Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 08, 2022

Daily Global Market Summary - 8 February 2022

All major US and most APAC and European equity indices closed higher. US and benchmark European government bonds closed lower. European iTraxx and CDX-NA closed tighter across IG and high yield. The US dollar, natural gas, silver, and gold closed higher, copper was flat, and oil was lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000 +1.6%, Nasdaq +1.3%, DJIA +1.1%, and S&P 500 +0.8%.

- 10yr US govt bonds closed +4bps/1.96% yield and 30yr bonds +4bps/2.26% yield.

- CDX-NAIG closed -1bp/63bps and CDX-NAHY -4bps/350bps.

- DXY US dollar index closed +0.3%/95.64.

- Gold closed +0.3%/$1,828 per troy oz, silver +0.5%/$23.20 per troy oz, and copper flat/$4.46 per pound.

- Crude oil closed -2.1%/$89.36 per barrel and natural gas closed +0.4%/$4.25 per mmbtu.

- The report entitled 'Consumer goods are flooding into the US'

fleshes out the US advance report on international trade in goods

published last week and adds details on trade in services. It also

gives a complete picture of the fourth quarter and of the year

2021. (IHS Markit Economist Patrick

Newport)

- The advance report showed the goods deficit, as measured by the Census Bureau, widening by $2.9 billion to $101.0 billion. This report shows (1) the goods deficit was $0.7 billion narrower in November and $0.5 billion narrower in December—a pittance; (2) the services surplus widened $1.8 billion with travel exports (tourists visiting the US) and transport exports accounting for most of the increase.

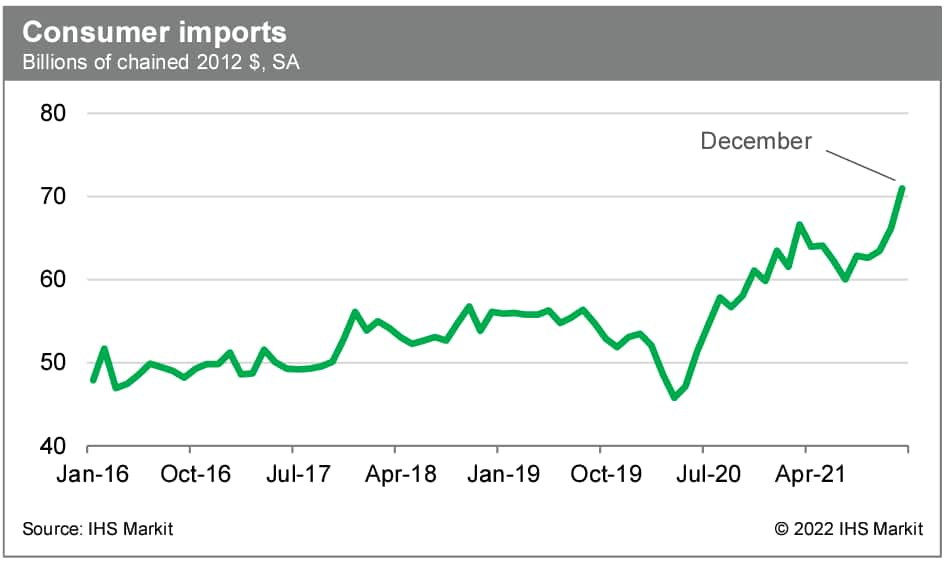

- Real goods imports grew an annualized 17.3% in the fourth quarter; real consumer imports soared 36.7% (annualized), while capital goods imports jumped 11.8% (annualized). Real imports were 13.8% above pre-pandemic levels (2019:4) in the fourth quarter.

- Real consumer goods imports have skyrocketed 18% since July. Contributing most to the flood are (1) cell phones and other household goods not classified elsewhere; (2) toys, games, and sporting goods; (3) apparel and household goods; and (4) pharmaceutical preparations.

- Real goods exports grew an annualized 23.5% in the fourth

quarter. Real goods exports were up across the board, led by a

77.7% (annualized) increase in foods, feeds, and beverages

(soybeans accounted for the entire increase); a 52.2% (annualized)

increase in consumer goods; and a 44.5% (annualized) increase in

automotive vehicles. Real exports were 2.5% above pre-pandemic

levels (2019:4) in the fourth quarter.

