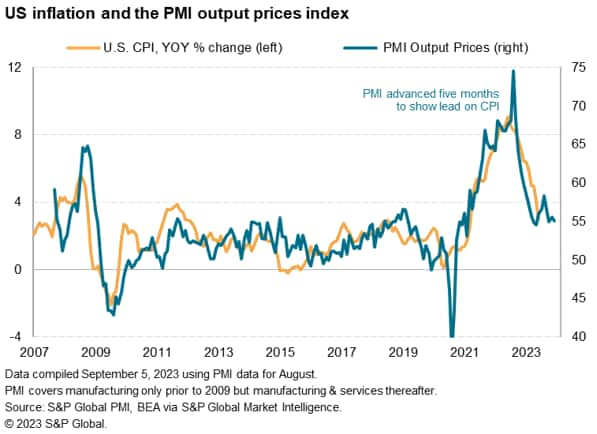

The latest PMI survey data from S&P Global send a signal of rising stagflation risks, as stubborn price pressures are accompanied by a near-stalling of business activity.

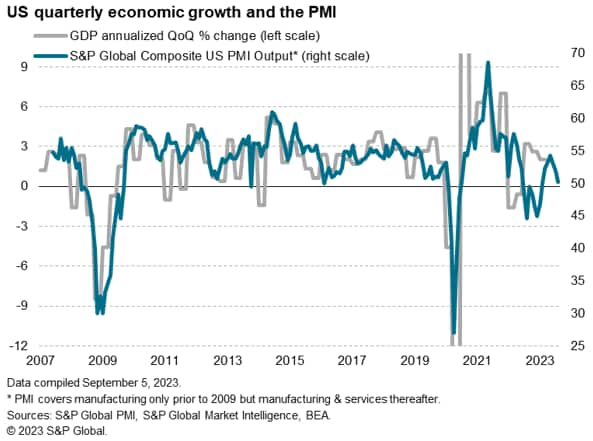

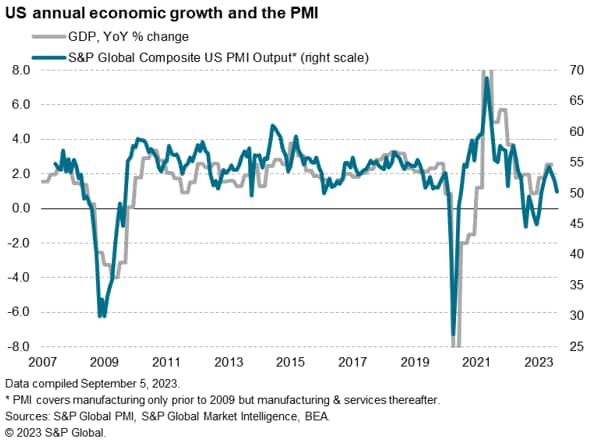

The PMI numbers for the third quarter so far point to a faltering of economic growth after a robust second quarter, as a renewed manufacturing downturn is accompanied by a deteriorating picture in the service sector.

While a post-pandemic revival of travel, recreation and hospitality spend contributed to an improved economic performance in the spring and early summer, this tailwind is losing momentum. Companies increasingly report customers to have become reticent to spend amid gloomier prospects as higher interest rates take their toll. However, financial services and business services providers are also increasingly feeling the pinch from weakening demand.

Persistent wage growth is meanwhile being accompanied by renewed upward pressure on energy, fuel and transport costs, as well as some broader firming of materials prices, driving cost growth higher. Competitive forces have kept a lid on selling price inflation, but the rate of increase of service sector charges remains elevated to the extent that consumer price inflation is likely to remain stubbornly above the Fed's target in the coming months.

Near-stalled business activity

Growth of business activity in the US came close to stalling in August, according to the final reading of S&P Global's US PMI. The survey's Composite Output Index, covering private sector services and manufacturing, fell from 52.0 in July to 50.2, remaining just a whisker above the 50.0 no change level to register the weakest expansion since February.

The underlying trend in the economy signaled by the PMI has closely matched that indicated by the smoother annual growth rate of GDP. As such, the clear signal from the PMI is that the underlying pace of business growth in the US has slowed midway through the third quarter after a robust second quarter.

