Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 15, 2023

The IRA and the US’s mineral supply challenge

This report was authored by Daniel Yergin, Ph.D., Vice Chairman, S&P Global; Tabitha Bailey, Associate Director, S&P Global Market Intelligence; Mohsen Bonakdarpour, Executive Director, S&P Market Intelligence; Mark Ferguson, Research Director, S&P Commodity Insights; Frank Hoffman, Associate Director, S&P Market Intelligence; Aurian de La Noue, Director, S&P Commodity Insights; and Keerti Rajan, Director, S&P Market Intelligence.

To what degree will the massive Inflation Reduction Act (IRA) achieve its goal of accelerating the US energy transition? That hinges on minerals: Will the US be able to secure sufficient supply of the minerals needed for its move toward net zero? An S&P Global analysis suggests there are formidable challenges.

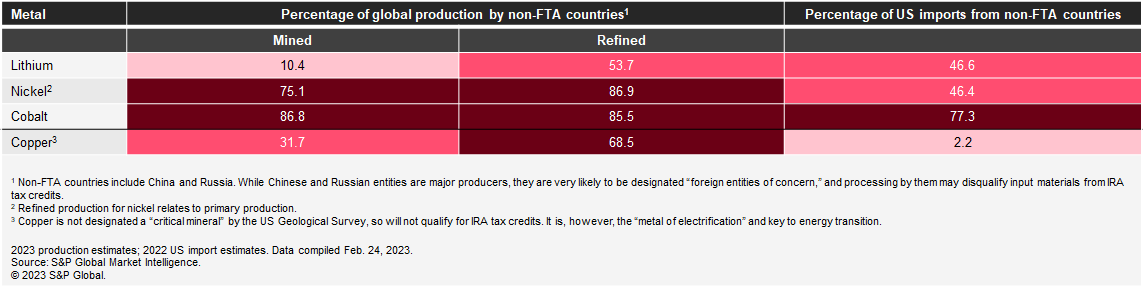

Prior to the IRA, it was already clear that the policy-driven quest for net zero was creating a new set of demands for minerals on top of traditional consumption - what we call "energy-transition demand." This rising energy-transition demand could lead to tighter markets, shortfalls, price impacts, and intensified international competition for access to both mined minerals and their refined products. The IRA, enacted August 2022, impacts minerals in two ways. On the demand side, it provides a major package of subsidies in the US for a wide range of mineral-intensive decarbonization technologies, from electric cars to off-shore wind turbines. On the supply side, it seeks to promote mineral development by imposing percentage requirements for mineral content from either the United States or from countries with which it has a free trade agreement ('FTA countries'). It also seeks to reduce reliance on "foreign entities of concern." These requirements quickly become stricter. For a new electric vehicle purchase to qualify for IRA tax credits in 2024, 50% of the critical minerals in its battery (by value) must meet these requirements; by 2027 that becomes 80%.

A new S&P Global study - Inflation Reduction Act: Impact on North American metals and minerals market - seeks to ascertain how much the IRA will add to energy-transition demand in the United States. Similar to S&P Global's 2022 report, The Future of Copper, it takes a detailed, bottom-up, technology-by-technology approach to project demand for four metals key to energy-transition applications: lithium, cobalt, nickel, and copper. The first three are inputs to electric vehicle batteries and, as US-listed 'critical minerals,' their use attracts IRA tax credits - subject to sourcing requirements being met. The fourth, copper, is not listed as a critical mineral in the US (although it is in the EU and Canada) but is fundamental to the energy transition as the "metal of electrification." The study then compares projected demand post-IRA to available supply, given IRA rules around sourcing in terms of country of origin for production and processing. Copper is listed as 'near critical in the medium term' in the US Department of Energy's Critical Materials Assessment 2023. This, however, does not render it an applicable critical mineral per the Inflation Reduction Act.