- A subsidiary of Amazon has secured a warrant to acquire 39.6 million shares in LiDAR sensor maker Velodyne, reports Reuters. According to the deal, Amazon.com NV Investment Holdings, a wholly owned subsidiary of Amazon, can exercise the warrant at USD4.18 per share on or before 4 February 2030. The warrant shares will vest over time based on Amazon's "discretionary payments" of up to USD200 million to Velodyne. According to the deal, Amazon can appoint a board observer when its shareholding crosses 12.3 million shares. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- On February 8, the Turlock Irrigation District (TID) in

California announced Project Nexus, a pilot project to build solar

panel canopies over a portion of TID's existing water canals,

adding solar capacity while helping protect water in the canals

from evaporation. Project Nexus is a public-private-academic

partnership among TID, the state Department of Water Resources

(DWR), Solar AquaGrid and the University of California, Merced.

This first-ever solar panel over canal development in the US would

(IHS Markit PointLogic's Barry Cassell):

- Assess reduction of water evaporation resulting from mid-day shade and wind mitigation.

- Improvements to water quality through reduced vegetative growth.

- Reduction in canal maintenance through reduced vegetative growth.

- Generation of renewable electricity.

- Certain internal documents between the USDA and the Department

of Justice (DOJ) on the antitrust lawsuit filed last year to stop

US Sugar Corp. from acquiring rival Imperial Sugar Company should

not be shared with the companies, DOJ told a judge last week. (IHS

Markit Food and Agricultural Policy's Joan

Murphy)

- US Sugar announced in March that it would buy Imperial Sugar, a port refiner with operations in Georgia and Kentucky, from commodities trader Louis Dreyfus Co.

- Under US Sugar's ownership, the company said, the Imperial facility will increase the overall output of refined sugar, ease reliance on foreign imports, and refine raw sugar grown by US farmers that US Sugar is unable to process.

- "In addition, this acquisition will provide customers with additional volume, access to a wider variety of sugar products, and security against supply chain disruptions caused, for example, by increased extreme weather-related events," the company said last month.

- But in November, DOJ filed a civil antitrust lawsuit to stop the deal, arguing the transaction would leave an overwhelming majority of refined sugar sales across 12 states in the hands of only two producers. As a result, US businesses and consumers would end up paying more for refined sugar.

- When announcing the lawsuit, Assistant Attorney General Jonathan Kanter of the Justice Department's Antitrust Division said the deal would "further consolidate an already cozy sugar industry."

- "Competition between these two companies has resulted in lower prices and better service for customers," Justice Department attorney Michael Wolin said in a February 4 letter to the court. US Sugar's deal would significantly decrease competition in the affected area, resulting in only two companies—United, the cooperative through which US Sugar sells all of its sugar, and American Sugar Refining—accounting for close to 75% of all sugar sales in the area, he said.

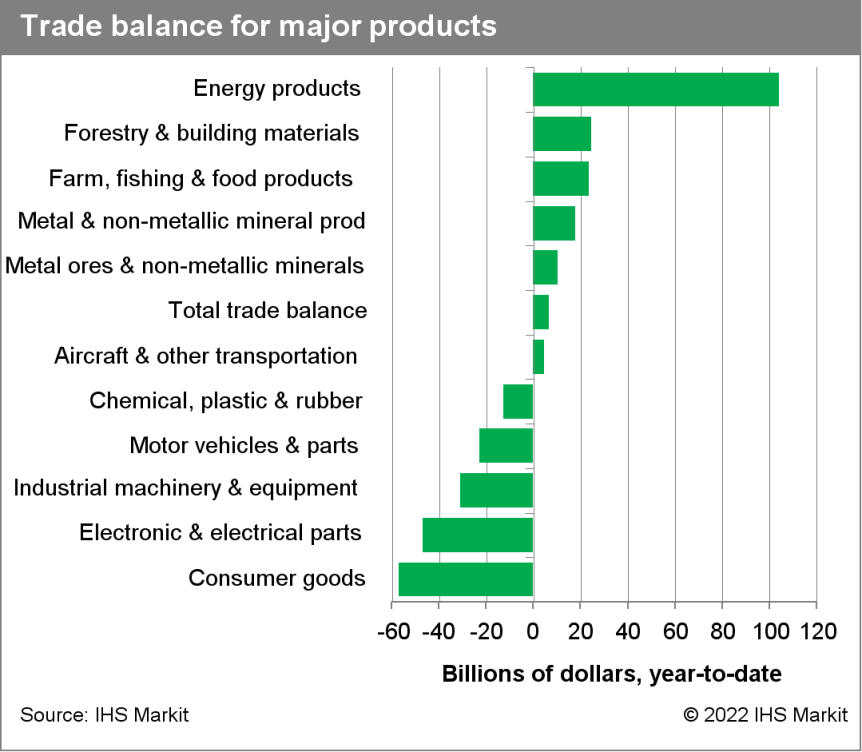

- Canada's nominal merchandise trade surpluses were recorded in

nine months in 2021, reaching a total surplus of $6.6 billion. This

is the first surplus since 2014 and the widest since 2008. (IHS

Markit Economist Evan Andrade)

- High commodity prices, created by global demand-supply imbalances, helped Canada reach its merchandise trade surplus in 2021. Annual export growth in nominal energy products (up 82.8% year on year: y/y), forestry and building materials (up 31.8% y/y), and metal ores and non-metallic minerals (24.6% y/y) were far greater than each product category's import counterpart.

