Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ARTICLES & REPORTS

Dec 22, 2022

Synthetic credit in 2022 and beyond

Many of us in the credit markets have been waiting for a decisive turn in the credit cycle since the recovery from the Great Financial Crisis. Thanks to interventions from governments and central banks this was like waiting for Godot. When the COVID-19 pandemic began in Q1 2020 and countries locked down, it seemed this was finally the catalyst for a sustained rise in credit risk and consequent spread widening. But massive fiscal support and supportive monetary policy ensure that creditors were insulated from the worst and default rates stayed low.

As we come to the end of 2022 the outlook is very different. Inflation is back after a long hiatus, driven by COVID-related supply chain disruptions and rising demand, then greatly exacerbated by the Russia-Ukraine and associated energy crisis. Rates are rising and much of the global economy is experiencing stagflation reminiscent of the 1970s. S&P Global Ratings is forecasting speculative default rates in the U.S. and Europe to double in 2023 (see report here), so it's no surprise that spreads have widened in expectations of increased credit stress.

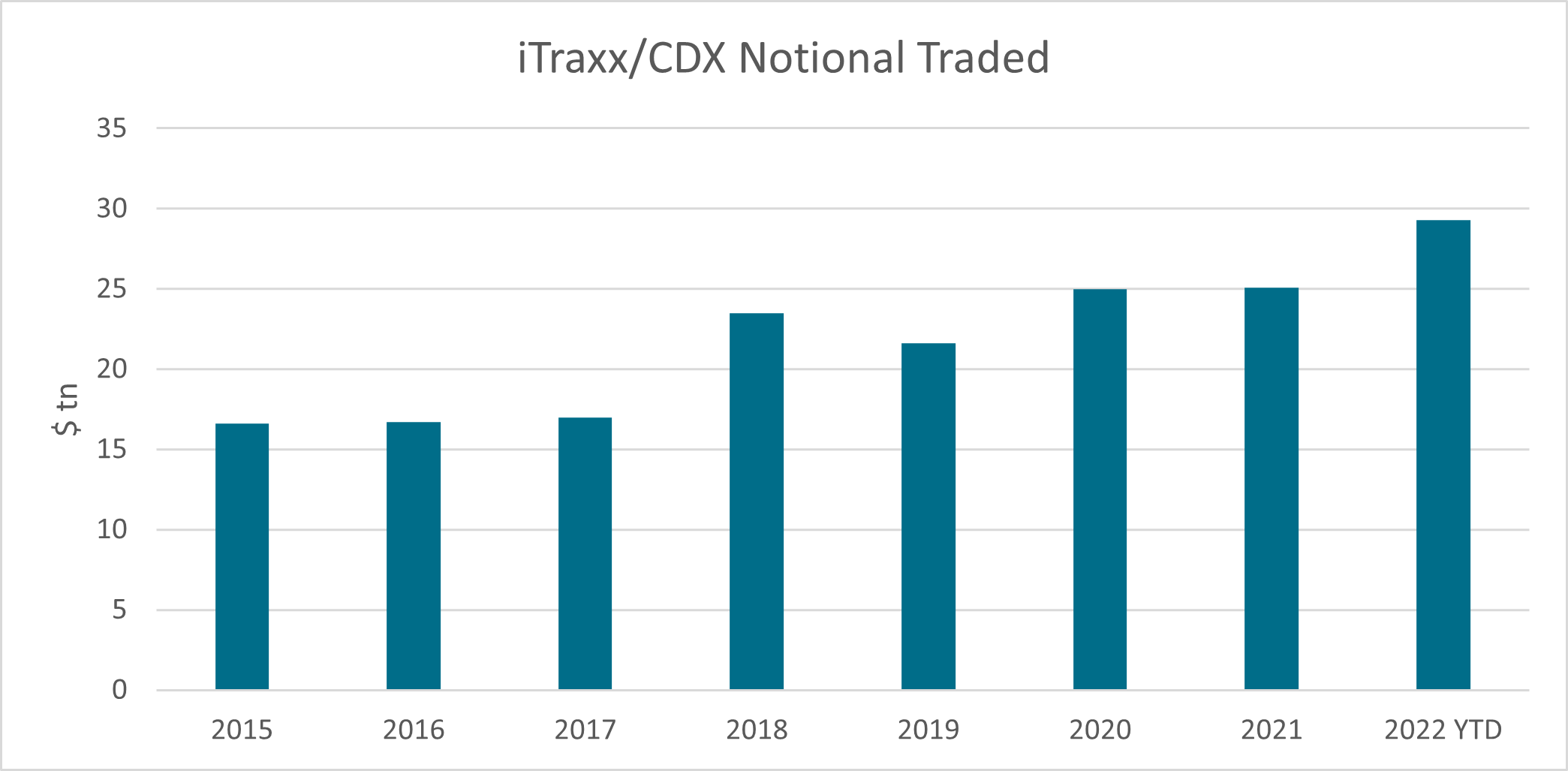

It's also no surprise that demand for credit default swaps and related instruments has increased. The protection afforded by government support and low rates saw single name volumes drop in 2021, but this year activity has bounced back sharply. CDS indices such as the iTraxx and CDX have once again proved their utility in a crisis - as they did in the initial stages of COVID in 2020 - and over $30 trillion has traded this year, easily surpassing the levels of the previous two years.

