US manufacturing output rebounds, confirming IHS Markit PMI signal

- Official data showed manufacturing output rebounding in November, albeit still on course to decline in the fourth quarter.

- The official data correspond closely with IHS Markit PMI signals, and contrast with a steep decline indicated by ISM data

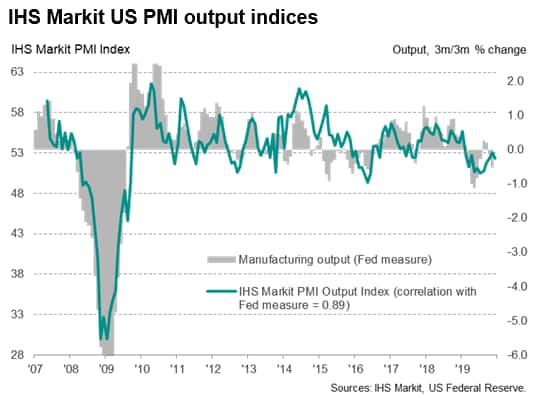

Some of the confusion over varying US survey signals was lifted after official data showed manufacturing output rebounding 1.1% in November, confirming the picture presented by the IHS Markit's PMI data. December flash PMI data meanwhile point to a further stabilisation of production.

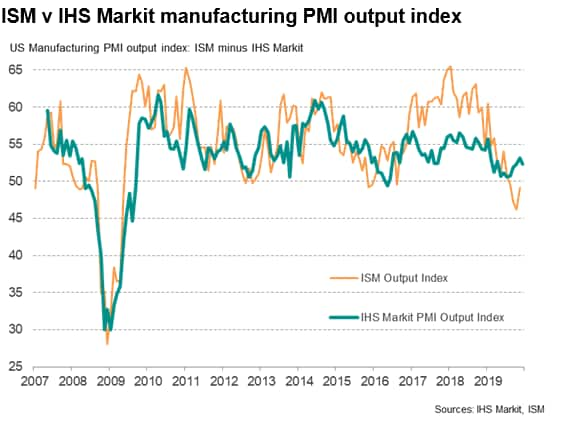

The manufacturing output index from the IHS Markit PMI survey had risen to a ten-month high of 53.7 in November, indicating that the goods-producing sector continued to gain growth momentum for a fourth successive month after having slumped earlier in the year.

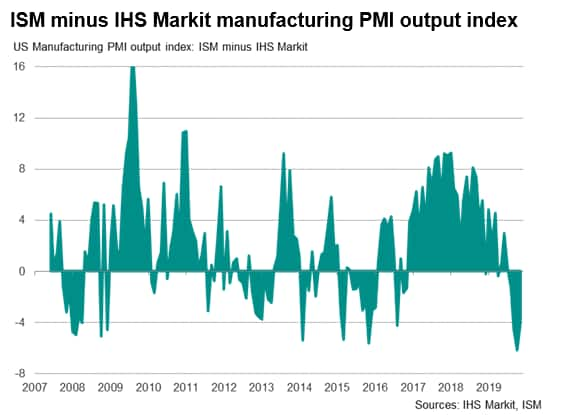

The improvement in the IHS Markit index contrasted with continued weakness in the ISM survey, where at 49.1 the November production index remained at its third-lowest since May 2009, albeit picking up from lower readings in September and October. The resulting gap between the two surveys in recent months, in terms of the weakness of the ISM index relative to the equivalent IHS Markit index, has been the largest ever recorded.

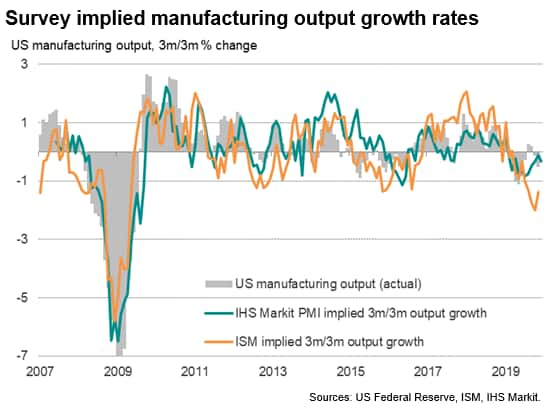

To draw meaningful conclusions from the survey indices we use regression analysis to compare the surveys against historical official data produced by the Federal Reserve. From these regressions we can derive comparable implied official growth rates from the two surveys [*]. These regressions reveal that since 2008 the IHS Markit index has exhibited a closer fit with the official data than the ISM has, the respective adjusted r-square values being 0.79 and 0.69.

The regressions also indicate that the IHS Markit production index is running at a level consistent with an average 0.3% quarterly rate of decline in the fourth quarter while the ISM index is consistent with a 1.7% rate of quarterly decline. By comparison, the official data from the Fed so far in the fourth quarter are running 0.4% behind the third quarter despite the November rebound, which is clearly far closer to the IHS Markit signals than the much-weaker ISM survey.

Looking in more detail at the latest official numbers, the 1.1% rebound in production in November partly reflected the return to work for striking GM workers after plant closures in October, which in turn contributed to a 0.7% drop in manufacturing output in October. However, even excluding autos, manufacturing output rose 0.3% in November, correlating well with the relatively robust IHS Markit signals. Moreover, the December flash PMI data from IHS Markit indicate that the sector continued to show signs of stabilisation from the soft patch seen earlier in the year, albeit losing a little momentum compared to November.

Survey differences

To help explain why the surveys differ we need to look closer at the methodologies:

- Survey panel sizes are different: IHS Markit's survey panel is larger than the ISM's stated panel size. IHS Markit surveys around 800 manufacturing companies (approximately double the size of the ISM panel size) from which an 80% response rate is typically received. However, unlike IHS Markit, ISM does not disclose actual numbers of questionnaires received. As a general rule, a large panel size produces more stable and accurate survey results, meaning the data tend to be less volatile and 'noisy'.

- The surveys also use different panel structures: ISM data are based only on ISM members, and as such are likely to reflect business conditions in larger companies, with small- and medium-sized firms under-represented. In contrast, IHS Markit's survey includes an appropriate mix of companies of all sizes (based on official data showing the true composition of manufacturing output each year).

- Survey responses may relate to different markets: The questionnaire that we have seen indicates that ISM does not specifically ask respondents to confine their reporting to US facilities/factories whereas IHS Markit specifies that all responses must relate only to business conditions at US factories. ISM data could therefore be more heavily influenced by global conditions facing of US-owned companies than the IHS Markit data. Note that global manufacturing growth outside of the US, as tracked by IHS Markit's other PMI surveys, accelerated sharply in 2017, and has since matched the pattern of growth shown by the ISM. More recently, note that global-ex-US growth has slowed sharply to show some of the weakest rates seen over the past ten years.

Put all of the above factors together and it becomes clearer as to why the ISM data may have exaggerated US manufacturing in 2017 and 2018, and why it is now possibly overstating the weakness.

*Note that rather than compare the surveys with month-on-month changes in official data, which show considerable volatility, we compare the surveys with a rolling three-month rate of change in the official data (i.e. the change in output in the latest three months compared to the prior three months). This has the advantage of highlighting the growth trend in the official data while avoiding (a) the volatility of the monthly data and (b) the induced lag of annual growth rates.

For more information contact economics@ihsmarkit.com.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.