Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 22, 2023

The world’s fastest growing economy

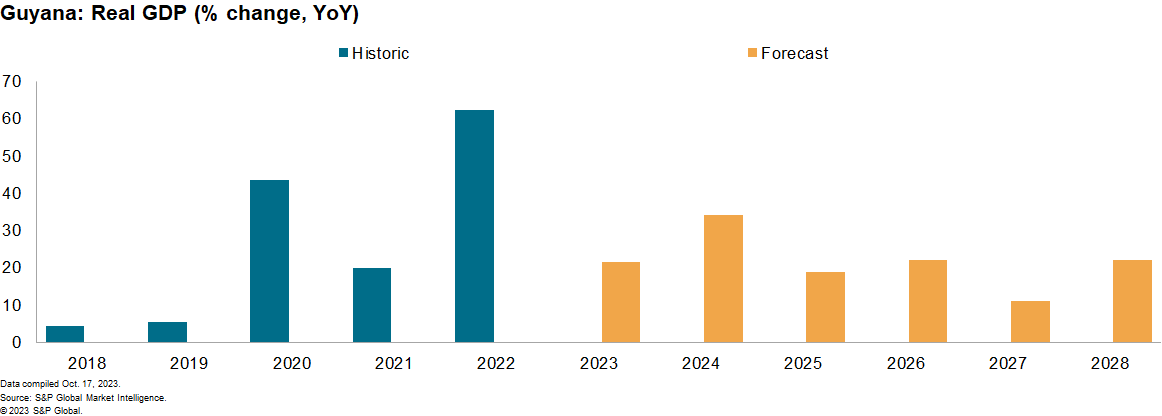

Guyana registered the world's highest real GDP growth rate in 2022, with its national output 62.4% higher. Driven by its booming oil sector, the economy is set to expand by 27.2% in 2023 and 34.2% next year — consolidating the country as the world's fastest-growing economy in 2024.

During 2010-15, Guyana was one of the lowest-income countries globally, with its economy based on the agricultural and mining sectors. Since 2015, the country's economic landscape has changed drastically due to the discovery of oil. The share of the petroleum, gas and support services sector increased from 0.2% of GDP in 2015 to 57.3% in 2022, displacing the agricultural sector as Guyana's main economic driver.

Real GDP will continue growing in the medium term. With oil sector growth also likely to encourage the expansion of non-oil sectors, particularly infrastructure and services throughout Guyana, S&P Global Market Intelligence projects that Guyana's real GDP will expand by 21.7% yearly on average during 2024-28.

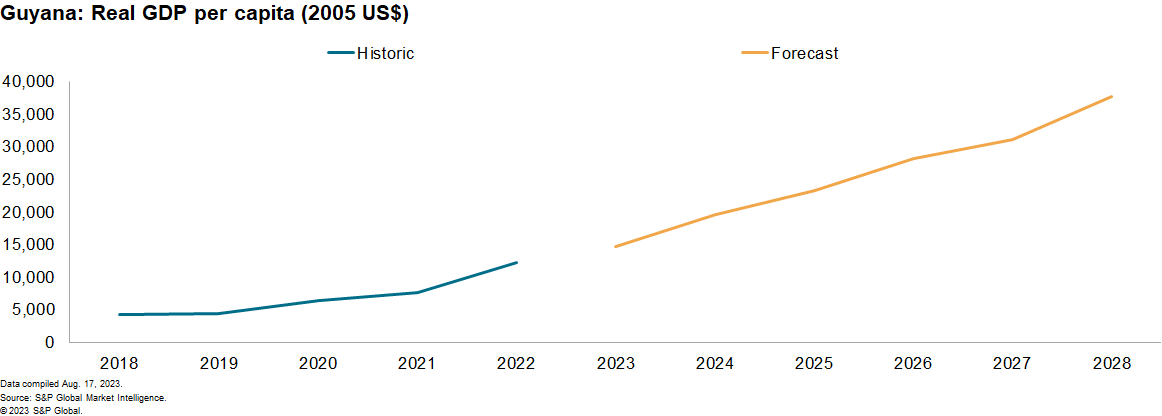

Guyana's real GDP per capita is expected to improve considerably over the medium term. Due to the impressive growth in oil output, Guyanese real GDP per capita increased to US$12,207 in 2022 from US$4,265 in 2018. Market Intelligence analysts project that rapid growth will continue over the medium term, projecting that per capita income will increase by 20.9% on average throughout 2023-2028, to reach slightly below US$38,000 by 2028. We forecast that there will be ample opportunity for investment in the non-energy sector, boosted by the government's infrastructure development plans and wider multiplier impacts extending to the services sector.

