Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 19, 2023

Uneven impact of high interest rates: manufacturing struggles while service thrives

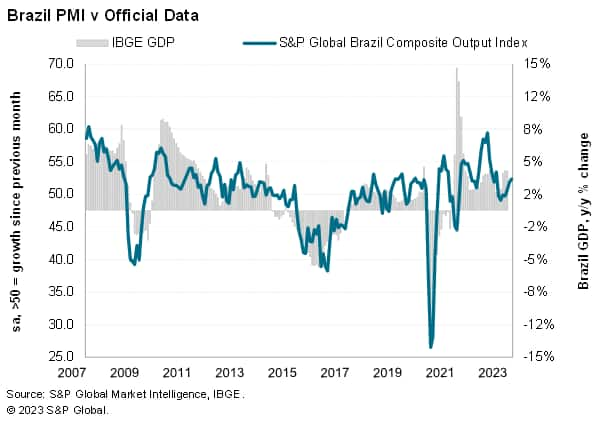

The Brazilian economy avoided entering a technical recession in the opening quarter of 2023, with a growth rate of 1.9% largely beating market expectations. PMI data up to May so far point to sustained growth for the second quarter, albeit with notable sector divergence. While the manufacturing industry continued to grapple with weak demand conditions and high interest rates, the service sector displayed notable resilience. Looking ahead, the prospects that inflation could retreat bode well for interest rate cuts and a potential revival in the country's economic performance.

Economy sees renewed growth, PMI signals resilience in second quarter

First quarter official data for Brazil signalled a reinstatement of growth, with the country avoiding a recession and PMI figures compiled by S&P Global indicating a sustained expansion in the second quarter.

The 1.9% rise reported by the statics office (IGBE) for the first three months of the year was primarily boosted by a remarkable 21.6% upsurge in Agriculture & Livestock. Services, Brazil's largest sector, saw growth of 0.6% while the industrial segment registered a marginal reduction of -0.1%.

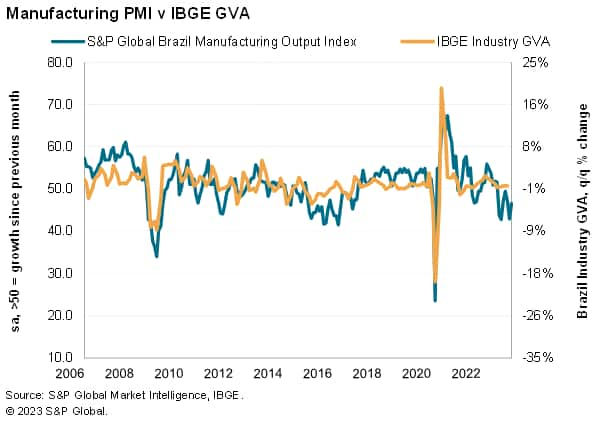

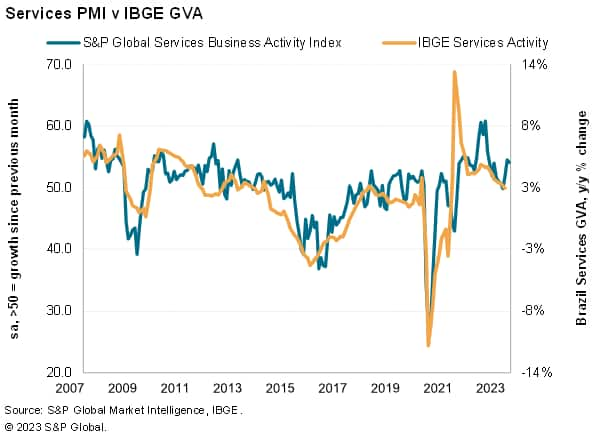

The latest results align with the trend reflected in the PMI surveys, whereby weakness in manufacturing had contrasted with resilience in the service economy through most of 2023 so far.

Compared to the opening quarter of 2022, GDP growth quickened to 4.0%. The Farming sector topped the rankings with an expansion of 18.8%, while Services rose 2.9% and Industry 1.9%.