Source: S&P Global Market Intelligence

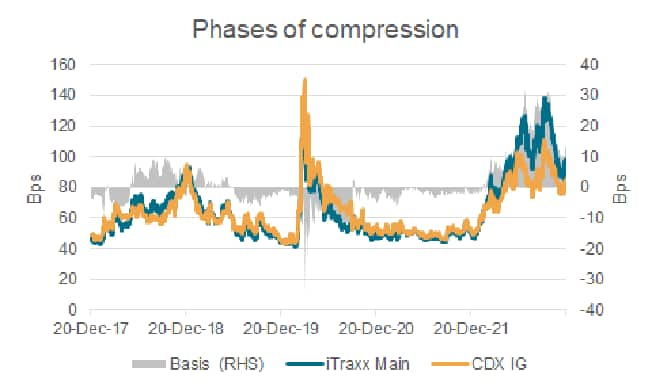

We mentioned above that spreads have widened this year, and both the CDX IG and iTraxx Europe (also known as Main) are trading at levels in excess of 2021 year-end. But that doesn't tell the whole story. In tandem with Russia's invasion of Ukraine on February 24, Europe's investment grade spreads started to diverge from the almost identical levels where the two indices started the year. By July, the iTraxx Europe was trading over 30bps wider than its North American counterpart. It was clear that Europe was more exposed to Russian imports of oil and gas - higher energy costs and sanctions would directly impact credit fundamentals.