Demand now falling for both goods and services

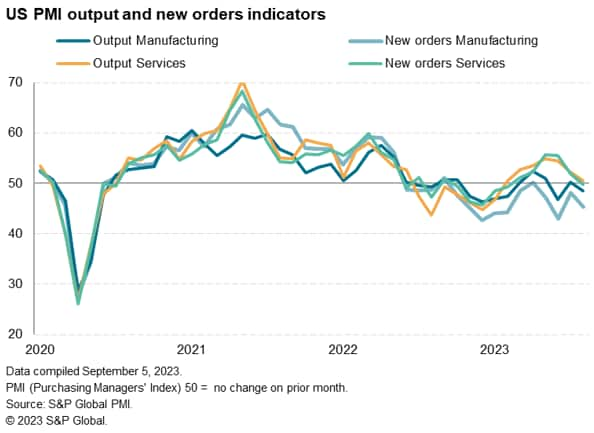

Looking at the broad split of the data, manufacturing output slipped back into decline after a brief resumption of growth in July. The goods-producing sector has now reported a broad deterioration in the production trend since mid-2022, broken by a few months of modest growth in 2023. Orders received by factories have been falling at a faster rate than output over this period, leading the production decline and fueling the risk of further contractions in output in the near-term.

However, the biggest changes in recent months have been witnessed in the service sector. A revival of service sector business activity in the spring drove the overall improving economic picture in the second quarter, but this expansion - which peaked in May when growth hit a 13-month high - showed further signs of fading in August. The resulting overall expansion of services activity in August was only marginal and the weakest recorded since the sector's recent revival began in February.

There was an even gloomier signal from the survey's new orders data, which showed new business inflows into the service sector falling (albeit marginally) in August for the first time since February, contrasting sharply with the particularly strong surge in demand recorded in May and June.

Spring demand revival for services fades

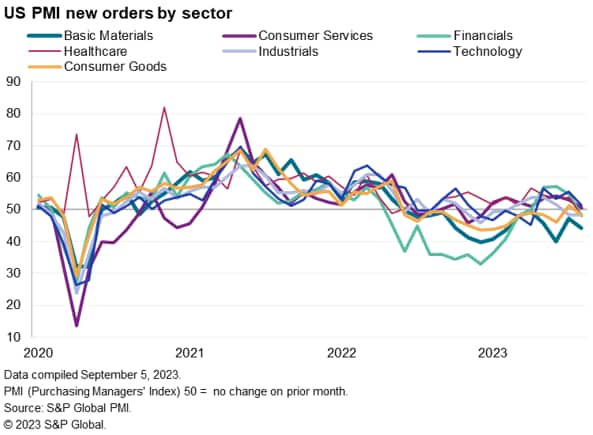

Drilling deeper into S&P Global's unique sector PMI data for the US, the new orders data reveal some particularly noteworthy trends.

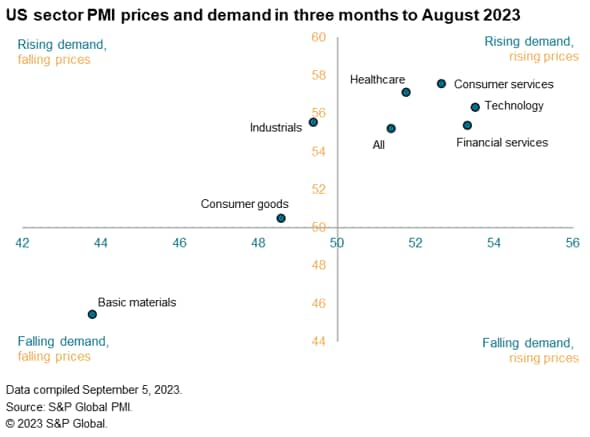

First, the manufacturing downturn is being led by basic materials, where demand has fallen especially sharply in recent months as dwindling final demand has been exacerbated by companies reducing their stockpiles of raw materials amid fewer supply scarcities and sluggish sales.

Industrials (which includes business service providers) reported falling inflows of new business for a second month running in August, suffering a knock-on effect from the manufacturing downturn.

Consumer goods producers have also reported especially subdued demand over the past year and into August, blamed on the rising cost of living and post-pandemic demand switching to services. However, July saw a brief return of modest demand growth and orders fell only slightly in August amid some reports of reduced downward pressure on demand from high prices.

The biggest change in recent months has meanwhile been seen for financial services, demand for which revived sharply earlier in the year but slipped back into decline for the first time in five months in August. Similarly, demand for healthcare fell for the first time for a year, and demand for consumer services, which had also revived in the spring, came close to stagnating and registered the weakest performance so far this year.