Considering the challenging economic climate, inflationary pressures, public policy uncertainty and the highest benchmark interest rate seen in nearly six-and-a-half years, the latest economic results surprised on the upside.

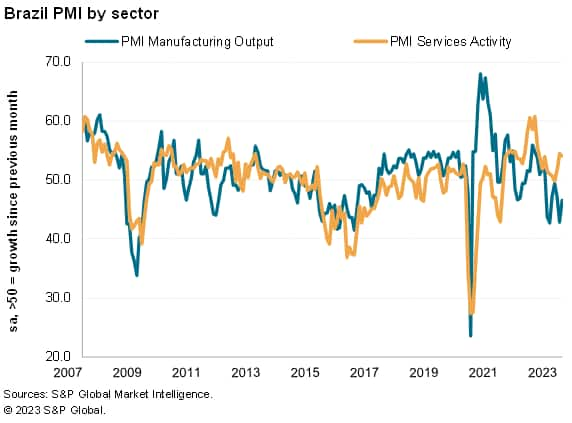

PMI shows widening gap between manufacturing and services

The divergence between the manufacturing and service sectors has become increasingly pronounced, with PMI data highlighting the contrasting paths these industries are crossing. While the manufacturing industry grapples with challenges such as adverse sales developments, reduced global demand, competitive conditions and elevated borrowing costs which restrict investment, services continued to exhibit resilience. Part of the upsurge in services could be attributed to a lower required investment relative to manufacturing, as well as the release of COVID-19 related pent-up demand.

Brazil's manufacturing PMI data continued to show concerning trends in May, with production contracting solidly and for the seventh month in a row. Demand for goods worsened further, leading to job shedding and cutbacks to input purchasing. Moreover, output and new orders fell in all of the three broad areas of manufacturing: consumer, intermediate and investment goods.

PMI data for the service economy showcased several positive developments in May. There was a sustained increase in new business, a solid expansion in employment and a notable upsurge in output. Furthermore, growth of business activity and sales was widespread across Consumer Services, Finance & Insurance, Real Estate & Business Activities and Transport, Information & Communication.

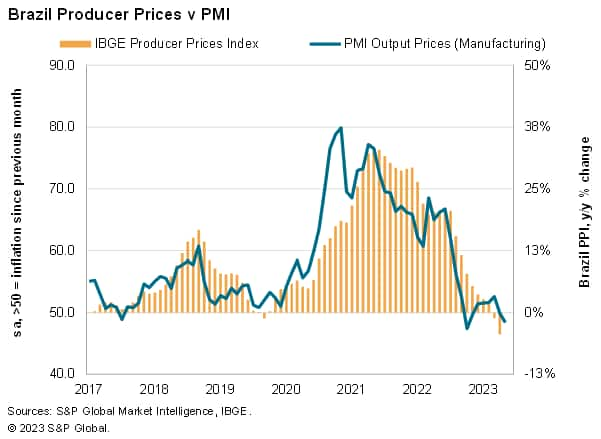

Interest rate policy could shift gear as inflation retreats

The downturn in manufacturing production overshadowed some positive developments. There was a noticeable dissipation of price pressures across the sector in recent months. During May, input costs decreased for only the third time in nearly nine years amid negative customer interest, lower commodity prices and efficient cost-management strategies. Firms were able to pass these cost savings on to their clients via discounting selling charges. This move aspired to stimulate demand and remain competitive in a challenging market.

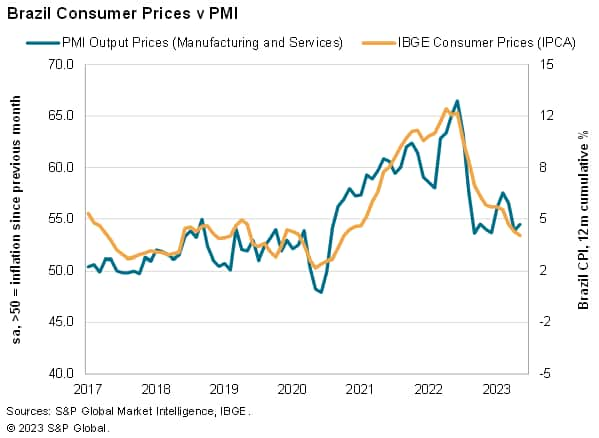

In the midst of the positive demand momentum, the services PMI data brought attention to stubborn inflation in May. Pressures on wages, input costs and operating expenses compelled companies to transfer part of this burden on to consumers, keeping inflationary trends historically elevated. However, rates of increase in input costs and output charges were considerably softer than the peaks seen in mid-2022. At the composite level, the rate of inflation for input costs softened while that for charges quickened.