Source: S&P Global Market Intelligence

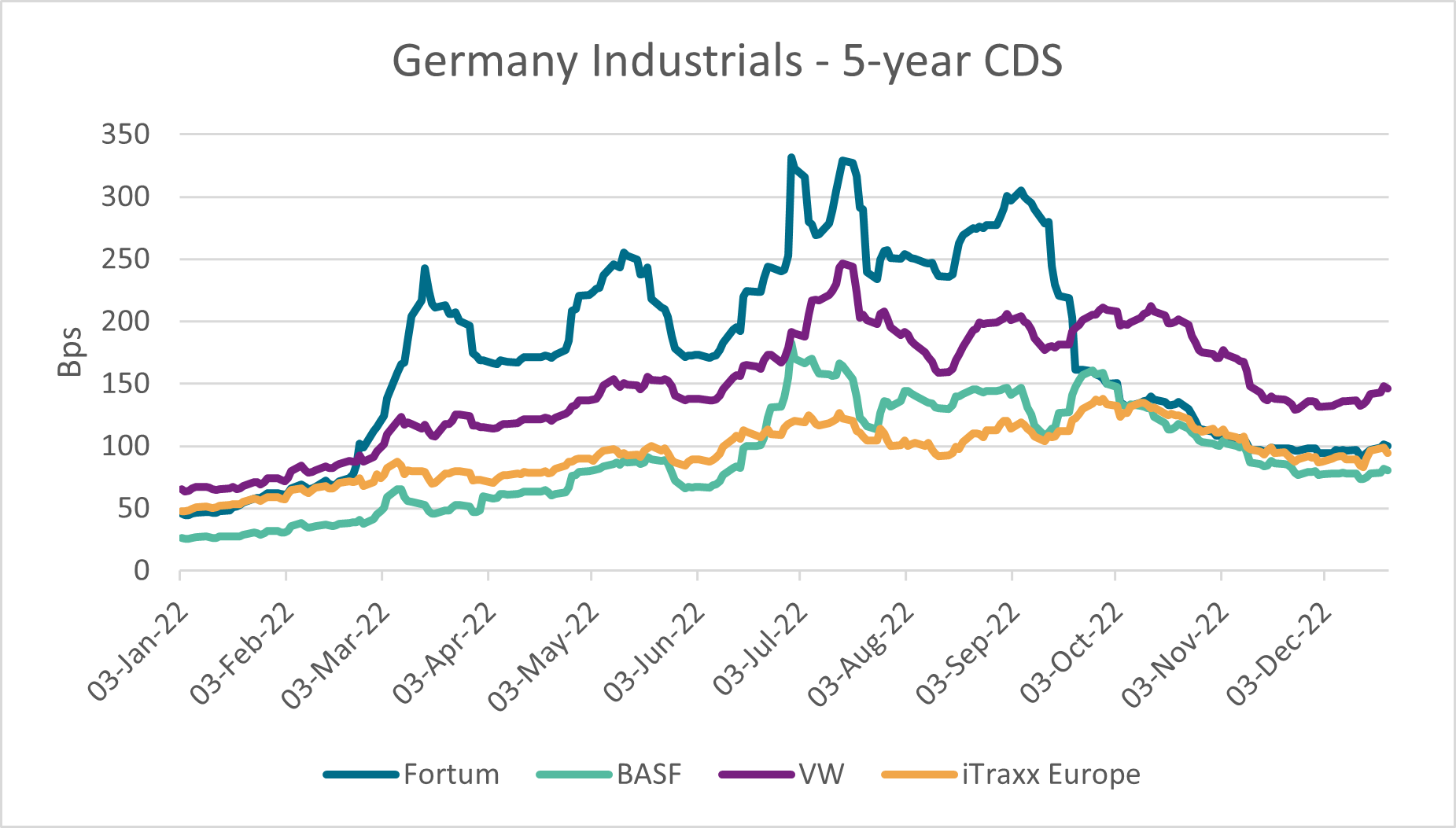

Nowhere was this more evident than in Germany, where the industrial sector disproportionate spread widening. Mainstays of the iTraxx Main, such as BASF and Volkswagen, were driving the underperformance of the index. Finnish power producer Fortum started the year in line with the index; by July it was over 200bps wider. Fortum owned German utility Uniper, and it was the subsidiary's reliance on Russian gas - and subsequent exposure to higher market prices - that weighed on Fortum's credit standing.

But Fortum's spreads have since recovered markedly after the German government announced that it would acquire Fortum's stake and nationalise Uniper. This demonstrates that, while central banks are no longer supportive, governments will still step into the breach when necessary. Investors need to consider likely state intervention in key industries when the credit fundamentals appear overwhelmingly negative.

It wasn't just German industrials that recovered in Q4. The broader market staged a strong rally on expectations that future rate rises may not be as severe as previously thought. European credit bounced back more strongly than North America and the basis between iTraxx Main and CDX IG decompressed, though the risk premium on the European index persists (12bps at the time of writing).

CDS Liquidity and Volumes

The regime change in monetary policy has triggered demand for CDS protection, both in single name and index form. The iTraxx and CDX index families generally offer strong liquidity and this attracts a diverse group of end users, ranging from banks and seasoned synthetic funds all the way to asset owners and equity managers.

Source: OSTTRA (YTD is up to end of Q3)

CDS indices are commonly used in overlay strategies in credit and multi asset funds, as well as macro funds. They are also used in the growing area of systematic credit. Evidence of the popularity of this product is apparent from the increase in traded volumes - over $30 trillion across iTraxx and CDX families (figures in chart from OSTTRA Q1-Q3, observations indicate a strong Q4).

