Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 17, 2023

Russia's Shadow Fleet - Understanding its Size, Activity and Relationships

The Russian shadow fleet or ghost fleet has been widely discussed and debated since the G7 Oil Price Cap for crude oil took effect on Dec. 5, 2022 and continued when the subsequent price cap on refined products became effective on Feb. 5, 2023.

The G7 cap, imposed on crude and refined oil cargoes of Russian origin, set a limit of US$60 a barrel for crude, US$100 a barrel for diesel and kerosene etc. which trades at a premium to crude and US$45 a barrel for fuel oil and naphtha which generally trades at a discount to crude. The ceilings will be reassessed in mid-March with further reviews every two months. A transition period for refined products is currently in place for of 55 days, this excludes from the price cap vessels currently carrying Russian petroleum products that were purchased and loaded before Feb. 5, 2023 and unloaded before April 1, 2023.

In this context, Russia has repeatedly stated that it will not work with the price cap, but the vast majority of seaborne Russian oil shipments rely on services provided by companies based in the G7. Large volumes of Russian oil are shipped on Greek owned vessels and very significant numbers of Russian vessels are insured through the United Kingdom-based International Group of P&I Clubs. If Russia insists on not conforming to the price cap, it cannot use services located in G7 countries due to sanctions controls. Therefore, Russia needs to transport its oil output in order to maintain current cargo levels by other means, as the current Russian fleet alone does not have the capacity to do so. This scenario gives rise to the need for a substantial shadow or ghost fleet of vessels able to transport Russian oil at close to capacity as possible while potentially evading G7 sanctions and the crude and refined oil price caps.

There are multiple estimates as to how many vessels make up the Russian shadow fleet, ranging from 100 to a higher estimate of 600[1]. While an exact number in the shadow fleet would be difficult to determine, there are certain vessels with particular characteristics and patterns that can be used in an assessment of ships likely to be involved in the transfer or movement of Russian oil.

The latest paper we published seeks to identify and analyze the key tactics and methods employed by Russian and non-Russian vessels when attempting to evade sanctions on the movement of oil and its refined products.

