Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 18, 2021

Speed, key to reduce carbon emission and indicators for freight demand

There has been some discussion on the consistent variation of sailing speed during major Brazilian round routes to find a solution to save fuel and reduce emissions by understanding speed patterns.

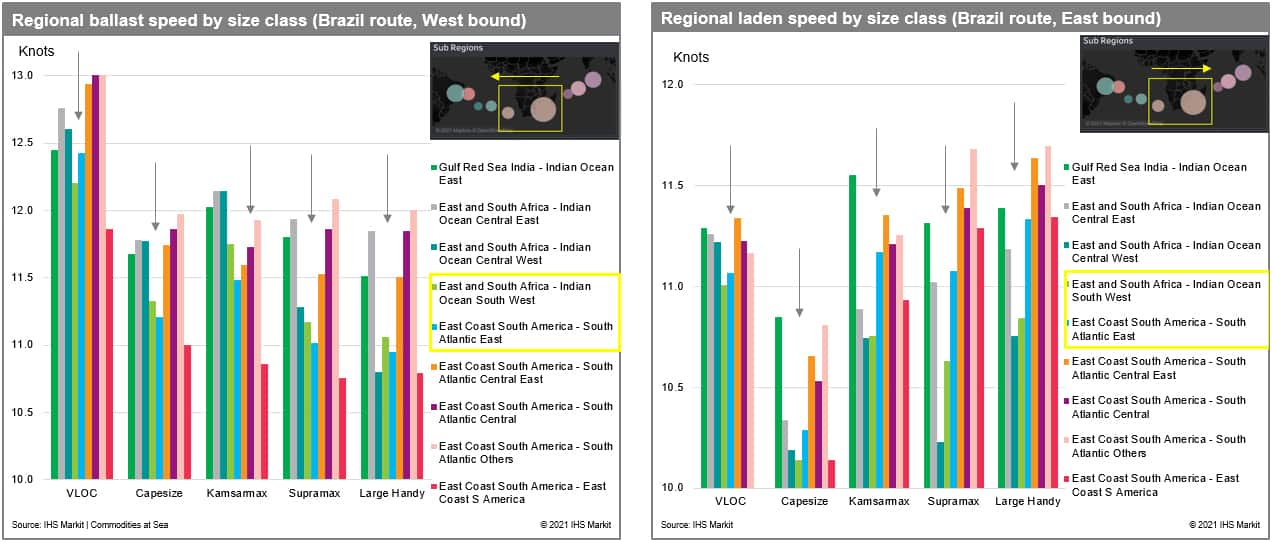

According to Bulkers at Sea Fleet metrics, the speed of all size classes (VLOC to Handysize) in the past four years by quarter (different market condition) and region (position) shows a consistent increase in speed in the second half of the year, which is in line with a higher earning season (see chart 2), and also a repeated drop in speed around the Cape of Good Hope. It seems that there are current (Brazilian/Agulhas) and weather issues. Bunkering operation around Port Elizabeth and Durban could also be another reason. (see chart 1).

Chart 1: Regional sailing speed on Brazil round route by size class

Source: IHS Markit Commodities at Sea

From a commercial point of view, since freight fixture needs to be done before passing the Cape of Good Hope—a deviation point— sometimes shipowners or operators are trying to idle (we have observed a large number of idled Capesize vessels in the second quarter of 2021) around the Cape of Good Hope to fix higher rates—it makes sense that the Brazilian voyage is usually longer. Taking into consideration of idle days, fuel tonnes per shipments/voyage may increase even with an overall reduction in average speed.

