Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Feb 14, 2022

Top attractive dividend stocks in APAC

As the world is making strides in its post-pandemic recovery, strained supply chains and the prospect of a rapid interest rate hike by the US Federal Reserve is piling on the fear that stock markets may be too frothy for their own good, especially in developed markets. Despite the recent sell off in US markets which saw the NASDAQ 100 decline by 11.7% year-to-date, the Index is still up 65.7% relative to its pre-pandemic levels which is leading investors to think hard about the durability of such price gains as rising interest rates threaten long duration stocks.

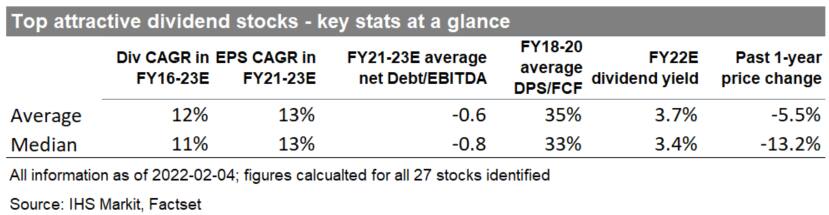

In times during which resilience is much sought after, we present the top attractive dividend payers that we expect to thrive moving forward. We have identified 27 stocks from 2145 stocks across 13 markets and 19 sectors in APAC that are expected to demonstrate stable growth pattern of annual dividends (special dividend combined) starting from FY2016 until FY2023E. The selection is based on a list of financial criteria including past dividend records, future dividends and earnings outlook, debt and free cash flow positions. 15 stocks are trading below last year's price (as of 2022-02-04).

For more information, please contact dividendsapac@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-attractive-dividend-stocks-in-apac.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-attractive-dividend-stocks-in-apac.html&text=Top+attractive+dividend+stocks+in+APAC+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-attractive-dividend-stocks-in-apac.html","enabled":true},{"name":"email","url":"?subject=Top attractive dividend stocks in APAC | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-attractive-dividend-stocks-in-apac.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Top+attractive+dividend+stocks+in+APAC+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-attractive-dividend-stocks-in-apac.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}