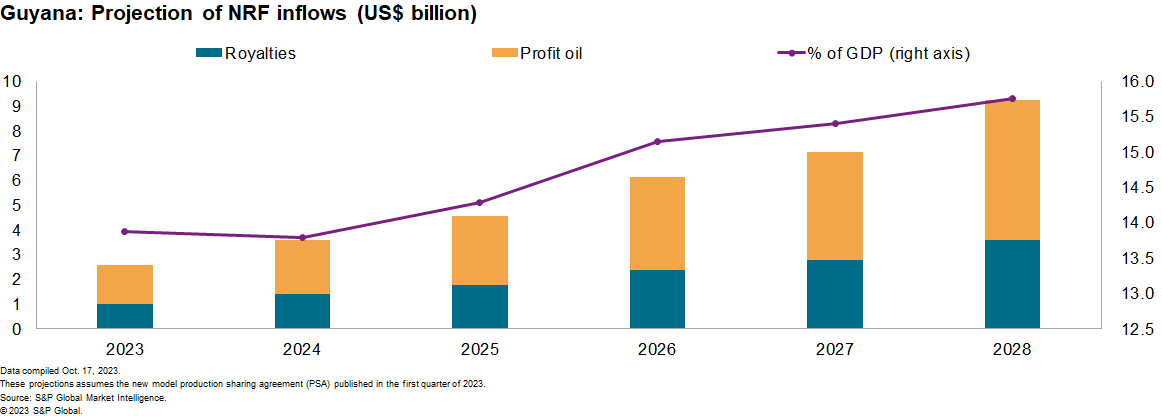

The current expansionary fiscal policy stance will continue to be financed mainly by oil revenue. The government of Guyana is expecting to earn US$1.41 billion in profit from oil and US$225.20 million from royalties in 2023. Market Intelligence estimates that the total assets of Guyana's Natural Resource Fund (NRF), the country's sovereign wealth fund, could reach about US$2.05 billion by the end of 2023, up 40.3% from the December 2022 level. We anticipate that NRF inflows will represent on average US$5.5 billion (14.7% of its GDP) on an annual basis throughout 2023-28.

Withdrawals from the NRF into the domestic economy will exert substantial upward pressure on the Guyanese dollar. The government has made NRF withdrawals to cover current spending, with the government's expansionary stance increasing the risk of overheating in the domestic economy and temporary external payment imbalances. Large NRF withdrawals would support significant expansion in government spending, further elevating inflation risk, especially over the next 1 to 3 years, when spending increases will be the largest relative to GDP. This could generate an expansion of credit and money supply that the local economy is unprepared to absorb, potentially increasing inflation across many sectors.

Strong government stability and a weak opposition will facilitate long-term planning and passage of legislation. The ruling PPP/C holds a majority sufficient to pass legislation and has improved its popularity, evidenced by PPP/C gains in the June 2023 local election, including in opposition strongholds. In contrast, the main opposition party, the People's National Congress (PNC), has lost mobilization power and support, exacerbated by internal divisions.

Advancing and accelerating oil and gas sector development will remain the major focus of the government at least until 2025. New legislation efforts have centered on maximizing domestic benefits, but the regulatory environment is likely to remain fluid. New PSA terms, designed to maximize profit from the oil sector, were approved in March 2023. The new PSAs will be implemented alongside the new Petroleum Law passed in August 2023, which replaced the 1987 Petroleum Act.

Beyond the oil sector, the government will focus on infrastructure and economic diversification, but reliance on loans will increase vulnerability to oil price volatility. President Ali has set out an infrastructure plan including countrywide road network expansion and improvement, as well as 48 bridge projects. Ali has also emphasized the need to diversify the economy beyond oil, with a particular focus on agriculture, healthcare, education, and electricity generation. Given limited domestic workforce capacity, the government has sought to develop these goals with international resources and is offering incentives to investors outside the oil sector. Road improvement projects are underway in multiple regions, while contracts have been signed with foreign companies for further projects, indicating that the development plan set out by the government is progressing favorably.

Although hydrocarbon-led growth gives Guyana the fiscal space to acquire new debt, the reliance on loans for multiple large-scale projects is a negative indicator of the country's long-term economic sustainability. The repayment of loans will be reliant on continued oil revenue, while oil sector dependence and high levels of long-term debt would increase the country's vulnerability to oil price volatility.

Learn more about our economic data and insights

Listen to our latest podcast episodes

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-worlds-fastest-growing-economy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-worlds-fastest-growing-economy.html&text=The+world%e2%80%99s+fastest+growing+economy+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-worlds-fastest-growing-economy.html","enabled":true},{"name":"email","url":"?subject=The world’s fastest growing economy | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-worlds-fastest-growing-economy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+world%e2%80%99s+fastest+growing+economy+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-worlds-fastest-growing-economy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}