Key Takeaways

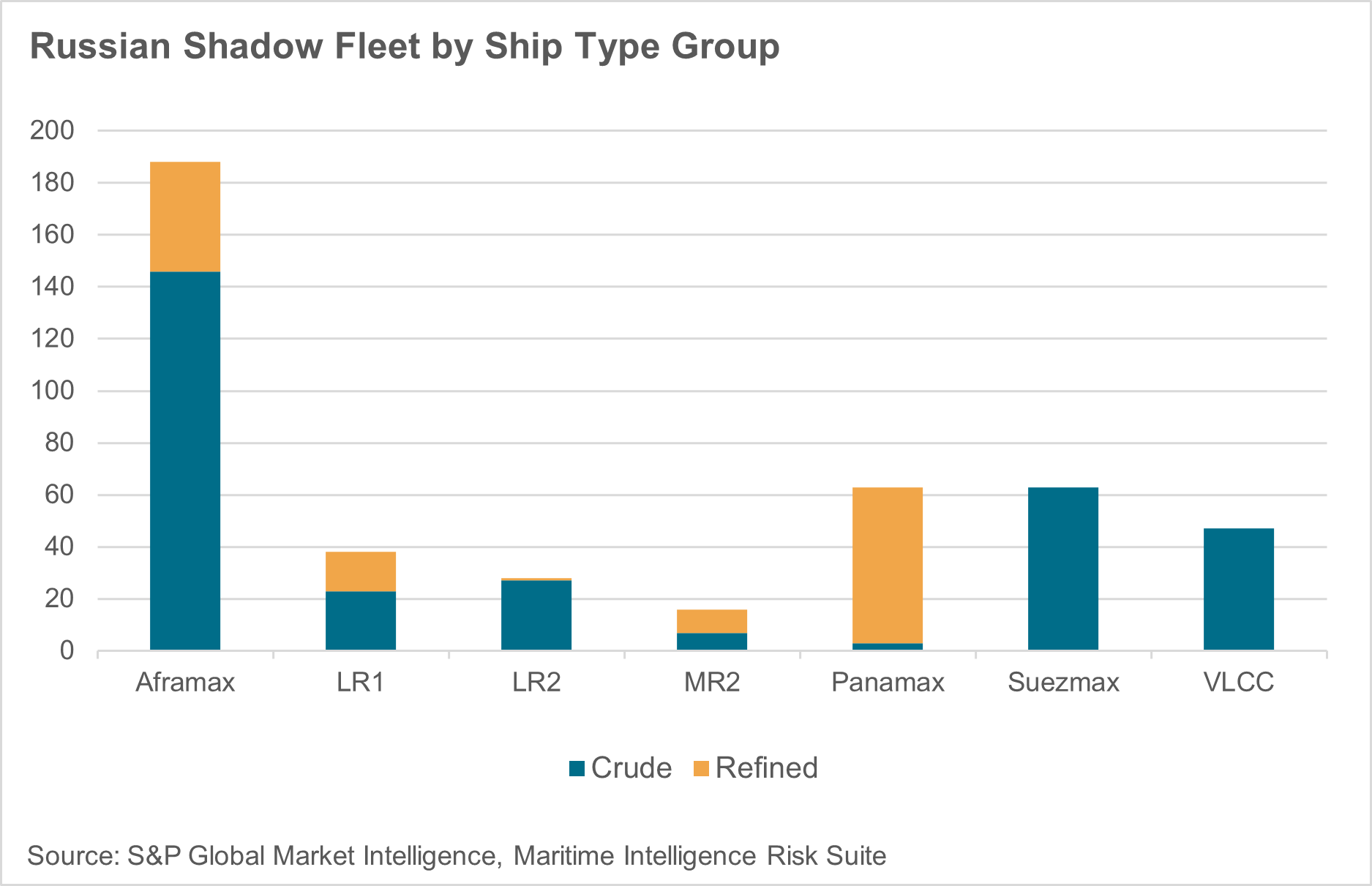

- Our latest paper estimates 443 tanker vessels (with a DWT greater than 10,000) are currently operating within the Russian shadow or ghost fleet

- The number of vessels with a wider potential for risk in regard to Russian sanctions is estimated to be 1,900. These are vessels of all nationalities and ownership that have made Russian port calls, STS transfers etc.

- From these 1,900 ships the majority are Greek owned and cover a wide range of flag registries from the Marshall Islands, Liberia and Panama

- New vessels have begun to work the Russian tanker routes. 35 new vessels have visited Russian oil ports for the first time in the period between Dec. 5, 2022 and Feb. 16, 2023

- Ceuta on the North African Mediterranean coast is the current hotspot for Russian oil STS (ship-to-ship) transfers, with a monthly average of 18 between October 2022 and January 2023

- Other STS transfer hubs for Russian oil are the Peloponnese region of Greece and South Korea

- Russian diesel appears to be finding a new home in North Africa with multiple cargo deliveries to Tunisia in 2023. For the first two months of 2023, Russian refined product cargoes delivered to Tunisia have already exceeded volumes in 2022

- An increasing number of vessels that once worked the Venezuelan oil cargo route and engaged in suspicious activity when delivering these shipments are moving over to Russian tanker routes

Download the complimentary paper: Russia's Shadow Fleet - Understanding its Size, Activity and Relationships

Subscribe to our complimentary Risk & Compliance quarterly newsletter, or subscribe to Maritime and Trade Talk podcast for the latest insight and opinion on trends shaping the shipping industry from trusted shipping experts.

[1] https://www.ft.com/content/955389bf-d01b-4acb-bd15-b764425a8a18 and https://www.economist.com/finance-and-economics/2023/01/29/how-russia-dodges-oil-sanctions-on-an-industrial-scale and https://www.weforum.org/agenda/2023/02/shadow-fleet-hurting-efforts-to-defund-the-invasion-of-ukraine/

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussias-shadow-fleet-understanding-its-size-activity-and-relat.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussias-shadow-fleet-understanding-its-size-activity-and-relat.html&text=Russia%27s+Shadow+Fleet+-+Understanding+its+Size%2c+Activity+and+Relationships+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussias-shadow-fleet-understanding-its-size-activity-and-relat.html","enabled":true},{"name":"email","url":"?subject=Russia's Shadow Fleet - Understanding its Size, Activity and Relationships | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussias-shadow-fleet-understanding-its-size-activity-and-relat.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russia%27s+Shadow+Fleet+-+Understanding+its+Size%2c+Activity+and+Relationships+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussias-shadow-fleet-understanding-its-size-activity-and-relat.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}