Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 05, 2023

Shifting Sands: Economic Trends Impacting Global Economies in 2023-24

The following is an extract from S&P Global Market Intelligence's latest Special Report. For the full report, please click on the 'Download Full Report' link.

Read this detailed review of some of the key signals from the Purchasing Managers' Index™ (PMI®) business survey data in 2023. With global and region-specific coverage and insights giving you an indication of what these trends mean for the global economy as we head into 2024.

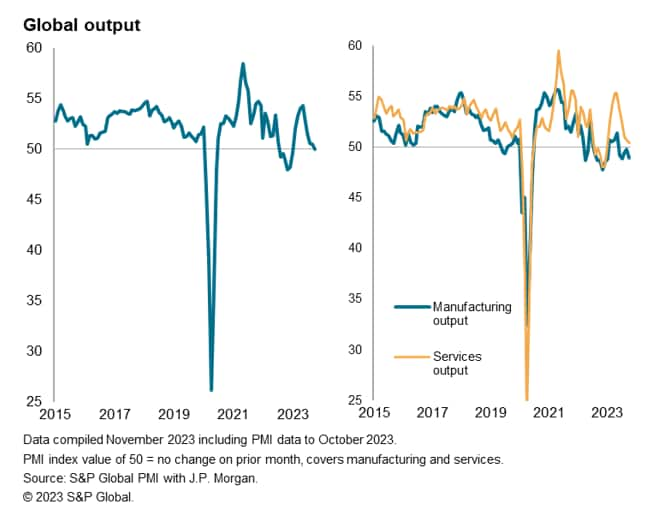

Global recovery stalls as caution prevails

Global economic growth has been on something of a rollercoaster ride in 2023. A worryingly weak start of the year quickly gave way to surprisingly robust growth, fuelled by the unexpected full reopening of China's economy and resurgent, post-pandemic, demand for activities such as tourism, travel and recreation. As 2023 was the first year of truly unfettered travel after three years of varying degrees of COVID-19 containment, pent-up consumer demand for leisure activities trumped higher interest rates. Looser overall financial conditions - despite higher central bank policy rates - also benefitted.

However, the latest available PMI data show growth has stalled again as the services expansion lost steam. Not only has the resurgence of demand for travel naturally faded after its initial momentum, companies report that the further ratcheting up of central bank interest rates mid-year amid elevated inflation has fed through to a tightening of financial conditions and has weakened demand for many non-essential services. Services activity barely grew in October.

The factory sector has meanwhile failed to regain any meaningful expansion since early 2022, blighted by a global trend of inventory reduction and subdued demand. Backlogs of work, accumulated during the pandemic, have helped to moderate the decline in factory output so far in 2023, but with these backlogs becoming depleted, factories are increasingly seeking to reduce production capacity, including laying off staff in rising numbers. Factory output hence fell at an increased rate at the start of the fourth quarter.

Near-term global output risks therefore seem skewed to the downside. The start of the fourth quarter showed companies continuing to pull back on hiring and wind down excess inventories, while rising interest rates and the cost-of-living crisis increasingly eroded spending power amongst both households and businesses.

The upside to this renewed loss of momentum is a cooling of price pressures: prices charged for goods and services rose globally in October at the slowest rate for nearly three years, rising at rates which central banks will be increasingly comfortable with.

The PMI output and price data therefore hint that peak interest rates are coming into sight, but many companies are conscious that the lagged impacts of prior rate hikes have yet to feed through. Business confidence about the year ahead is consequently running well below its pre-pandemic long run average, with the PMI surveys suggesting that companies are entering 2024 with a cautious approach to spending, expansion, hiring and investment.

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshifting-sands-pmi-economic-trends-impacting-global-economies-in-202324.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshifting-sands-pmi-economic-trends-impacting-global-economies-in-202324.html&text=Shifting+Sands%3a+Economic+Trends+Impacting+Global+Economies+in+2023-24+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshifting-sands-pmi-economic-trends-impacting-global-economies-in-202324.html","enabled":true},{"name":"email","url":"?subject=Shifting Sands: Economic Trends Impacting Global Economies in 2023-24 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshifting-sands-pmi-economic-trends-impacting-global-economies-in-202324.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shifting+Sands%3a+Economic+Trends+Impacting+Global+Economies+in+2023-24+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshifting-sands-pmi-economic-trends-impacting-global-economies-in-202324.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}