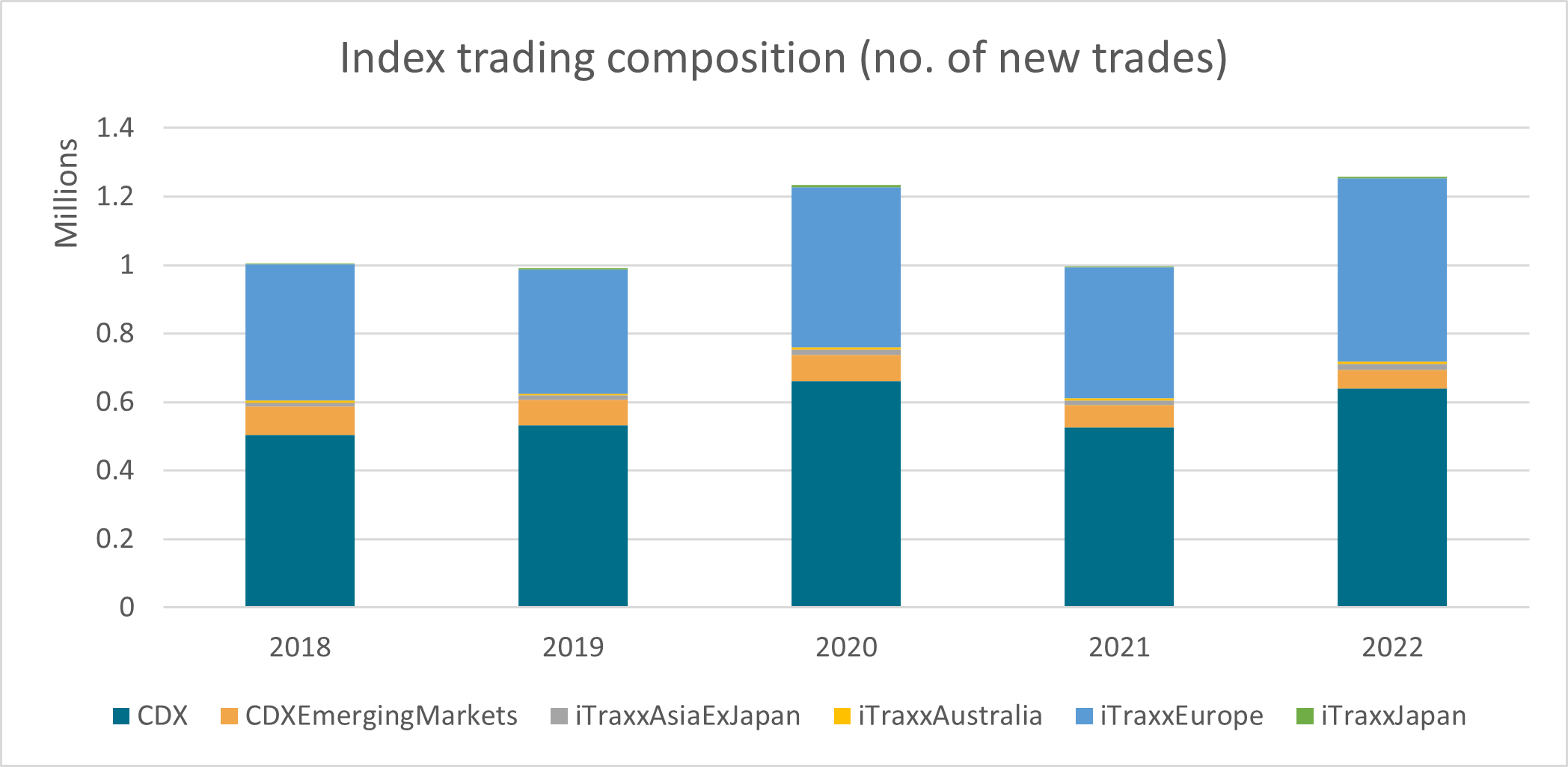

Source: OSTTRA (YTD is up to end of Q3)

The composition of index trading is broadly static in recent years - CDX and iTraxx Europe make up approximately 90% of total number of trades. It's notable that the share from iTraxx Europe has gone up to 43% from an average of 38% in previous years, no doubt a reflection of the increased macro risk in the region. CDX EM has slipped to 4.4% in 2022 from 8.2% in 2018, a somewhat surprising trend given the elevated risk in emerging markets. It may be attributable to investors being selective and using single name sovereign CDS rather than seeing EM as a homogeneous asset class.