- December saw a substantial swing, as the merchandise trade balance returned to a modest deficit of $137 million from a surplus of $2.5 billion in November.

- Nominal exports fell 0.9% month on month (m/m) to $57.6 billion, while imports rose 3.7% m/m to $57.7 billion.

- In real terms, exports rose at a 10.8% quarter-on-quarter

annualized rate (q/q a.r.) and imports jumped at a quicker 13.0%

q/q a.r. This suggests that goods trade will be a drag on

fourth-quarter and annual 2021 real GDP growth—in line with the

latest forecast.

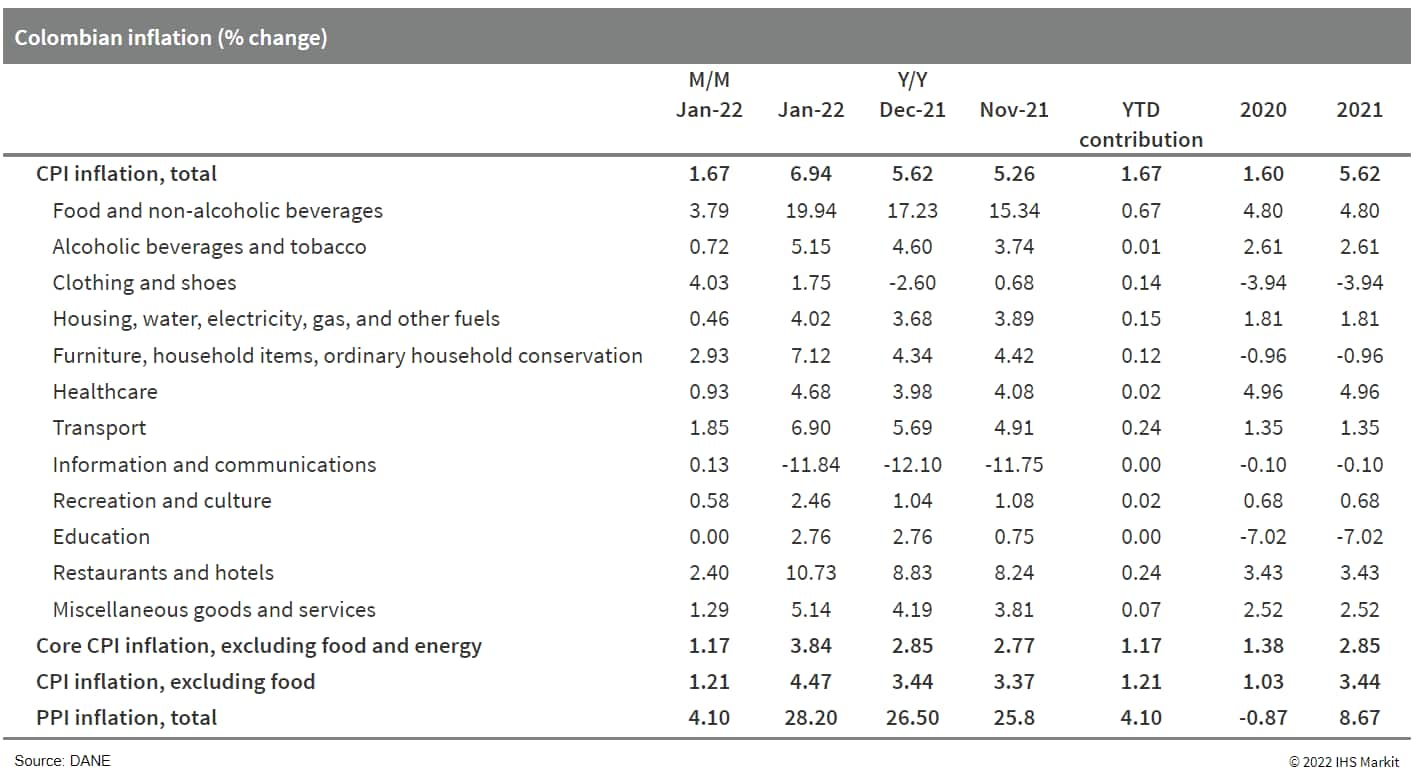

- According to the National Administrative Department of

Statistics (Departamento Administrativo Nacional de Estadística:

DANE), Colombia's Consumer Price Index (CPI) jumped to 6.9% year on

year (y/y) in January, its highest reading since September 2016,

and more than double than the target of 3% +/- 1 percentage point

established by Banrep. (IHS Markit Economist Dariana Tani)

- Food and non-alcoholic beverage prices continued to be the main driver of inflation in January, posting the biggest annual increase on record and contributing 3.2% of total annual inflation. Meanwhile, core inflation, measured by the CPI that excludes food and energy prices, accelerated to 3.8% y/y.

