Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 28, 2023

Time, tariffs and tracking: Supply chain outlook for fourth quarter 2023

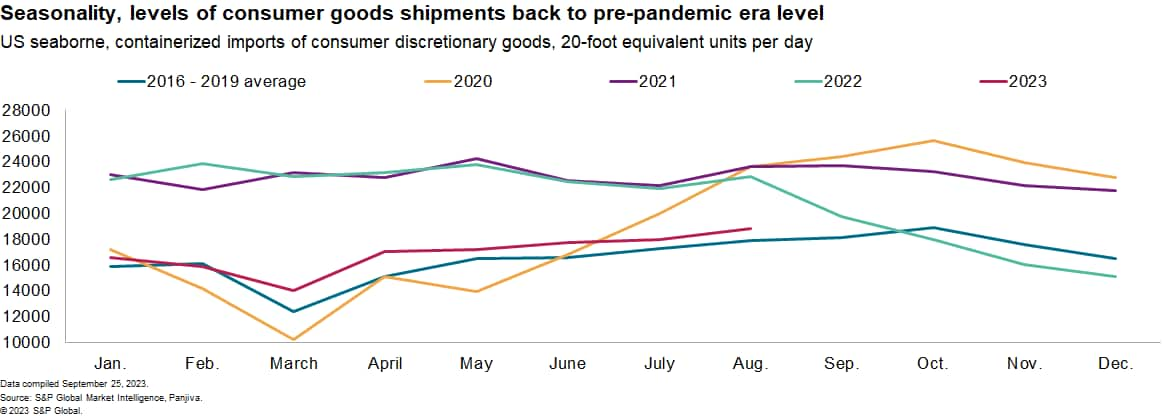

Supply chain activity has largely returned to normal, although uncertainties remain around corporate strategy, global trade policy, and environmental measures. Lower consumer demand is evident in US seaborne imports of consumer goods that have fallen by 26%. Industrial manufacturing has declined globally for over a year. Trade policies are becoming more restrictive and sustainability policies will start to have real consequences. Shipping firms have raised prices due to inclusion in the EU emissions trading scheme and water stress risks are affecting shipping worldwide.

Explore our global supply chain offering

Time to go back to 'just in time'

Supply chain challenges have resulted from high demand for goods. US consumer spending on durable goods fell slightly in Q2 2023, and a further slowdown is expected in early 2024. The decline in consumer spending has led to a reduction in trade activity, particularly in US seaborne imports. We see signs of improvement, with the seasonality of shipments returning to pre-pandemic levels. The industrial sector may also see limited demand in the coming months, according to S&P Global PMI data.

Global manufacturing orders have been declining for 14 months, causing backlogs and reduced purchases. The rate of decline has slowed since June, although a return to normal levels won't be confirmed until Q4 2023 and 2024. We expect global trade activity to stabilize in Q3 2023, and growth will remain lackluster with weak electronics exports and an ongoing autoworkers' strike. Labor actions could cause supply chain disruptions and higher costs.

At the same time, companies are looking to conserve cash, with a wide range of data showing inventory strategies have returned to "just in time" approaches rather than more conservative strategies. Multisourcing strategies tend to add costs in the near term for qualifying suppliers while also reducing economies of scale. Retail inventories are still recovering, with some sectors returning to pre-pandemic levels. Manufacturers' inventories are declining, but at a slower rate, with the automotive sector seeing improvement. Tariff adjustments may be necessary as trade policies become more restrictive, particularly in the technology, autos, and renewable energy sectors.

Industrial and trade policies will remain in focus in 2023, with an emphasis on tariff-related interventions and multilateral protectionism challenges. The US is reviewing Section 301 duties on imports from mainland China, although tariffs are unlikely to be reduced before the 2024 election. Firms are reshoring supply chains in response to tariffs, with mainland China's share of US imports falling and Mexico and Vietnam's increasing.

Resource protectionism is likely to continue due to rising prices and government security strategies. The war in Ukraine creates supply chain uncertainties, with the EU considering more sanctions against Russia and the country banning petrol and diesel exports.