That left technology as the only sector recording any material increase in demand in August, and even here the rate of growth fell to the lowest since April.

Stubborn inflation

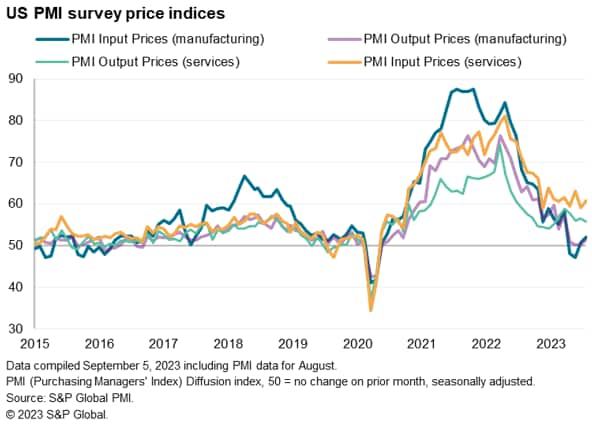

From an inflation perspective, the slowing of business activity growth and downturn in demand have lowered inflation pressures, but there are signs of some price stickiness persisting into August, and even cases of price pressures rising, albeit at a relatively low level.

At the broadest level, average prices charged for goods and services rose in August at rate broadly in line with that seen in June and July. This rate is roughly commensurate with CPI inflation holding around the 3% per annum rate in coming months.

Note that input cost inflation accelerated slightly to also remain elevated by historical standards, though remains in line with the average seen over the prior six months.

Both selling price and input cost inflation data continue to run especially hot by pre-pandemic standards in the service sector. Manufacturing selling price inflation has meanwhile evaporated, albeit with costs no longer falling.

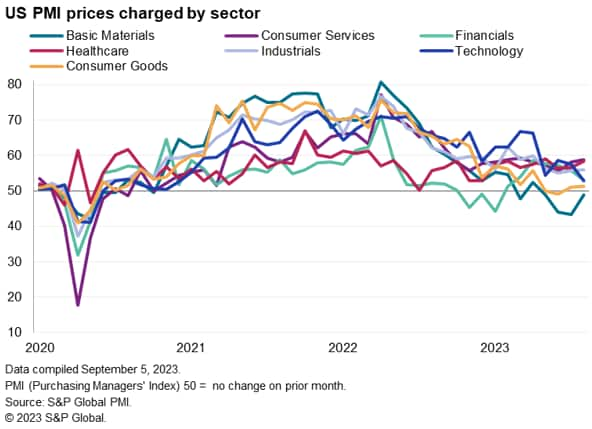

In more detail, selling prices rose at the fastest rates for consumer services and healthcare in August, reflecting higher wage pressures and a lack of capacity relative to demand. Industrials also saw robust price gains.

In contrast, selling prices for basic materials continued to fall, albeit at a reduced rate in part due to higher energy costs. Prices charged for consumer goods rose only marginally.

Big changes were meanwhile seen for technology and financial services, which saw selling price inflation rates cool markedly to 32- and six-month lows respectively.

Comparisons of the sector PMI new orders and selling price data illustrate how pricing power has been associated with demand strength, as can be seen in our scatter chart displaying the average changes in both variables over the three months to August. Sectors which have seen the strongest demand growth so far this year - notably consumer services, tech and financial services, have also seen some of the strongest price gains. However, from an inflation fighting perspective, it's important to note that in August these three sectors also saw demand growth wane markedly, hinting that pricing power could likewise cool.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-stagflation-risks-rise-as-service-sector-falters-alongside-manufacturing-downturn-Sept2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-stagflation-risks-rise-as-service-sector-falters-alongside-manufacturing-downturn-Sept2023.html&text=US+stagflation+risks+rise+as+service+sector+falters+alongside+manufacturing+downturn+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-stagflation-risks-rise-as-service-sector-falters-alongside-manufacturing-downturn-Sept2023.html","enabled":true},{"name":"email","url":"?subject=US stagflation risks rise as service sector falters alongside manufacturing downturn | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-stagflation-risks-rise-as-service-sector-falters-alongside-manufacturing-downturn-Sept2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+stagflation+risks+rise+as+service+sector+falters+alongside+manufacturing+downturn+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-stagflation-risks-rise-as-service-sector-falters-alongside-manufacturing-downturn-Sept2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}