- On a month-on-month (m/m) basis, inflation rose by 1.7% m/m, the highest level since 2001, with the breakdown of the data showing the largest price rises in clothes and shoes because of the normalization of prices following the days without value-added tax (VAT) in the last three months of 2021.

- Separate data from DANE indicate that producer prices, as

measured by the Producer Price Index (PPI), rose at a faster pace

in January than in the previous month to set a record high of

28.2%, driven mainly by a surge in agriculture costs as logistics

issues continued to add upward pressure on prices. We assess that

the longer these issues stay in place, the more of these costs will

be passed onto consumers.

Europe/Middle East/Africa

- Most major European equity markets closed higher except for UK -0.1%; Spain +1.4%, Italy +0.3%, France +0.3%, and Germany +0.2%.

- 10yr European govt bonds closed lower; Italy/Spain +3bps, Germany +4bps, France +5bps, and UK +8bps.

- iTraxx-Europe closed -2bps/64bps and iTraxx-Xover -11bps/310bps.

- Brent crude closed -2.1%/$90.78 per barrel.

- The UK parliament's Transport Committee has called for a revised vehicle taxation policy in preparation for the country's transition to electrification. In a statement, it said that around GBP35 billion is currently raised from fuel duty and vehicle excise duty (VED), neither of which is currently levied on battery electric vehicles (BEVs). It also highlights the importance of these taxes to the exchequer, given only around 20% of the revenue from them is spent on maintaining and developing the road infrastructure. In preparation for the UK government's plans to end sales of non-plug-in vehicles by 2030, it said that it needs to "start an honest conversation with the public on the funding implications for road development and maintenance and for other essential public services of decreased revenue from vehicle excise duty and fuel duty." It has called on the government to "set out a range of options to replace fuel duty and vehicle excise duty," adding that, "those options should be revenue neutral and not cause drivers, as a whole, to pay more than they do currently", and "one of those options should be a road pricing mechanism that uses telematic technology to charge drivers according to distance driven, factoring in vehicle type and congestion." However, it warned of the potential overlap from a "patchwork of devolved schemes" such as congestion zones and clean air zones" and the possibility of both "confusion and unfair double taxation". (IHS Markit AutoIntelligence's Ian Fletcher)

- Early February's combination of much higher-than-expected

January Eurozone HICP inflation and a hawkish shift at the ECB's

subsequent press conference has led to a major change in market

expectations of monetary policy prospects, with spillovers across

Europe's financial markets. At the time of writing, a close to 80%

chance of a 10-basis-point (bp) rise in the ECB's Deposit Facility

Rate (DFR; currently -0.50%) by June is priced into futures

markets. A total of 50 bps of DFR hikes is priced in as soon as

December. (IHS Markit Economist Ken

Wattret)

- Germany's sovereign yields have surged, with intra-eurozone sovereign yield spreads widening markedly, although they remain well below their peaks at the onset of the pandemic in March 2020. The euro has also appreciated versus the US dollar, rising above 1.14 despite strong US non-farm payroll growth data over the same period, reinforcing expectations of a series of rate hikes from the US Federal Reserve (Fed) from March onwards.

- In short, contrary to expectations of a large, base-effect driven drop, HICP inflation reached a new record high, with energy, again, being the main contributor.

- In brief, while the ECB's statement was broadly unchanged versus the December 2021 version, and dovish compared with those of other major central banks recently, the press conference had a rather different hue. There were numerous signals of increased alarm within the ECB over inflation prospects, with upward revisions to the staff inflation projections following the next policy meeting on 10 March likely to trigger an earlier withdrawal of policy accommodation.

- As highlighted previously, the evolution of the ECB's inflation projections will be the key influence on how monetary policy evolves and February's press conference revealed that the ECB believes it is "much closer" to achieving the three inflation criteria required to elicit policy rate hikes. At the same time, however, ECB president Christine Lagarde insisted that the ECB will "follow the sequence" of policy steps laid out in its forward guidance.