Looking further ahead, an increase in populist measures that could disrupt supply chains may increase heading into 2024 given there are over 70 national elections globally due to be held during the year. The 13th World Trade Organization ministerial conference in February 2024 provides an opportunity to reset the dispute settlement system.

Listen to our podcast episode on the supply chain outlook

Green rubber hits the green road

Sustainability policies will start to exact real consequences for supply chains strategies.

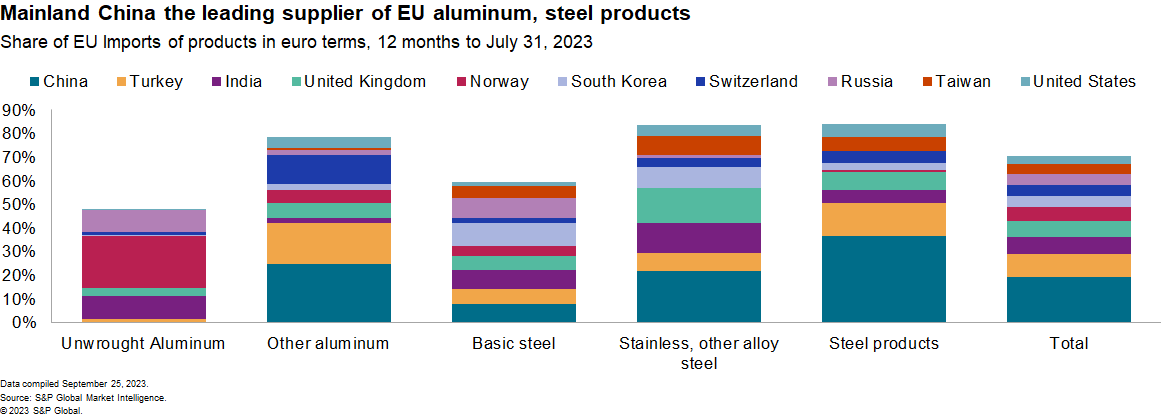

The EU's Carbon Border Adjustment Mechanism will begin with reporting requirements in January 2024. Germany may push for smaller companies to be excluded. Mainland China supplied the most steel and aluminum to the EU, and the CBAM could create supply chain upheaval. The UK's lower permit prices may require UK exporters to pay under CBAM. Australia and South Korea are considering their own CBAMs. Steel suppliers to the EU are exploring strategic options, such as alternative fueling and reshoring opportunities.

The EU Corporate Sustainability Directive passed European Parliament approval in June and will require firms to monitor and assess their impact on environmental and human rights measures. Similar rules have already been implemented in Germany. These regulations will apply to most firms, including non-EU ones with over €150 million of global revenue if €40 million came from the EU. Direct cost increases from tighter environmental rules for shipping will start from January 2024.

Starting in January, the EU Emissions Trading Scheme will include maritime shipping, covering 50% of journeys to and from EU ports. Certificates covering emissions will be required, starting at 40% in 2024 and rising to 100% in 2026. The International Maritime Organization is also developing greenhouse gas reduction rules, due in Spring 2026. Container lines expect compliance costs to be significant and plan to apply surcharges. Leading companies are cooperating on fuel technologies, with long-term fuel arrangements likely to be made.

Supply chain decision-makers are dealing with water shortages in the Panama Canal causing shipping delays and reduced flexibility. As a result, some are turning to alternative routes like the Suez Canal or rail transportation from the US west coast. Inland water transportation around the world is also being affected by water stress.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-chain-outlook-2023-q4.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-chain-outlook-2023-q4.html&text=Time%2c+tariffs+and+tracking%3a+Supply+chain+outlook+for+fourth+quarter+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-chain-outlook-2023-q4.html","enabled":true},{"name":"email","url":"?subject=Time, tariffs and tracking: Supply chain outlook for fourth quarter 2023 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-chain-outlook-2023-q4.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Time%2c+tariffs+and+tracking%3a+Supply+chain+outlook+for+fourth+quarter+2023+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-chain-outlook-2023-q4.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}