Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 07, 2022

US regional economic expectations for 2022: Employment, housing, and inflation

Regional US economies made strides in their post-pandemic recoveries over the course of 2021, but the unpredictable evolution of the virus threw a wrench in many states' rebounds. In some ways, the pandemic temporarily accelerated long-standing regional trends, i.e., migration from the Northeast and West Coast to the South and Mountain regions; suburbanization; and corporate expansions in lower-cost areas moving headquarters from California to Texas. In 2022, as COVID-19 transitions from being a pandemic to an endemic disease, migration patterns and housing spikes will start to settle. Yet supply chain disruptions, inflation pressures, and persistent virus risk will be ongoing challenges. Here is a look at our headline expectations for 2022.

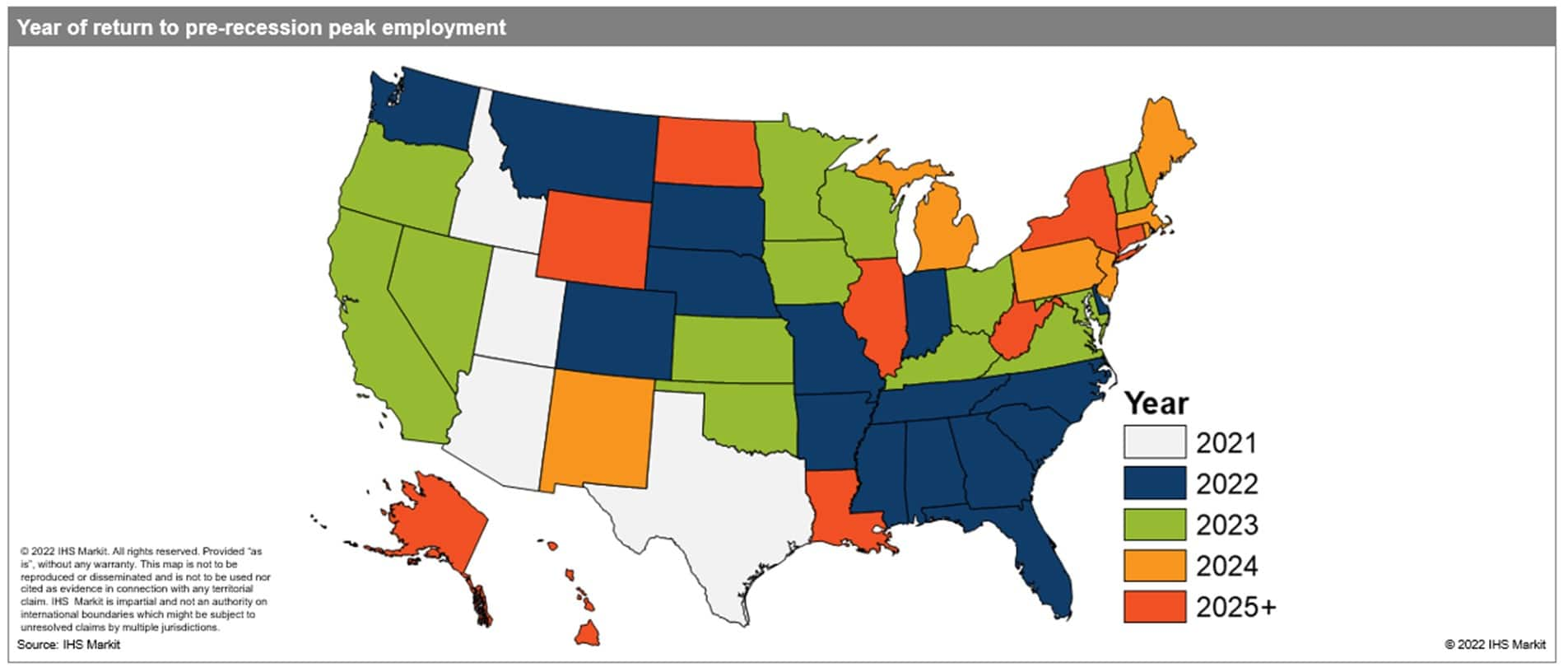

20 states will surpass their pre-pandemic employment peaks.

It has been a tenuous recovery for state labor markets since early 2020. Through December 2021, only four states—Arizona, Idaho, Texas, Utah—had surpassed their pre-pandemic employment peaks. The magnitude of the April 2020 employment declines has been tough to rebound from in an environment where certain economic activities are restrained by the lingering virus risk. Nevertheless, state labor markets have been trending upward overall and will continue to do so through 2022. By the end of the year, a total of 20 states will recoup their pandemic-related job losses.