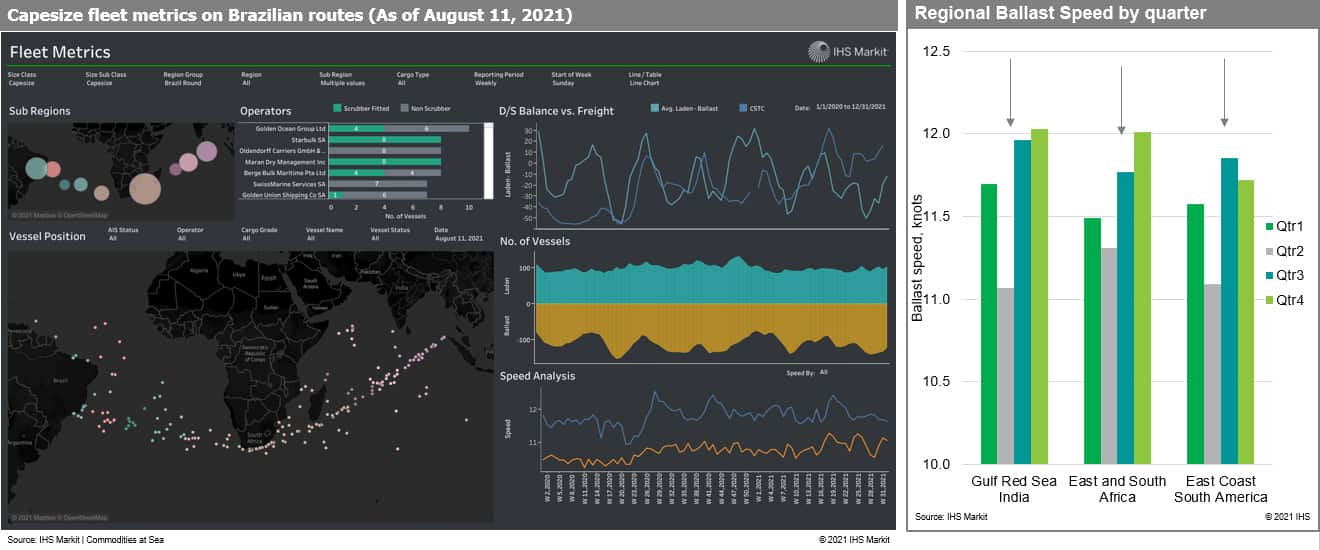

Chart 2: Higher speed was observed in the third and fourth quarters, in line with a higher earning season; recently laden speed for Capesize has increased, while ballast speed remains stable

Source: IHS Markit Commodities at Sea

To better understand this, speed level is actually about relevant freight or TC rates and profitability against the additional cost and future earning expectation. Higher profit (freight or TC savings minus additional bunker cost with additional engine power) equals higher speed. Therefore, along with the developments in technology, a reduction in emissions is determined by its commercial benefits in our view. The recent CII Rating and EEXI is a major commercial approach to reduce fuel consumption by increasing commercial cost.

Meanwhile, recent higher laden voyage speed of capesize indicates a strong demand for iron ore tonnage. Laden speed usually increases when more fixtures are required to cover forward demand, which leads to higher capesize rates. Freight models have predicted C5TC to increase further in August and September to beyond $40,000/day.

For more information on the product used in this analysis:

Freight Rate Forecast: ihsmarkit.com/FRF

Commodities at Sea: ihsmarkit.com/CAS

For more insight subscribe to our complimentary commodity analytics newsletter

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fspeed-key-to-reduce-emission-and-indicators-for-freight-demand.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fspeed-key-to-reduce-emission-and-indicators-for-freight-demand.html&text=Speed%2c+key+to+reduce+carbon+emission+and+indicators+for+freight+demand+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fspeed-key-to-reduce-emission-and-indicators-for-freight-demand.html","enabled":true},{"name":"email","url":"?subject=Speed, key to reduce carbon emission and indicators for freight demand | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fspeed-key-to-reduce-emission-and-indicators-for-freight-demand.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Speed%2c+key+to+reduce+carbon+emission+and+indicators+for+freight+demand+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fspeed-key-to-reduce-emission-and-indicators-for-freight-demand.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}