- Therefore, if, as we expect, inflation projections are revised upwards in March, the initial response will be to accelerate the tapering of the ECB's net asset purchases. Net purchases under the pandemic emergency purchase programme (PEPP) are already scheduled to cease at the end of March, but net purchases under the asset purchase programme (APP) are expected to continue at a pace of EUR20 billion per month until October, and potentially beyond, under the ECB's current guidance. Our base case is for an announcement in March that all net purchases will cease by the third quarter of 2022 as we assume that the ECB will want to avoid a cliff-edge (i.e., a sudden stop of net purchases) and will opt to taper them over several months.

- France has allowed the temporary marketing and use of seed

treatments based on the neonicotinoid insecticides, imidacloprid

and thiamethoxam, on sugar beet. The two seed treatment products

whose use is allowed for 120 days from 31 January onwards are:

Bayer's Gaucho 600FS (imidacloprid 600 g/liter) and Syngenta's

Cruiser SB (thiamethoxam 600 g/liter). The seed treatments are to

tackle yellowing virus damage to the country's sugar beet crops.

The viruses are transmitted by aphids. A consultation on this

derogation was launched at the end of December. (IHS Markit Food

and Agricultural Policy's Sanjiv Rana)

- In the absence of an effective alternative solution that can be mobilized on a large scale from 2022, this derogation is based on scientific criteria, the Ministry points out. In accordance with the opinions of the French food safety agency, the Anses, the order strictly regulates crops planted following a crop of sugar beet treated with neonicotinoids, in order to preserve pollinators. The Ministry adds that the sugar beet sector has also undertaken to further accelerate in 2022, the establishment of honey strips for pollinators to reach the figure of 4,000 ha by the end of 2022.

- In September 2018, France banned five neonicotinoid insecticides, including imidacloprid, clothianidin, thiamethoxam, thiacloprid and acetamiprid. That was merely days before the EU's ban on outdoor uses of clothianidin, imidacloprid and thiamethoxam.

- But in August 2020, confronted with an "unprecedented crisis" of yellowing virus damage to the country's sugar beet crops, the French Ministry of Agriculture came up with an action plan, including allowing the use of neonicotinoid insecticide seed treatments. In November 2020, the Parliament passed a bill that allowed the use of imidacloprid or thiamethoxam-based seed treatments for sugar beet seeds for the 2021 season until, at most, 2023. A similar derogation was granted in 2021 allowing the use of the seed treatments for a period of 120 days. The sector remains economically fragile in 2022, the Ministry says.

- Stellantis has halted light commercial vehicle (LCV) production at its Sevel facility in Val di Sangro (Italy). UILM union representative Nicola Manzi told Reuters that the facility was stopped on Monday (7 February) due to shortage of engines supplied from France, but would resume on Tuesday (8 February). He noted that the stoppage came in the wake of an additional production day on Saturday (5 February) to catch up production lost due to a stoppage that was also caused by a shortage of engines. Manzi said, "Clearly we cannot rule out more stoppages could occur in the future, due to components, materials and in general one of the many issues affecting the global supply chain." (IHS Markit AutoIntelligence's Ian Fletcher)

- Skoda Auto DigiLab said its peer-to-peer car-sharing service HoppyGo was a success last year. HoppyGo, a car-sharing portal, is available in Czechia, Poland, and Slovakia. In 2021, registered customers for the service reached 150,000, up by 50% year on year (y/y). The number of rental days rose by one-third, while the rental period increased to 4.7 days from 4.2 days a year earlier. Jarmila Plachá, head of Skoda Auto DigiLab, said, "Carsharing concepts are economical, sustainable and increasingly popular. HoppyGo users love the platform, because it offers them the choice of the right vehicle for all needs at any time, for any occasion and it is simple to use. It offers them flexible rental conditions for a fair price, which is appreciated by our customers not only in the Czech Republic, but also in Poland and Slovakia". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Middle Eastern ride-hailing firm Careem is looking to hire more than 200 people, reports Reuters. This is in connection with its plan of expanding the rollout of its "Super App", which offers services such as ride-hailing, food delivery, digital payments, and courier services. According to the report, Careem was looking to fill jobs "from engineers to data analysts, operations managers to platform designers, and everything in between". Careem was established in 2012 and operates in more than 100 cities in 13 countries in the Middle East, North Africa, and South Asia. In 2019, Uber acquired Careem for USD3.1 billion. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Saudi Central Bank (SAMA) has tightened bank account rules

by prohibiting banks from opening accounts for entities that are

involved in illegal activity. SAMA's new bank account rules implies

that banks will not be allowed to offer banking services without

successful account validity and that they will also have the right

to freeze accounts in the event of bank account verification and

validity failure, effective from 2 February. Another implication of

the regulation is that Saudi banks must submit a statement at the

end of March every year to SAMA, listing unclaimed and abandoned

accounts, and such accounts will be subject to an internal audit

every two years. Accounts held by government members and agencies

will enjoy some exceptions to the rules. (IHS Markit Banking Risk's

Natasha

McSwiggan)