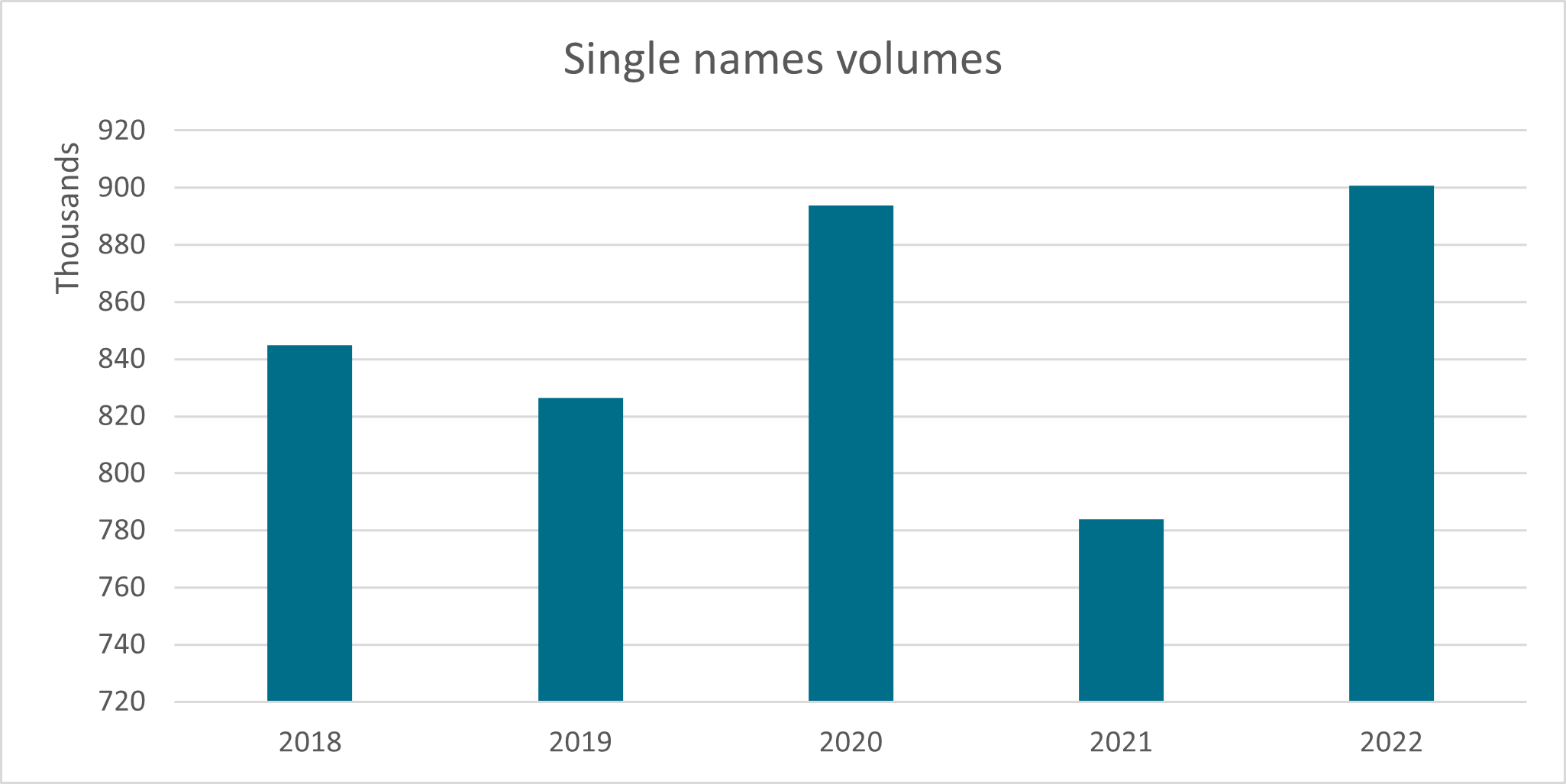

Source: OSTTRA (2022 is extrapolated from Q3 to Q4 using average of Q4 volumes in previous five years)

Single name volumes are up compared to recent years, though not to the same extent as indices. The single name product should have more utility during the current stage of the credit cycle as differentiation between names will increase. Strategies that were previously unfashionable due to the prevailing low credit risk and high correlation are beginning to attract capital flows. Many investors will use a combination of bonds and synthetic credit to implement such strategies.

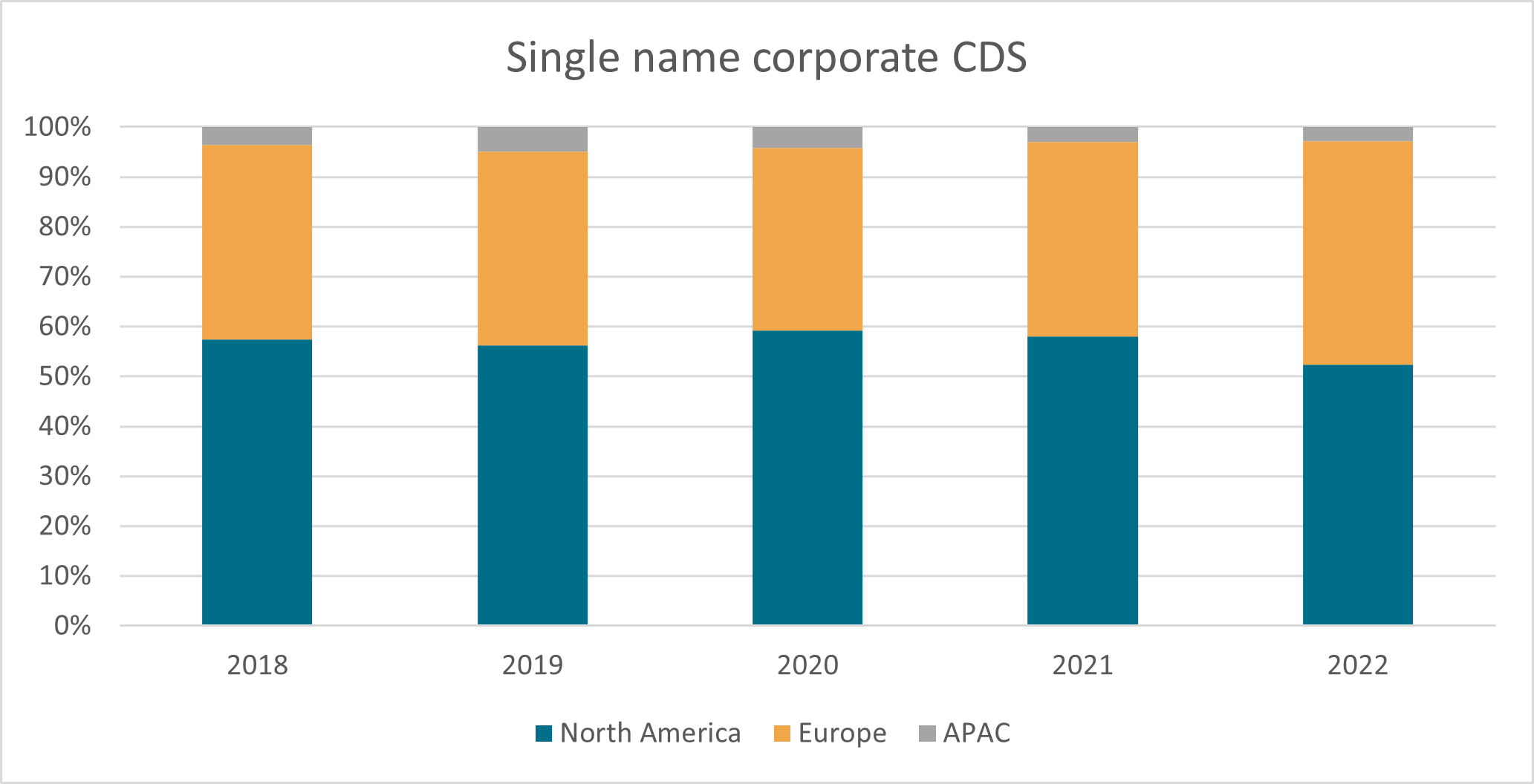

Source: OSTTRA

North American entities continue to be the most heavily traded with over 52% of the total, though European entities are at their largest share for several years at 45%.

