Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 07, 2022

Stocks spoiled the festive cheer

Research Signals - January 2022

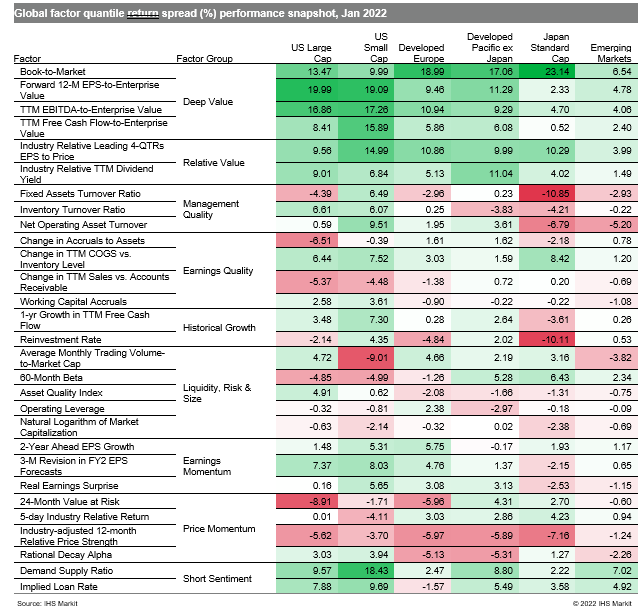

After toasting to a stellar year for equity markets in 2021, stocks faced a rough month at the start of the new year. Value factors prevailed (Table 1) as investors grappled with the prospects of central bank interest rate hikes and monetary tightening. Meanwhile, the J.P.Morgan Global Manufacturing PMI slowed to a 15-month low, reflecting weaker growth in new business, supply chain disruptions and ongoing waves of COVID-19 variants, with pronounced weakness from the US as well as China, which returned to contraction territory as it begins to celebrate the Year of the Tiger.

- US: Deep Value measures extended their recent run into 2022, with factors such as Forward 12-M EPS-to-Enterprise Value reaching robust double-digit decile return spreads

- Developed Europe: Value outperformed growth once again, as captured respectively by TTM EBITDA-to-Enterprise Value and Reinvestment Rate

- Developed Pacific: Book-to-Market more than doubled the prior month's strong performance, while Industry-adjusted 12-month Relative Price Strength underperformed

- Emerging markets: Price Momentum's return to favor was short-lived, as Deep Value measures (e.g., Forward 12-M EPS-to-Enterprise Value) emerged once again as the most highly rewarded group in January

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-spoiled-the-festive-cheer.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-spoiled-the-festive-cheer.html&text=Stocks+spoiled+the+festive+cheer+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-spoiled-the-festive-cheer.html","enabled":true},{"name":"email","url":"?subject=Stocks spoiled the festive cheer | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-spoiled-the-festive-cheer.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Stocks+spoiled+the+festive+cheer+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-spoiled-the-festive-cheer.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}