- Saudi authorities have continually worked to strengthen their anti-money laundering and counter-terrorist financing (AML/CFT) framework over the last decade and the Kingdom was granted full membership in the Financial Action Task Force (FATF) in June 2019. In the FATF's latest follow-up report (January 2020), out of 40 recommendations, Saudi Arabia was found to be compliant with 17 recommendations; largely compliant with 21; and partially compliant with 2.

- Tighter bank account rules are a positive development, signaling a move from SAMA to address and deter illicit activity in the banking sector and to likely to address AML/CFT deficiencies. This is also likely to be a positive step towards compliance with the FATF's recommendation relating to comprehensive AML/CFT statistics.

- The Reserve Bank of Malawi held its key interest rate at 12.0%

at its monetary policy meeting held on 2-3 February, despite rising

inflation expectations. The liquidity reserve requirement (LRR)

ratio on domestic- and foreign-currency deposits was maintained at

3.75% and the Lombard rate was held at 20 basis points above the

policy rate. (IHS Markit Economist Archbold

Macheka)

- According to the central bank's monetary policy committee (MPC), the latest rate action was viewed as appropriate to contain the rising inflationary pressures while providing space for supporting continued recovery of the economy from the coronavirus disease 2019 (COVID-19) virus pandemic-induced slowdown. Despite noting that price pressures were increasing, the MPC considered the inflationary sources to be temporary and "likely to dissipate after the lean period."

- Headline inflation accelerated to 10.8% in the fourth quarter of 2021, up from 8.7% in the third, thanks largely to cyclical factors, speculative tendencies by market traders, water tariff and Malawi Housing Corporation rental increases, and domestic fuel pump price increases. The Reserve Bank of Malawi anticipate annual headline inflation will average 10.4% in 2022 compared to an earlier forecast of 8.9% in December 2021.

- The central bank expects real GDP growth of 4.1% in 2022 from an estimated 3.9% in 2021 anchored by robust agriculture output on assumption of favorable weather conditions and continued implementation of the Affordable Input Program (AIP). Investments in mining and quarrying, utilities and construction will also support non-agricultural GDP, but downside risks emanating from uncertainty around the evolution of the COVID-19 virus pandemic and its containment measures remain elevated.

- In terms of the currency, the MPC noted that the kwacha appreciated 0.3% against the US dollar and 2.1% against the South African rand in the fourth quarter of 2021, "reflecting improved supply of foreign exchange following offloading of foreign exchange by some market participants". Nonetheless, the kwacha weakened against the British pound and the euro during the same period.

Asia-Pacific

- Most major APAC equity markets closed higher except for Hong Kong -1.0%; Australia +1.1%, Mainland China +0.7%, India +0.3%, Japan +0.1%, and South Korea +0.1%.

- Mainland China's tourism and box office revenues during the

2022 Lunar New Year lag 2021 levels, suggesting weakening

consumption growth and further roll-out of stimulus measures for

economic stabilization in the first quarter. (IHS Markit Economist

Yating

Xu)

- Data from the Ministry of Transport showed a 31.7% year-on-year (y/y) increase in passenger trips by car, rail, and air and water transport during the week-long Lunar New Year holiday starting from 31 January.

- However, the rise in passenger trips may not have translated into higher consumption. According to the Ministry of Culture and Tourism, travelers made 251 million domestic trips during the holiday, down 2% compared with the same period in 2021 and equivalent to 73.9% of the pre-pandemic (2019) level. Revenue generated from domestic tourism during the period was 3.9% lower than the 2021 level and 43.7% lower than the 2019 level.

- Meanwhile, box office revenues during the holiday were 23.1% lower year on year according to Caixin, citing statistics from Dengta, a Chinese box office data tracker platform. Considering the 9% y/y increase in the average movie ticket price, the number of tickets sold this year was over 30% lower year on year.

- The higher volume of passenger trips is attributed to the less-stringent COVID-19 controls during the 2022 Lunar New Year compared with those in 2021. Despite the numerous regional outbreaks around the end of 2021 due to the spread of the Delta and Omicron variants of COVID-19, local authorities are now implementing more flexible and targeted pandemic controls under the "dynamic zero-COVID" policy. For example, migrants from low-risk regions were allowed to return to their hometowns to celebrate Lunar New Year this year.