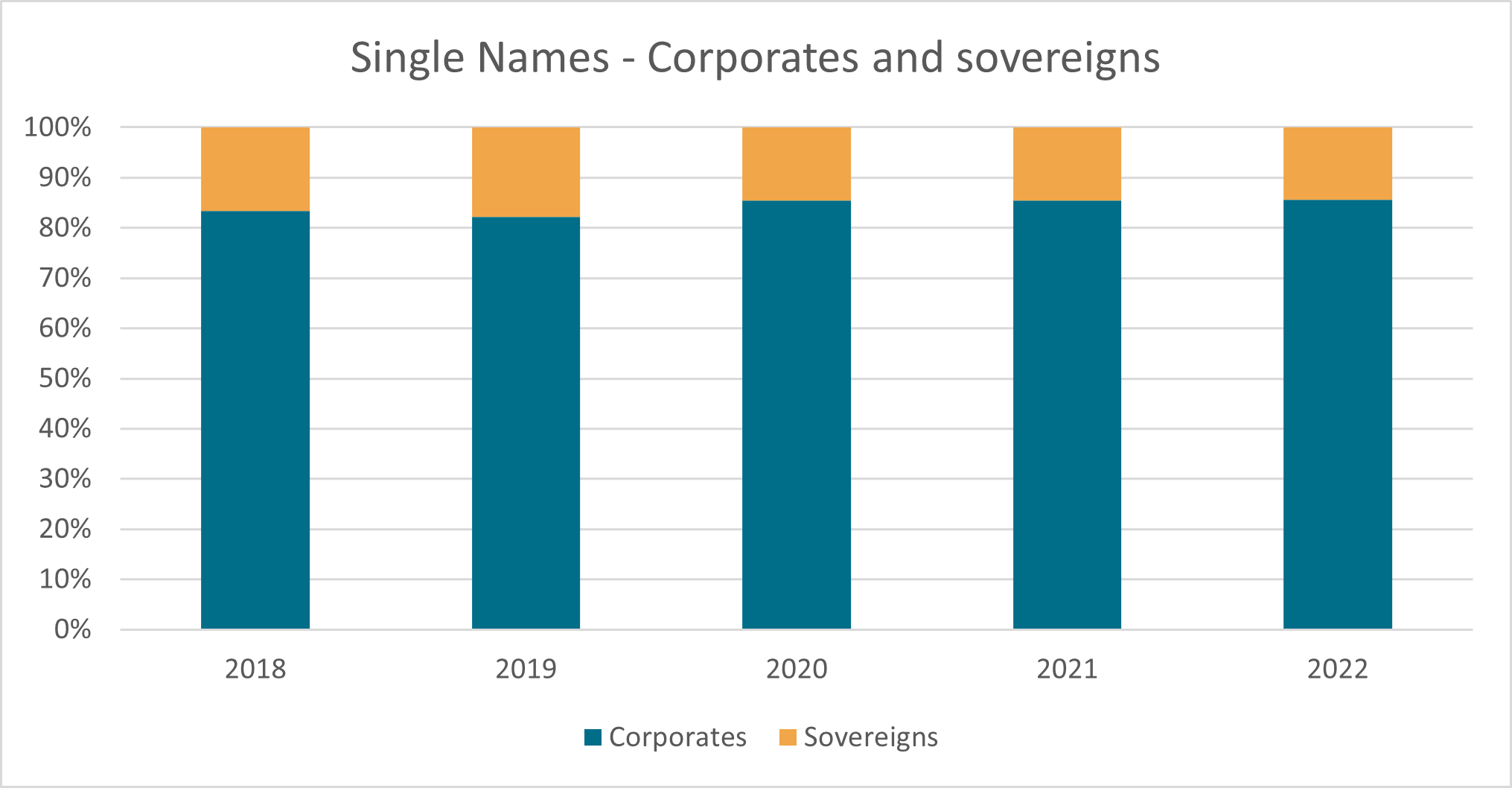

Source: OSTTRA

In terms of proportion of trades between corporates and sovereigns, the mix is approximately 85:15 in the past three years. It should be noted that the universe of sovereign names is considerable smaller than corporates (less than 100 names compared to 900-1000 that trade regularly). EM sovereigns with significant external financing requirements, such as Turkey and South Africa, are the most heavily traded names in the CDS market. Western European sovereigns such as Italy are also active (though not to the same extent as during the eurozone debt crisis), with much of the trading conducted by bank CVA desks hedging counterparty credit risk.