Florida, Georgia, Indiana, North Carolina, Tennessee, and Washington are the biggest states in that cohort. The South has an outsized representation among the soon-to-be recovered given the dynamics around the pandemic and the fact that it is historically a faster-growing region. At the other end of the spectrum, densely populated cities had a harder time through the pandemic, and there are many in the Northeast, Midwest, and West Coast. Those regions struggled more in their recoveries. As a result, Texas, Florida, Georgia, and North Carolina will recoup their employment losses by the end of 2022, while California, New York, Pennsylvania, Illinois, Ohio, and Michigan will not. Their recoveries will span into 2023 or longer.

The West will experience the fastest job growth of the four Census regions.

Conditions will further normalize this year, which will help some of the harder-hit states see above-average gains as employment returns off its current low base. The West will benefit most from this phenomenon and lead the four Census regions in pace of employment expansion. California will be a key driver, accounting for over 50% of the region's job growth. Nevada and Hawaii, both highly dependent on tourism, will see outsized growth rates as leisure/hospitality hiring rapidly increases as part of its long climb back to health. The Mountain states, which have been resilient in the post-pandemic era, will see solid gains in 2022, as the region continues to be a magnet for in-migration and business formation. The combination of outsized growth in states coming back from big losses and continued robust momentum in the Mountain states will elevate the West ahead of the other three Census regions.

The disruption to migration patterns sparked by the pandemic will start to settle.

The net number of people who moved to a new state in 2021 was the highest in 15 years. The pandemic accelerated a trend of migration away from the Northeast, Midwest, and the West Coast to the South and Mountain regions. The population drain in 2021 was simply enormous in California and New York, in particular. Domestic outmigration was over 350,000, far exceeding typical trends, with each individually losing more residents than the other 18 states with outflows combined. Meanwhile, Florida, Texas, Arizona, the Carolinas—states that historically have been magnets for in-migration—experienced even higher-than-normal inflows last year. In 2022, we expect that outflows from California and New York will remain elevated but recede from 2021 levels. Correspondingly, in-migration will soften in the major destination states. Strengthening economies in the hard-hit Northeast, Midwest, and Western states and broad improvements in the management of COVID-19 will help get migration trends moving back towards historical norms, even if they will not fully return this year.

International migration slowly recovered in 2021, as COVID-19-related restrictions that limited mobility began to ease. The states that had historically taken in the most migrants—Florida, Texas, New York, and California—reached their lowest level in the series history in 2020 (data back to 2001). As pandemic conditions began to improve in 2021, international migration climbed off the 2020 lows, but remained well below typical levels. IHS Markit analysts expect continued upward momentum through 2022, to the point where international migration will come close to reaching 2019 values, which historically were on the low side. This will set the stage for further recovery in the years thereafter. This will be a net positive for states across the US but be especially impactful in the aforementioned states as well as New Jersey, Massachusetts, Virginia, Pennsylvania, and Georgia, which also attract large inflows of international migrants.

Home price growth will moderate in all four Census regions, but a major correction is not in sight.

Home price growth hit record highs in 2021, well outpacing even the hottest years of the mid-2000s housing bubble. The housing market has been red hot across most of the country for the past year; according to the latest quarterly data from the Federal Housing Finance Agency's (FHFA's) purchase-only index, home prices catapulted up by 19% year on year (y/y) nationally during the third quarter of 2021, ranging between 15% growth in the Midwest and 23% in the West. Among the 100 largest metros, the top 30 all saw prices jump by 20% y/y or more, while 99 metros saw double-digit growth. It has been a truly incredible run, spurred by low mortgage rates, tight inventories, and the pandemic-induced migration as telecommuting prompted workers to consider locations further from the urban core or in new markets altogether. Indeed, two destination metros—Boise City, Idaho, and Austin, Texas—saw prices surge by more than 30% y/y, driven in part by transplants from California, New York, and other high-cost markets.

This pace cannot be sustained. Inventories will start to ease this year, as the housing stock expands and some homes protected by forbearance will be put up for sale. More aspiring homeowners will be priced out of the market, and relocations sparked by considerations around the pandemic will start to dwindle. Mortgage rates will rise as the Fed starts tightening this year, further eroding affordability. These forces will put downward pressure on home price growth. However, a strong labor market and continued demand from the millennial generation will keep prices trending upward, just at a diminished pace. By the fourth quarter of 2022, price growth will be well below the pace seen in 2021; cut in half or more. But while price growth will decelerate markedly, there will not be a correction akin to the late 2000s, since the dynamics that catapulted prices up in 2021 are very different.

Upward pressure on CPI inflation will abate over the second half of 2022. Inflation will fall most rapidly in the Midwest, while prices prove to be more stubborn in the rest of the country.