- Kia plans to scale up its investment in China and introduce a series of new electric vehicles (EVs). The South Korean automaker signed an agreement with the Yancheng city government on 7 February to expand its existing joint venture (JV), Dongfeng-Yueda-Kia, reports Korea JoongAng Daily. According to the report, Kia will release six EVs in China by 2027, starting with the EV6 next year. A separate report by China Daily indicates that the new investment committed by Kia and its Chinese partner Jiangsu Yueda Automotive Group could reach USD900 million. Dongfeng-Yueda-Kia was originally set up as a three-way JV between Kia, Jiangsu Yueda Investment (Yueda Investment) and Dongfeng Motor Group. However, Dongfeng already withdrew from the JV in December 2021 by selling its 25% share to Jiangsu Yueda Automotive Group, a subsidiary of Yueda Investment's parent company, Jiangsu Yueda Group (Yueda Group). Kia is expected to announce a new name for the JV in April. Dongfeng's withdrawal from the JV is primarily due to its poor performance, as Kia's sales have been declining over the past five years. The JV posted a net loss of CNY4.75 billion (USD746 million) in 2022 on revenue of CNY21.94 billion. In the next five years, much of Kia's China strategy will be centered on expanding its EV line-up and launching more higher-priced models in China. Between 2022 and 2027, Kia will introduce a new EV in China each year to meet growing consumer demand for them. (IHS Markit AutoIntelligence's Abby Chun Tu)

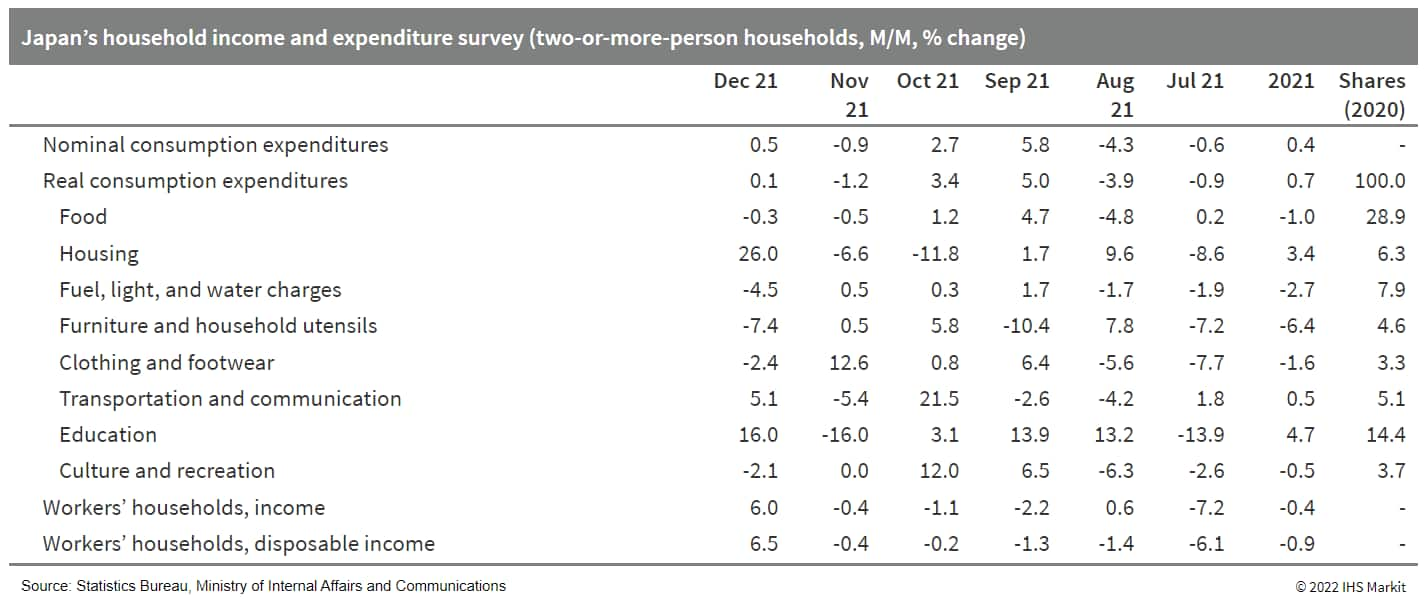

- Japan's real household expenditures notched up by 0.1% month on

month (m/m) in December 2021 following a 1.2% m/m drop in the

previous month. The annual figure for 2021 rose only by 0.6% after

a 6.5% fall in 2020. The m/m increase largely reflected solid

rebounds in spending on housing and education. These rises were

largely offset by declines in spending on fuel, power and water

charges, furniture and household utensils, clothing and footwear,

and culture and recreation. (IHS Markit Economist Harumi

Taguchi)