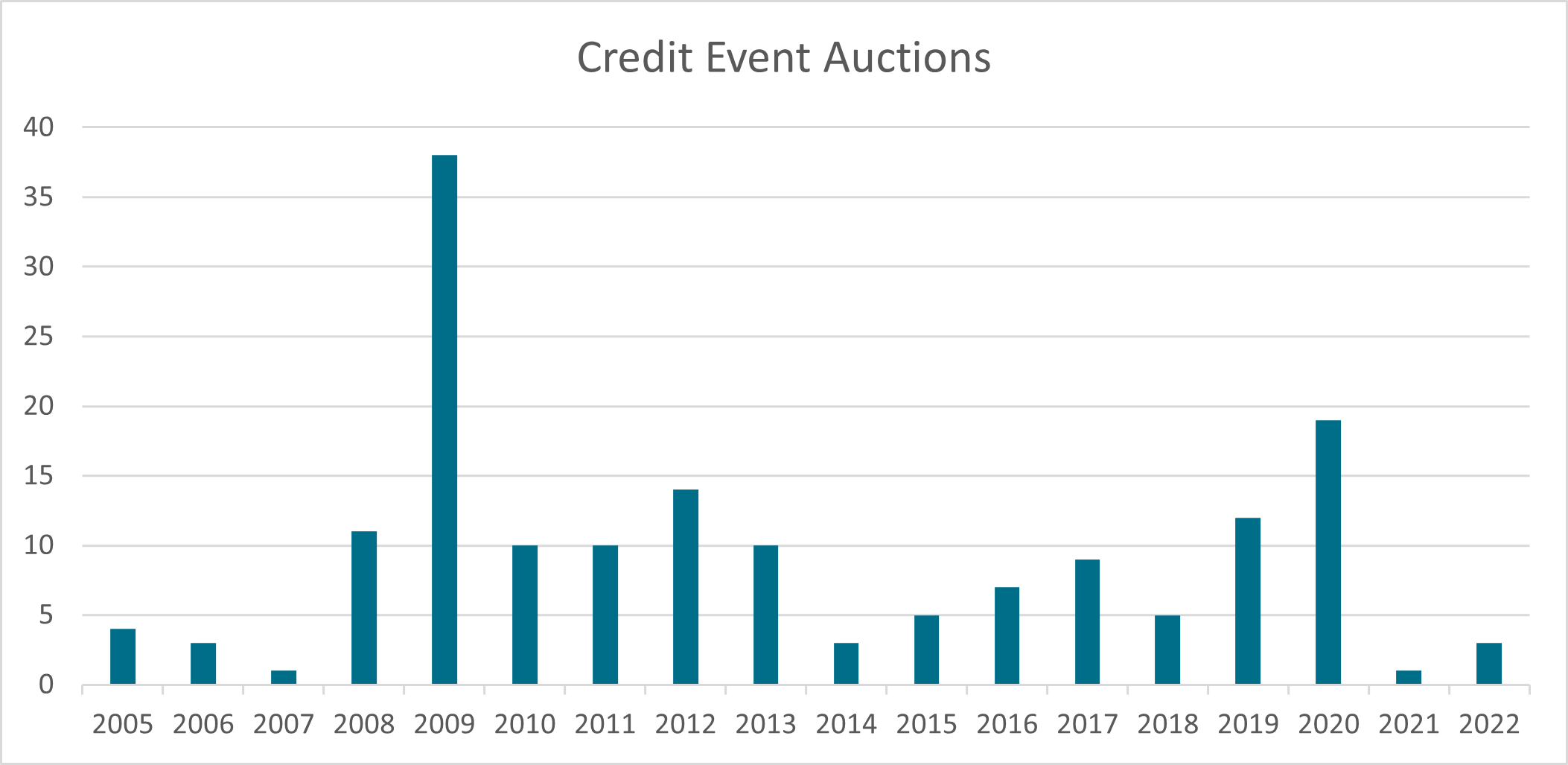

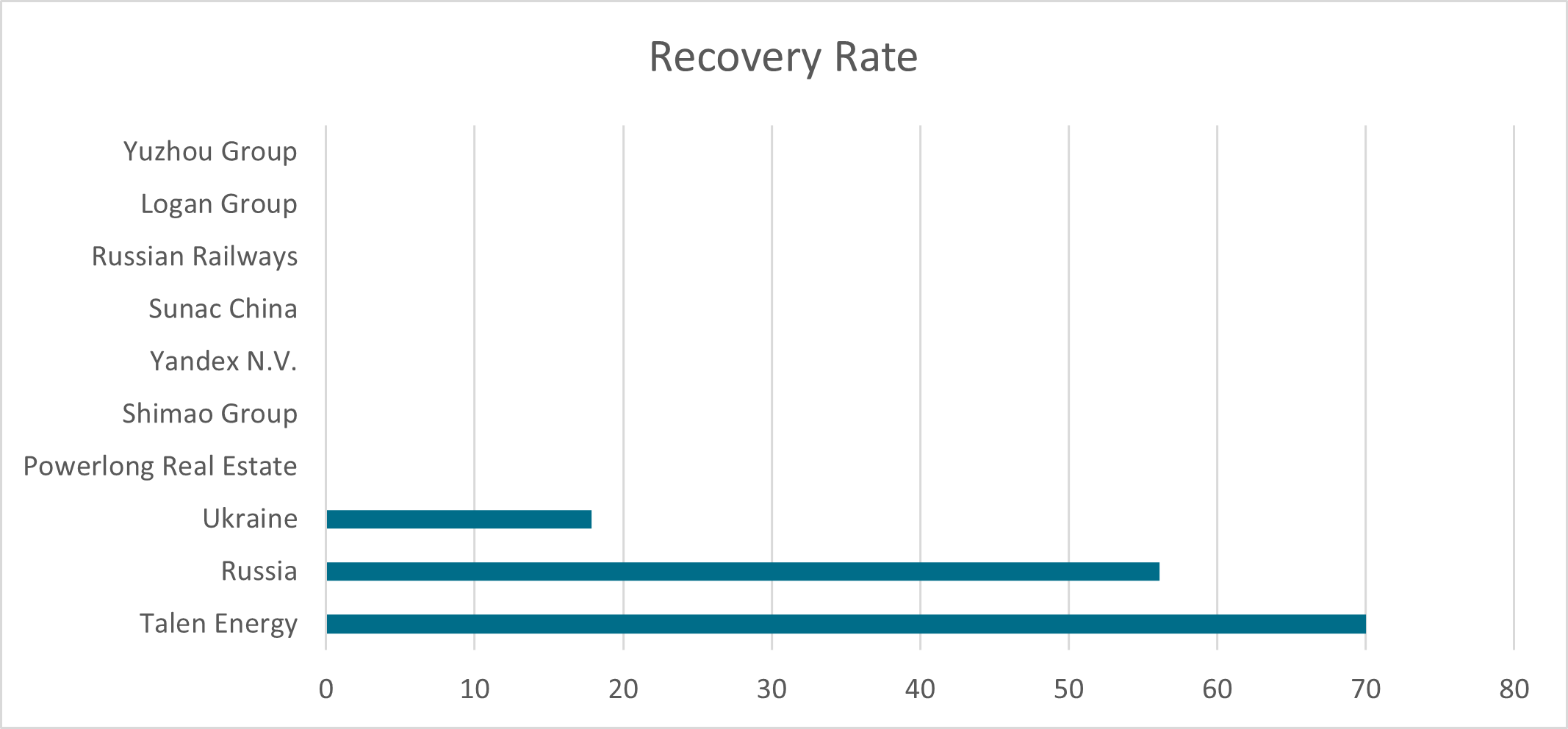

Credit Event Auctions

One might expect the number of CDS credit events and consequent auctions to have risen given the backdrop of rising credit risk. But there have been only three auctions this year - Talen Energy, Russian Federation and Ukraine. This is up from the very low levels of last year but below historical averages. Corporates took advantage of favourable refinancing conditions over the last two years and that has alleviated near-term risks of default in many sectors.

Source: S&P Global Market Intelligence

But the above chart obscures the real picture of CDS defaults. There have been 10 credit events this year but only three have met the criteria for an auction ( as deemed by the ISDA Determinations Committee). The remaining seven are all EM corporates, the bulk of them related to Chinese property and construction. The main reason auctions haven't been held is that the 300/5 transaction criteria hasn't been fulfilled (essentially not enough trades outstanding and not enough dealers active). This suggests that more liquidity provision is required in the EM corporate market, which will in turn give investors the confidence of an auction derived settlement following a credit event.

Source: S&P Global Market Intelligence (top 7 names were settled outside of auction process)

2023 and beyond

Rates are rising and likely to stay at elevated levels (by modern standards at least) throughout 2023. Higher financing costs and tighter lending conditions are the most acute risks for corporate and EM credit next year. Mitigating credit risk will there be high priority for investors and CDS - whether in index, non-linear or single name form - remains the tool that best fits requirements.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsynthetic-credit-in-2022-and-beyond.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsynthetic-credit-in-2022-and-beyond.html&text=Synthetic+credit+in+2022+and+beyond+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsynthetic-credit-in-2022-and-beyond.html","enabled":true},{"name":"email","url":"?subject=Synthetic credit in 2022 and beyond | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsynthetic-credit-in-2022-and-beyond.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Synthetic+credit+in+2022+and+beyond+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsynthetic-credit-in-2022-and-beyond.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}