Stronger growth and lower inflation: our key take-aways from the Eurozone flash PMI

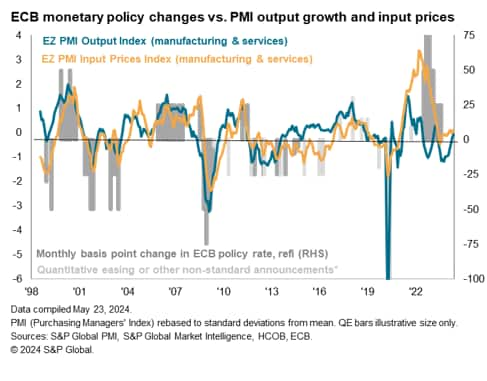

Business activity in the euro area rose for a third successive month in May, the rate of growth accelerating to a one-year high, according to the provisional 'flash' PMI® survey data. At the same time, price pressures cooled, with services sector inflation - the recent stickiness of which has been a major concern for policymakers worried about sustained elevated inflation - notably down to the lowest seen over the past three years.

Here are our top-five take-aways from the May flash PMI data:

1. Economic growth at one-year high

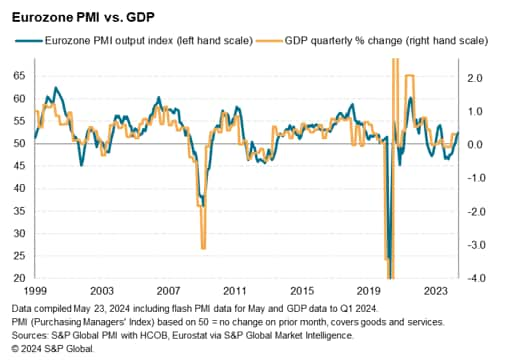

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, rose from 51.7 in April to 52.3 in May, its highest for 12 months and indicating rising output across the combined manufacturing and services sectors for a third successive month.

At its current level, the PMI is broadly indicative of eurozone GDP growing at a quarterly rate of 0.2%, according to a simple OLS regression model based on prior PMI and GDP data alone.

More growth is likely in the coming months, after companies reported the most optimistic future output expectations for 27 months in May.

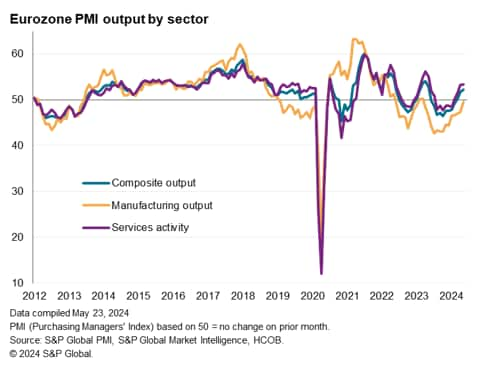

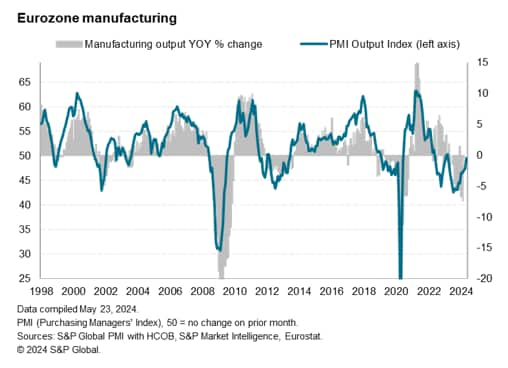

2. Manufacturing close to stabilising

Although the service sector continued to drive the upturn, sustaining growth at the fastest rate for a year in May, manufacturing output came very close to stabilising, registering the smallest decline for 14 months, as the sector's rate of decline has moderated almost continually over the past year.

Manufacturing orders and new export orders both showed the smallest declines for two years in May, hinting at a welcome steadying of demand and trade flows for goods.

