Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 14, 2021

US holiday sales growth will set a record in 2021

This holiday season feels a bit more "normal" than the last, with COVID-19 related restrictions on mobility essentially nonexistent and many Americans engaging freely in travel, recreation, and holiday shopping. More than two-thirds of the US population is fully vaccinated against COVID-19, most students have resumed in-person learning, and the economy, as a whole, is booming. Still, collective anxiety levels remain uncomfortably high as still-elevated levels of COVID-19 cases and deaths have kept the virus a central consideration for many households. Additionally, consumers are no longer receiving stimulus money, and inflation is at its highest in decades. How will these crosscurrents impact spending over the 2021 winter holidays? Will pandemic-era shopping trends continue to prevail, or will we see new wrinkles in the retail sector this year?

First, let's assess where we are today. Through October, total retail sales (excluding food services) were 14.8% above last October and 23.1% above February 2020. For comparison, nominal personal consumption expenditures for services in October were only 3.6% above the pre-pandemic level (February 2020). The pandemic-induced shift toward relatively more consumer spending on goods has not yet let up despite fewer business restrictions and gradually improving volumes of travel, dining out, and entertainment. While it is difficult to gauge the long-term impacts of the pandemic, at present, it is clear that spending patterns continue to be heavily influenced by health considerations and related lifestyle choices such as more time at home for work, school, and pleasure. Consumers have responded by spending more on groceries, sporting goods, home improvement, and anything they can purchase online. This holiday season is likely to bring more of the same as shoppers remain uncertain about the path of the pandemic and the extent to which new variants will impact our lives.

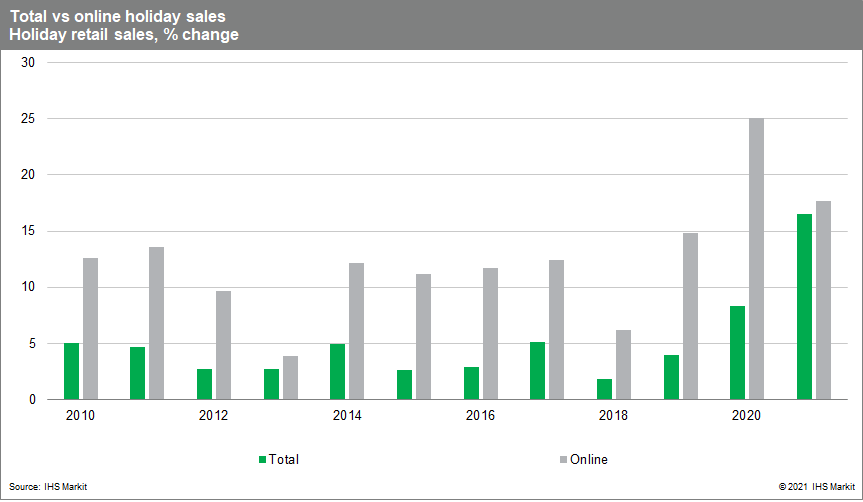

Overall, pandemic-induced shopping trends have been a net plus for the overall holiday retail outlook. We forecast that holiday retail sales this year will amount to $888 billion, or an increase of 16.6% above last year's sales. This would easily be the strongest growth rate on record dating back to 1992. Even more impressive is that this comes on the heels of 8.3% growth last year, which was only bested by a 1999 holiday surge of 8.7%.

To be sure, some of this year's strength in holiday sales, relative to last year, reflects considerably larger increases in prices for consumer commodities. However, the acceleration in holiday sales was considerable, even after adjusting for price change. Based on published CPI's and their relative importance measures, we estimate that the CPI for commodities excluding motor vehicles and gasoline rose roughly 5% over the twelve months ending this November following roughly 1% growth over the twelve months ending last November. Using these to deflate holiday sales, would imply about 11.6% growth in real holiday sales this year following about 7.3% real growth last year.

At first glance, our projection for the "best year ever" sounds bold amid the aforementioned sources of uncertainty and levels of consumer sentiment which are mired near the lowest levels experienced during the pandemic. But it is important to consider that the level of retail sales is already running extremely hot, so it would take an outsize contraction in spending over November and December to change the outlook materially. Even in a downside scenario, where retail sales decline in November and December, holiday sales are almost certain to clock in with record-breaking growth.

That said, there are several reasons to expect that retail sales will, in fact, slow from their recently elevated rates over the holiday season. First and foremost, we believe that consumers began their holiday shopping earlier than is typical this year. Media coverage of supply chain bottlenecks has been ever-present since late summer, preparing shoppers for potential product shortages and delayed delivery times during the peak shopping season between Black Friday and Christmas. There is some evidence that this pull forward in shopping is playing out. Google Trends measures of searches for "supply chain" in the US peaked in mid-October at levels double the usual rate earlier in 2021, which coincided with a strong reading on retail sales in October. Additionally, there were reports from retailers and consumer mobility trackers that suggested disappointing levels of retail foot traffic over the Black Friday weekend, suggesting that shoppers got started earlier this year.

There remains considerable uncertainty about how the current supply-chain dynamics will impact shopping strategies. On the one hand, the prospect of empty shelves in stores could frustrate some shoppers and encourage more purchases from direct online platforms, but longer delivery times and products being on back-order may entice shoppers to further embrace the "buy online, pick up in-store" option that has become increasingly popular in the last couple years. The benefit of this model is that consumers can ensure their desired product is in stock and able to be secured that very same day, with the added feature of avoiding crowded aisles and short-staffed checkout lines. This is not an option for all shoppers or all stores, so it seems logical that this will benefit retailers who have already embraced this practice during the pandemic. Smaller businesses will likely have a more difficult time fulfilling orders amid supply-chain bottlenecks and these shifting consumer preferences. Nevertheless, pure online shopping will remain the best-performing category of retail over the holiday period. We forecast that online holiday sales will grow 17.7% over last year, compared to the 25.1% rate in 2020 which was the strongest ever. The expected growth this year would nudge the online share of total holiday sales up from 23.2% in 2020 to 23.4% this year.

Despite concerns about supply chains, inflation, and the pandemic, fundamentals are generally strong, and households have continually proved resilient in their spending over the last two years. Consumer expectations about the labor market are decidedly optimistic, household balance sheets are healthy, and Americans have accumulated wealth via stimulus and asset holdings over the past couple of years. Moreover, there is a general sense that each "wave" of the COVID virus will have a lesser impact on the economy and that the human toll will eventually lighten. These tailwinds should ensure a cheerful 2021 holiday season for retail spending.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-holiday-sales-growth-will-set-a-record-in-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-holiday-sales-growth-will-set-a-record-in-2021.html&text=US+holiday+sales+growth+will+set+a+record+in+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-holiday-sales-growth-will-set-a-record-in-2021.html","enabled":true},{"name":"email","url":"?subject=US holiday sales growth will set a record in 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-holiday-sales-growth-will-set-a-record-in-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+holiday+sales+growth+will+set+a+record+in+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-holiday-sales-growth-will-set-a-record-in-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}