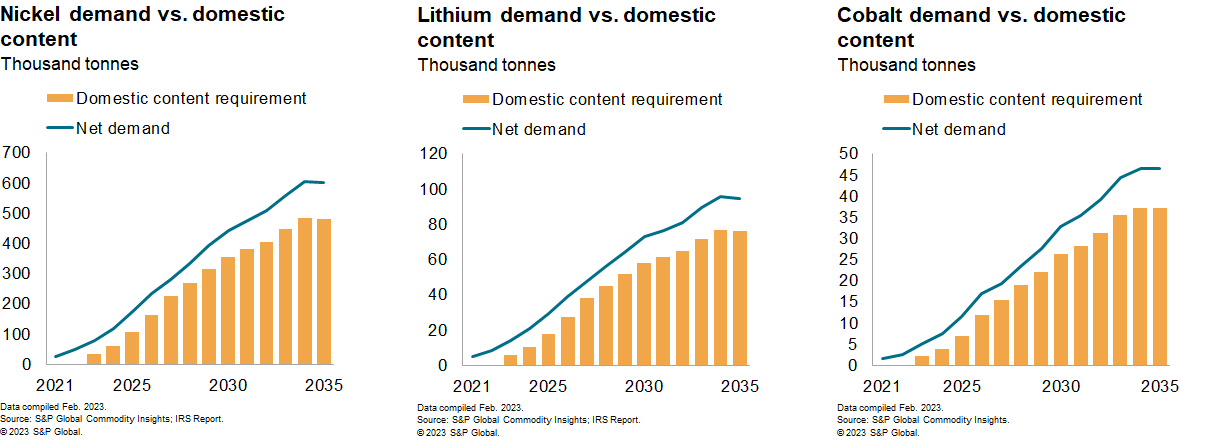

The results indicate that, post-IRA, US energy-transition demand for lithium will be 15% higher by 2035 than projected pre-IRA; 14% higher for nickel; 13% for cobalt; and 12% for copper. Compound annual growth rates for the listed critical minerals to 2035 range between 20% and 30%. US energy-transition demand for these three metals together will grow 23 times between now and then, driven mostly by electric vehicles. Meanwhile, growth for copper will double, driven by a broad range of applications.

But the challenges of meeting these needs are formidable. Over time, lithium is the mineral most likely to be sufficiently supplied to the US under the IRA's content requirements. Assuring supply of nickel and cobalt that meets rapidly growing US demand will be more difficult. Nickel production is concentrated in non-FTA countries. Enough cobalt will be processed in FTA countries to meet the US's energy-transition demand - but it is exported to other countries.

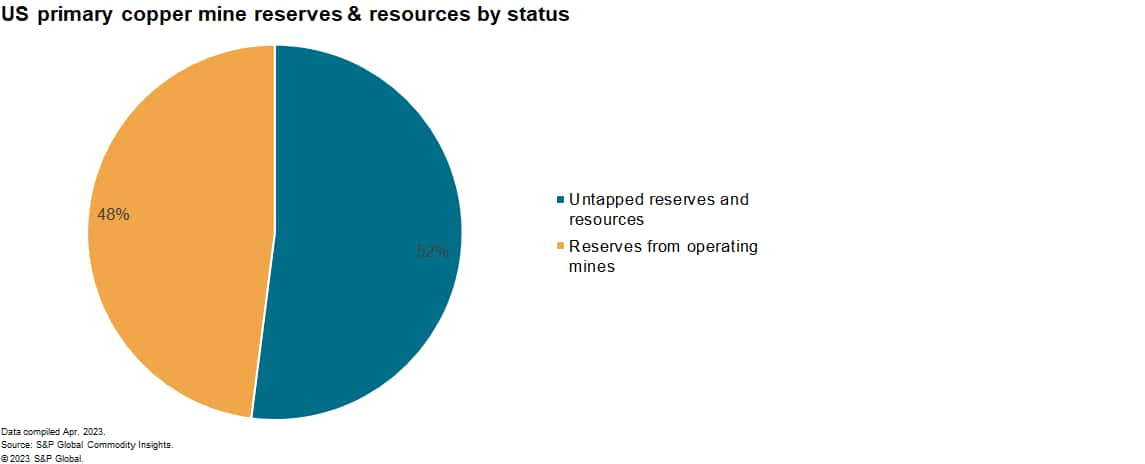

Copper presents a substantial domestic opportunity. There is an estimated untapped copper endowment of over 70 million metric tons in the US - equivalent to about three years of global production. But lengthy and complicated regulatory and permitting processes, along with litigation risks, inhibit the development of this endowment and, more broadly, mineral development in the United States.

Across FTA countries too, a series of above-ground challenges can restrict new minerals projects. Permitting delays and litigation can create extensive roadblocks. Investors will struggle to identify and act on "actionable opportunities." Political controversies within resource countries will impede progress. Environmental concerns and opposition to mining will challenge development. Labor disputes and rising costs will impede output. Government and companies will struggle to agree on investment terms and operational processes. International competition for constrained resources will increase as governments push their 2050 goals. And, in this new era of Great Power competition, the quest for minerals will become entangled in the rivalry between the US and mainland China - and China already has a predominant international position in minerals. Given all of these above-ground challenges, there will be a persistent struggle to match post-IRA demand with supply that meets the IRA's requirements.

Some may argue that near-term fluctuations in the price of these minerals indicates less pressure coming for mineral supply, but that is not a good guide to what the future holds in the march to net zero. For now, energy-transition demand is still a relatively small part of overall demand. Current prices are much affected by traditional demand, which tracks GDP, and near-term expectations. The post-COVID performance of mainland China's economy, high interest rates, slowdowns in Europe and the United States - these all are affecting markets.

But the heating up of energy-transition demand points to increasing pressure on supplies in the years to come. What this new analysis demonstrates is the extent that the IRA will add to the heat - and thus to the challenges and quandaries ahead for mineral security.

For more insight, download the complete report.

Learn more about our critical minerals research capabilities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-ira-and-critical-mineral-supply-challenge.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-ira-and-critical-mineral-supply-challenge.html&text=The+IRA+and+the+US%e2%80%99s+mineral+supply+challenge+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-ira-and-critical-mineral-supply-challenge.html","enabled":true},{"name":"email","url":"?subject=The IRA and the US’s mineral supply challenge | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-ira-and-critical-mineral-supply-challenge.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+IRA+and+the+US%e2%80%99s+mineral+supply+challenge+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-ira-and-critical-mineral-supply-challenge.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}