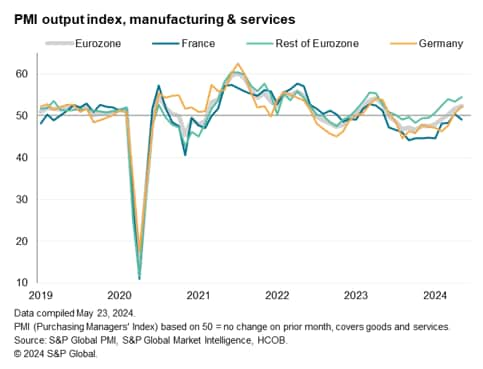

3. 'Periphery' leads recovery

While the flash PMI data include responses from companies in Italy, Spain, Ireland, the Netherlands, Austria and Greece as well as France and Germany, only national data are provided for the latter two in the publication of the flash data. The data from the other member states are, however, presented as a 'Rest of Eurozone' GDP-weighted aggregate. The Rest of Eurozone in fact led the economic upturn across the region in May, as it has done since its output began rising at the start of the year, with May seeing the rate of growth accelerate to the fastest for 13 months. Services output rose especially sharply in the 'periphery', but manufacturing output also rose.

The data point to particularly strong service sector expansions in countries such as Italy and Spain, which have in recent months enjoyed rising demand in particular for travel and tourism related activities above a beyond normal seasonal levels.

However, Germany also continued to recover, with output up for a second month running after nine months of decline, reporting the fastest growth in 12 months. A further improvement in services growth was accompanied by the smallest manufacturing decline recorded for more than a year.

France bucked the recovery trend, with output falling slightly in May amid declines for both goods and services. However, the past two months combined have seen France's output stabilise on average, representing its best performance for a year.

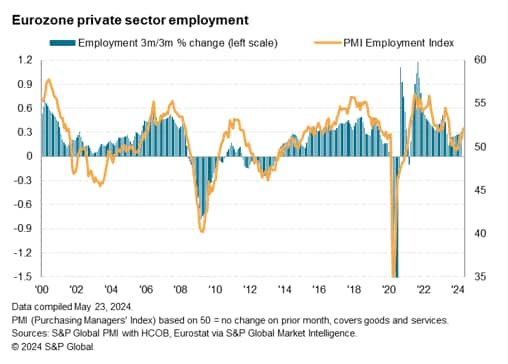

4. Employment gains to help sustain upturn

Employment increased across the eurozone for a fifth month in a row in May after two months of marginal declines at the end of 2023, with the rate of net job creation accelerating to an 11-month high. Further job gains in the service sector (an 11-month high) were accompanied by an easing rate of job losses in manufacturing to the lowest in eight months.

The stronger jobs growth is encouraging in respect of the associated improvement in job security and consumer spending implications for the region, which should help support broader economic growth in the months ahead if sustained.

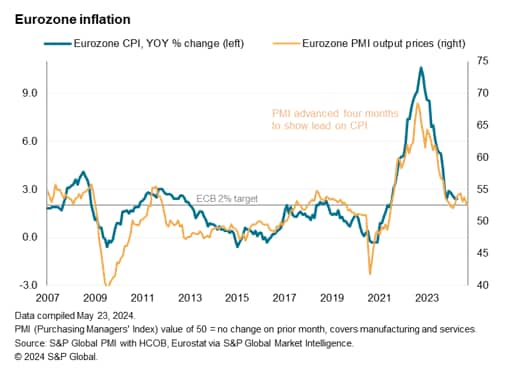

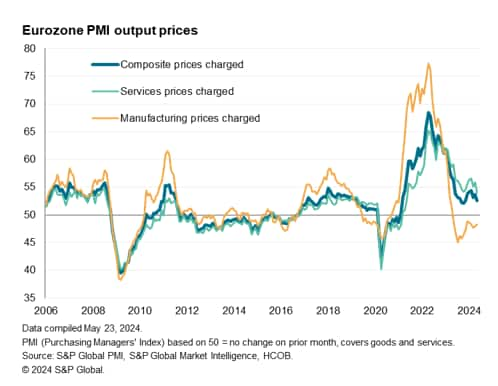

5. Prices rise at slower rate as service sector inflation slides to joint-lowest in three years

One of the factors that has buoyed business confidence and led to increased demand, output and hiring in recent months, has been the cooling of inflation and associated speculation that interest rates will soon start to fall. In this respect, the flash PMI for May brought further cause for optimism. Average prices charged for goods and services rose at the slowest rate for six months, rising at a level which is broadly consistent with headline consumer price inflation meeting the European Central Bank's 2% target.

May saw manufacturing prices fall for a thirteenth successive month, while service sector prices rose at the slowest rate since last October, and the joint-slowest rate for three years. Service sector input costs - which are heavily influenced by wage pressures - notably rose at the slowest rate for three years.

The cooling of services inflation is especially important, as this has been the stickiest area of price growth in recent months, and hence been the main area of concern for policymakers.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.