Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 05, 2022

Shipping market outlook - Container vs Dry bulk: Q3 2022 update

Third-quarter 2022 Dry Bulk Utilization Index is now available through the Freight Rate Forecast

Volatile path to lower freight rates in near term before recovering in late 2023 with regulation impact on supply and gradual demand recovery

Summary

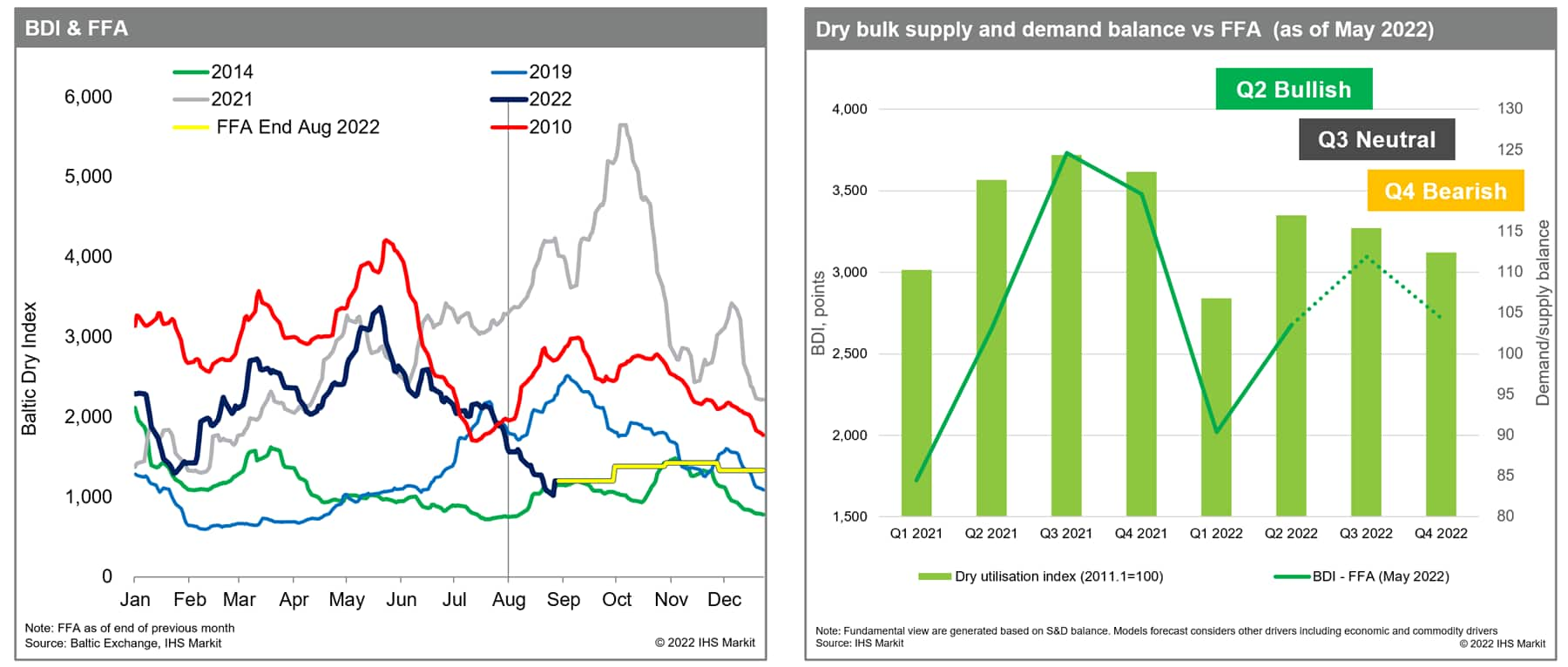

Dry bulker earnings have continued to fall over the last three months after a brief rebound in the early third quarter of 2022. The seasonality pattern fell to that of 2014 which we observed as being the low case scenario of market (2010 as base-case scenario of seasonal trend). Typical seasonality of the market indicated that dry freight rates would peak again in the third quarter of 2022 as can be seen in the FFA assessment at the end of May 2022; however, our fundamental analysis and forecast of the previous FRF long-term outlook (May 2022) showed that the second quarter would be the peak of 2022. Therefore, in previous edition, we outlined several downside risks from the later part of the third quarter of 2022, including:

- Softening container market with a changing consumer pattern, as well as a weaker purchasing power

- Higher efficiency or productivity of vessels with reduced congestion and higher speed

- Lower Russian coal demand after the European and Japanese coal import ban, stronger domestic coal production in mainland China

- Limited wheat export volume during the Black Sea grain season

As of end of August 2022, it seems all risk factors turned out to be worse than expected.