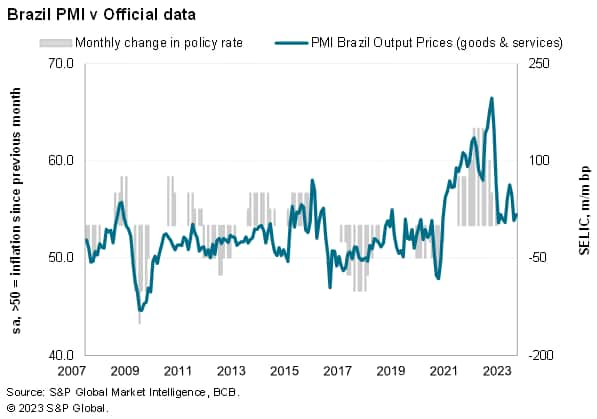

Brazil's inflation figure for monetary policy target retreated in each of the past 11 months, coming down from a series peak of 12.1% in April 2022 to 3.9% in May and therefore sitting within the central bank's tolerance interval. The prospects that inflation could continue to descend raise the possibility of long-waited cuts to the benchmark interest rate in the near-term, which currently stands at 13.75%.

Economic outlook strives for stability amid challenges

The S&P Global PMI data, suggested that Brazil's private sector economy expanded further, so far pointing to a growth picture for second quarter GDP. Additionally, the upturn in services employment seen in the PMI survey indicated the sector's contribution to overall labour market stability and economic growth. This is a positive sign for both individuals seeking work and the broader economy.

Moreover, both manufacturers and service providers were strongly confident towards the year-ahead outlook for business activity. Among the latter, predictions that sales developments will remain favourable underpinned upbeat forecasts. Goods producers, saw new plants, diversification, machinery acquisitions and the prospects of lower interest rates as the main opportunities to growth prospects. More detailed figures on business confidence will be published on 17th July, in which PMI panellists will provide their assessments surrounding output prospects, hiring intentions, investment plans and inflation expectations.

It remains crucial for policymakers and businesses to closely monitor and address the underlying factors contributing to the contractions seen in manufacturing and to implement strategies that foster sustainable growth and resilience in the goods producing sector. One positive policy announced by the government was the launch of a subsidy program aimed at reviving the automotive sector, in which tax breaks were offered on low-priced vehicles. Another support includes a plan by Brazil's national development bank (BNDES) to offer more affordable credit to goods producers intending to invest in innovation.

Finally, should the central bank change its stance on interest rates, borrowing and investment could increase, promoting consumer spending and business investment. Naturally, the decision to cut rates is a delicate balancing act and the central bank will continue to carefully assess various economic indices and risks to price stability.

Access the full press release here.

Pollyanna De Lima, Principal Economist, S&P Global Market Intelligence

Tel: +44 1491 461 075

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2funeven-impact-of-high-interest-rates-manufacturing-struggles-while-service-thrives-June2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2funeven-impact-of-high-interest-rates-manufacturing-struggles-while-service-thrives-June2023.html&text=Uneven+impact+of+high+interest+rates%3a+manufacturing+struggles+while+service+thrives+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2funeven-impact-of-high-interest-rates-manufacturing-struggles-while-service-thrives-June2023.html","enabled":true},{"name":"email","url":"?subject=Uneven impact of high interest rates: manufacturing struggles while service thrives | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2funeven-impact-of-high-interest-rates-manufacturing-struggles-while-service-thrives-June2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Uneven+impact+of+high+interest+rates%3a+manufacturing+struggles+while+service+thrives+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2funeven-impact-of-high-interest-rates-manufacturing-struggles-while-service-thrives-June2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}