Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 29, 2021

Spending on Halloween candy projected to be up a spooktacular 10%

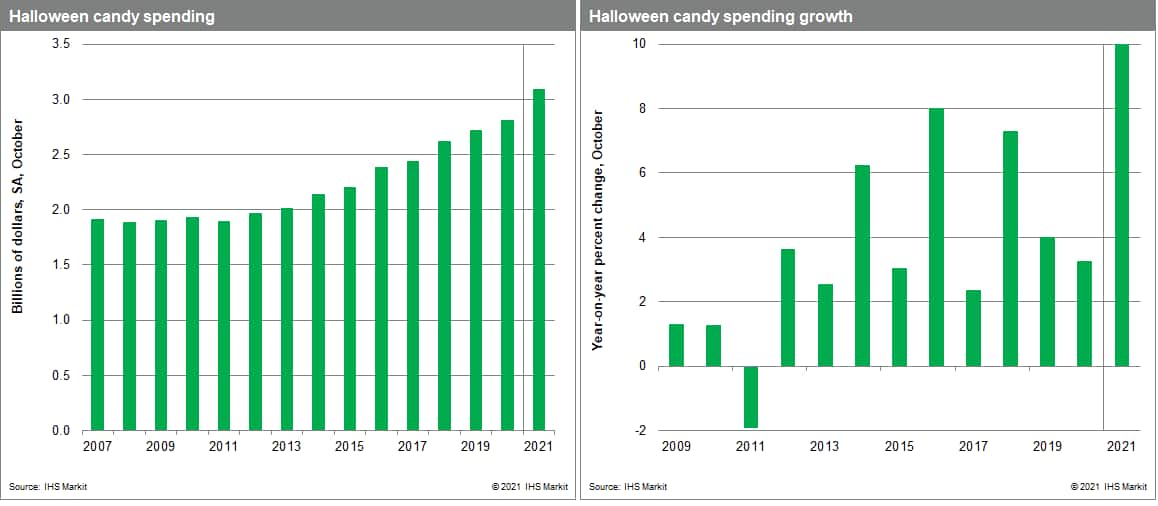

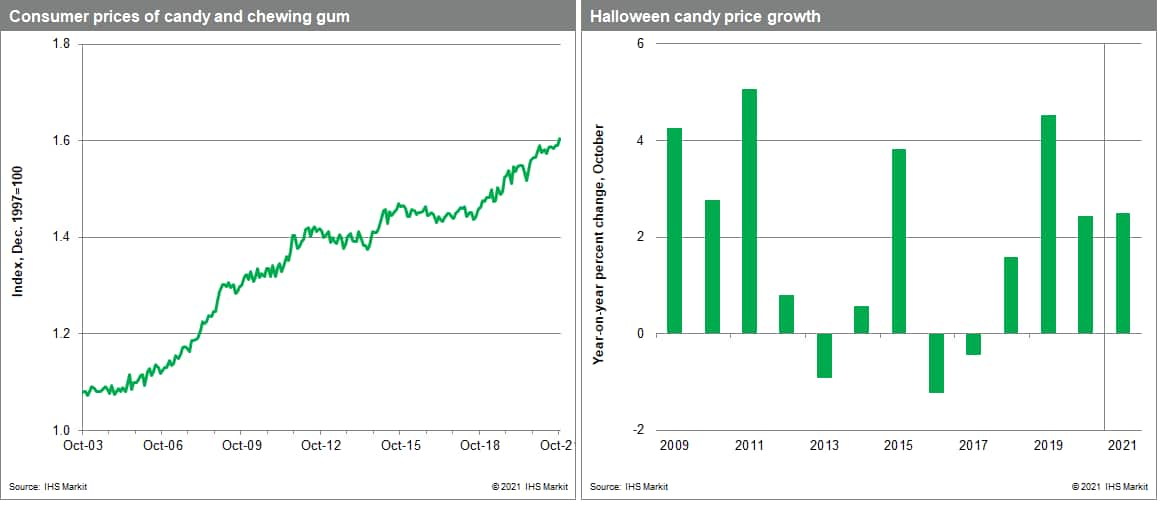

- IHS Markit is forecasting Halloween candy prices this year to rise a surprisingly modest 2.5% over last year. Halloween candy price is the not-seasonally-adjusted Consumer Price Index (CPI) for candy and chewing gum.

- Total spending on Halloween candy, on the other hand, is BOO-ming and expected to be up 10.0% over last year, reaching a total of $3.1 billion in the month of October. Halloween candy spending is IHS Markit's estimate of seasonally-adjusted personal consumption expenditures on candy and chewing gum.

After subdued celebrations last year and a fourth wave of COVID-19 infections that almost buried plans this year, Americans are back with a vengeance and are expected to splurge on candy, costumes, and other ghoulish goods and goodies for Halloween. Prices of Halloween candy are forecast to rise 2.5%. Parents are expected to scare up $3.1 billion to spend on candy this Halloween, the most ever, which works out to $24.10 per household.

Despite sharp increases in the prices of sugar and labor, candy prices, to the delight of ghouls and goblins everywhere, are projected to rise only a modest 2.5%, compared to a 5.5% projected rise in the overall CPI. Candymakers, on the other hand, may be frightened! US sugar prices are up about 3.5% from a year ago, and candy manufacturers are being haunted by labor shortages. This September, the 12-month change of average hourly earnings of food manufacturing workers was 4.8%, as factories shelled out more to fill vacancies. Beyond labor shortages and higher input costs, elevated energy prices and supply-chain bottlenecks are also keeping candymakers up at night.

Retail sales are on a sugar high this year with year-to-date sales running at nearly 20% above last year through September, and retailers are hoping to summon more of that magic for the Halloween holiday. However, global supply chain disruptions could spoil the party; while most of the Halloween candy that consumers see on store shelves is made in the US, much of the decorations and seasonal packaging is imported from other countries. With many retailers having already sold out and still waiting on more inventory, last-minute shoppers might be seeing ghosts this year as their worst nightmare comes to life—empty shelves. So, if the horrifying lines at California ports didn't have you jumping out of your seats to shop early for Halloween, you might have to get a little more creative to conjure ghosts and gremlins this year.

Notwithstanding the higher prices, supply shortages, and weakness in consumer sentiment, the consumer horror-scope is upbeat. Consumers aren't easily scared anymore with job openings near record highs and average hourly earnings up 4.6% from a year ago. Moreover, with COVID-19 cases trending down, high vaccination rates and few social restrictions, consumers will be goblin candy all night—we expect a 10.0% y/y increase in spending on Halloween candy, bringing the total to $3.1 billion in October.

Here's witch-ing you a scary, sugary Halloween!

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fspending-halloween-candy-projected-up-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fspending-halloween-candy-projected-up-2021.html&text=Spending+on+Halloween+candy+projected+to+be+up+a+spooktacular+10%25+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fspending-halloween-candy-projected-up-2021.html","enabled":true},{"name":"email","url":"?subject=Spending on Halloween candy projected to be up a spooktacular 10% | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fspending-halloween-candy-projected-up-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Spending+on+Halloween+candy+projected+to+be+up+a+spooktacular+10%25+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fspending-halloween-candy-projected-up-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}