- Container freight market: We have consistently argued that as long as container freight rates remain high enough to capture part of general cargo vessels (multipurpose) and open hatch cargo vessels share in the commercial container sector, small geared bulker rates are expected to be supported, specifically for the backhaul routes. That is why our major assumption for dry bulk demand and supply has been heavily linked with the container market outlook. As we had forecast, container freight rates have indeed declined significantly over the last three months with slower container trade demand growth in response to high inflation rate and endemic consumer pattern. After the third-quarter peak season is over, the de-containerized trend is expected to be reversed and some part of the container spillover-related minor bulk cargo will gradually return to container box. A large amount of scheduled newbuilding deliveries of container vessel capacity, starting from the end of 2022 and expected further softening in port congestion, would put the container shipping rates as well as the backhaul dry bulk freight rates under further pressure. Now, we assume container freight rates will continue to decline to an average of $4,000-5,000 per box (FEU) in 2023 from an average of $7,000 per box (FEU) in 2021-2022.

- Efficiency : We believe that much of the reduced mainland Chinese port congestion level in Panamax and Capesize, along with weaker cargo arrivals, was one of the major reasons behind a significant decrease in freight rates. The relatively stable congestion level in geared vessel tonnage with stable export activity has kept geared vessel congestion higher than the larger size segment market. Based on expectation of cargo arrivals into mainland Chinese ports, we do not expect extremely high congestion again in the coming quarters. Interestingly, CII rating issue would incentivize higher demurrage to reduce idling time and prevent further upside risk in congestion in coming years. On the other hand, significant drops in freight rates prevented potential sailing speed increase with lower bunker prices in the short term. In the medium and long term, we expect that EEXI's EPL impact will be limited on commercial speed, while CII will start to impact from 2024 onwards in operational speed as well as scrap activities. Meanwhile, EEXI-CII regulation impact is considered in this supply outlook; however, with the ongoing uncertainty of penalty and reduced earning, the potential recovery in demolition activities and slippage will remain the major downside risk for 2023-2024 fleet supply growth outlook.

- Coal and grain: We expect that strong coal trade will continue due to the uncertainty around gas supply issues linked to the ongoing Russia-Ukraine conflict. However, with difficulty in insurance and several sanction risks, we expect limited coal and grain shipments to be out of the Atlantic side of Russian ports in the coming months compared with normal seasonal pattern. Also, limited ballast tonnage availability towards Russian ports and stronger domestic coal production in mainland China may limit further Russian cargo shipping demand.

Although we expect some seasonal improvements in dry bulk market in the coming months, volatile path to lower rates is expected in the absence of high congestion, slower-than-expected economic growth with continued weakness in mainland China's real estate sector in the near-term. Eventually, overall dry bulk freight rates may return to the level that we have seen in pre-pandemic period in the coming months. However, limited supply growth driven by regulation and lack of new building order will help to market to recover in the second half of 2023 and 2024. In this context, we predict the Baltic Dry Index (BDI) is expected to fall about 20 to 30 percent on the year to average about 1,300-1,400 points in 2023 before recovering to average about 1,400-1,500 points in 2024. Earlier-than-expected change in mainland China's 'zero-COVID' policy or ceasefire agreements in the Russia-Ukraine war would remain the major upside risks, while strong domestic coal production and faster declining container market with global recession remain as major downside risks in the medium and long-term.

Chart1. Typical seasonality of market indicated dry freight rates would peak in the third quarter; however, fundamental analysis (May 2022 outlook) showed Q2 would be the peak of 2022

For more insight suscribe to our complimentary commodity analytics newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthirdquarter-2022-dry-bulk-utilisation-index-is-now-available-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthirdquarter-2022-dry-bulk-utilisation-index-is-now-available-.html&text=Shipping+market+outlook+-+Container+vs+Dry+bulk%3a+Q3+2022+update+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthirdquarter-2022-dry-bulk-utilisation-index-is-now-available-.html","enabled":true},{"name":"email","url":"?subject=Shipping market outlook - Container vs Dry bulk: Q3 2022 update | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthirdquarter-2022-dry-bulk-utilisation-index-is-now-available-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shipping+market+outlook+-+Container+vs+Dry+bulk%3a+Q3+2022+update+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthirdquarter-2022-dry-bulk-utilisation-index-is-now-available-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}