- The Diffusion Index (DI) of current conditions in the January 2022 EWS fell by 19.6 points to 37.9 in January, reflecting the negative effects of the rapid increase in Omicron-variant infections. The survey covers people holding jobs that enable them to closely observe aspects of regional economies. The decline in January 2022 was the largest m/m drop since March 2011, when the Great East Japan Earthquake and Tsunami occurred. It reflects decreases in all component indicators, particularly for food and beverages (down 39.8 points to 23.6) and services (down 28.6 points to 30.6) in household activity-related indicators. The DI for future conditions also continued to decline, moving down 7.8 points to 42.5, reflecting drops in all component indicators.

- The weak December 2021 results were in line with slack retail

sales (see Japan: 31 January 2022: Japan's retail sales weaken in

December 2021 while consumer confidence drops sharply in January).

However, a 4.8% quarter-on-quarter (q/q) increase for real

household expenditures suggest that a recovery in private

consumption was the major driver for real GDP growth in the fourth

quarter of 2021 (data will be released on 15 February 2022).

- Japanese electronics specialist Toshiba is planning to invest around JPY125 billion (USD1.08 billion) to set up a technologically advanced 300-mm fabrication plant in central Japan for power management chips, reports Reuters. The new plant will start operations by March 2025 and will increase output capacity to 2.5 times the current level. These chips will be able to efficiently control electric power in cars, electronic devices, and industry equipment. This investment includes JPY25 billion to build a 300-mm fabrication at an existing chip plant, according to a Toshiba spokesperson. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Japan's Mitsui & Co. plans to partner Malaysia's Hong Seng

Consolidated in building a nitrile butadiene latex (NBL, more

commonly known as nitrile butadiene rubber or NBR) plant, as well

as in constructing a butadiene and acrylonitrile (ACN) tank farm,

Hong Seng said yesterday. (IHS Markit Chemical Market Advisory

Service's Chuan Ong)

- Hong Seng said it had accepted a letter of intent (LOI) from Mitsui on Feb. 7, expressing mutual intention to exclusively negotiate partnerships in both the NBR business and the tank farm project.

- The Malaysian company said its subsidiary signed a sublease agreement in mid-2021 with authorities for industrial land in Kedah Rubber City, an industrial park focused on the rubber industry, to build the NBR plant.

- Hong Seng said another subsidiary had agreed in late-2021 to sublease from authorities industrial land located at Prai Bulk Cargo Terminal, in Penang Island, to construct a tank farm and house logistical services for storage, supply and delivery of feedstocks butadiene and ACN.

- Mitsui expressed in the non-legally binding LOI its intent to provide one-stop supply chain management for feedstock and raw materials of the NBR plant, its intent to finance the tank farm through providing raw materials, and its intent to support other potential businesses for the project, Hong Seng said.

- Both parties did not confirm when construction will be completed, but a local source expects both the tanks and the plant to be ready in 18 months.

- The NBL plant is expected to have a 960,000 mt/year capacity, with a 240,000 mt/year line, the first phase out of four, expected by 2024's second quarter, according to the source.

- Taiwan's Foxconn aims to produce 150,000 electric vehicles (EVs) in Thailand by 2030 through a joint venture (JV), Horizon Plus Co., Ltd. that started yesterday (7 February), reports Taiwan News. In September 2021, Foxconn signed a memorandum of understanding (MOU) with Thailand-based oil and gas conglomerate PTT Plc to set up a new company to build an EV production facility in Thailand's Eastern Economic Corridor. Foxconn's wholly owned subsidiary Lin Yin holds a 40% stake in Horizon Plus, while PTT's wholly owned subsidiary Arun Plus holds a 60% stake. The JV is expected to begin construction of the EV manufacturing plant this year, and production is expected to start in the first quarter of 2024. The initial capacity of the plant will be 50,000 vehicles per year, with the goal of ramping up production to 150,000 EVs a year by 2030. In the early stages of Horizon Plus, Foxconn and PTT are expected to invest around USD1 billion. As previously reported, Foxconn, best known for contract manufacturing high-technology consumer goods, such as Apple's iPhone, has recently expanded its activities in EVs. The company presented its EV platform in October 2020 and has since announced partnerships for EV production and technology sharing with several automakers, including Zhejiang Geely Holding Group, Stellantis, Fisker, and Lordstown Motors. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-february-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-february-2022.html&text=Daily+Global+Market+Summary+-+8+February+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-february-2022.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 8 February 2022 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-february-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+8+February+2022+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-february-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}