After reaching extraordinary levels in 2021, consumer price index (CPI) inflation will remain elevated nationwide through the first half of 2022 as supply disruptions and high energy prices persist. Supply-chain bottlenecks will start to ease later in the year as demand for goods diminishes, and energy price pressures will be alleviated by increases in production. Car prices stand to benefit greatly from supply-chain improvements by the end of 2022. With energy and transportation costs driving the moderation in topline CPI inflation in the latter half of the year, the Midwest—where spending is most heavily weighted toward transportation—will see the lowest year-over-year inflation rate of the four Census regions by the fourth quarter of 2022. Midwestern states are more car-dependent, so their overall price levels are more sensitive to changes in gas prices and automobiles. On the other hand, the price level for services is expected to remain elevated everywhere, as demand continues to recover from the effects of the pandemic. After seeing a relatively modest increase in 2021, strong price growth in services will drive inflation to above-average levels in the Northeast and West, where services spending holds a higher weight in their respective CPI baskets.

Manufacturing-intensive states, led by Michigan and Indiana, will continue to grapple with shortfalls in inputs, owing to global supply chain woes.

Over the first half of 2022, the automotive sector will be among those suffering the worst of the impacts of supply chain issues, owing to a shortfall in computer chips. Short-term layoffs and shift reductions will become less common as computer chip supplies improve, however, setting the stage for an upward trend in US vehicle production over the course of the year. Meanwhile, automakers will produce as much as they are able in an effort to meet robust demand and to retain employees in a competitive labor market. US light-vehicle sales, hampered by low inventory, will trend higher with production. We expect to exit 2022 with a sales pace more similar to pre-COVID-19 levels.

Total personal income growth will slow substantially as the fiscal stimulus wanes. Texas, New England, and Mountain regions will hold up the best as wage and salary income picks up the slack.

Personal income grew at its fastest rate in 15 years during 2021, after an expansive fiscal stimulus plan was used to supplement US incomes in the face of pandemic-related disruptions. After the last round of direct economic impact payments in the first quarter of 2021 and the expiration of enhanced unemployment insurance that September, transfer payments quickly declined over the second half of the year. In 2022, as the effects of transfer payments subside, personal income growth will largely be determined by contributions from wage and salary income.

In 2022, Texas, New England, and Mountain states will see income growth rates among the highest in the country, driven by gains in wage and salary income. Many of these states, including Texas, Utah, Colorado, and Massachusetts, have robust finance and technology sectors, which have high average wages and managed to weather the pandemic downturn reasonably well. Meanwhile, the East South Central and East North Central regions will see personal incomes grow at the slowest rates. Transfer payments tend to account for a larger share of total income in these regions, which will amplify the overall decline. Additionally, these states will see weaker expansions in wage and salary income as their employment growth is expected to lag the nation this year.

The recovery in the mining sector will pick up steam in the top oil-producing states.

As oil prices spiraled downward in early 2020, the top oil-producing states saw their mining sectors completely unravel. Fortunately for producers, prices rose over the second half of 2020 and through 2021. Brent prices were firmly over $70/barrel during the second half of last year, exceeding their 2019 averages. Still, the recovery to date in mining activity has been lackluster in the nation's top oil producers. Through the third quarter of 2021, real mining output was 21% below its late 2019 peak, and mining employment was down 22% combined in Texas, North Dakota, New Mexico, Oklahoma, and Louisiana (including Gulf of Mexico production). These states combined account for more than 80% of US crude and condensate production and were the top producers going into the 2020 correction. New Mexico was the only state in the group that staved off a prolonged contraction during this cycle. Its share of the Permian region bounced back very quickly as real mining output and oil production reached new highs in 2021, although employment remains in deficit.

As we move through 2022, the recent tides will change. IHS Markit energy experts expect US production to ramp up this year, accounting for 1.4 MMb/d of the world's total 6.0 MMb/d supply growth in 2022-23. This momentum can already be seen in increasing rig counts, with the number of US oil rigs closing in on 600, their highest level since early April 2020 and more than twice the recent low in August 2020. The top oil-producing states will give an extra boost to gross state product growth in 2022 as mining output climbs higher with production. However, given the extent of the pandemic declines, both mining output and employment will remain below their late 2019 peaks in the five top producing states except for New Mexico, where output has already reached new highs. While the long-term outlook for US oil production is clouded by the transition to clean energy, the near-term outlook is bright.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-regional-economic-expectations-for-2022-employment-housing-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-regional-economic-expectations-for-2022-employment-housing-.html&text=US+regional+economic+expectations+for+2022%3a+Employment%2c+housing%2c+and+inflation++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-regional-economic-expectations-for-2022-employment-housing-.html","enabled":true},{"name":"email","url":"?subject=US regional economic expectations for 2022: Employment, housing, and inflation | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-regional-economic-expectations-for-2022-employment-housing-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+regional+economic+expectations+for+2022%3a+Employment%2c+housing%2c+and+inflation++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-regional-economic-expectations-for-2022-employment-housing-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}