Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 03, 2023

Rising cost of living is likely to fuel protests in Europe in 2023

The increased cost of living is likely to be one of the main drivers of protests in Europe in 2023.

S&P Global Market Intelligence expects a probable weakening

of the investment environment, exports, and private consumption.

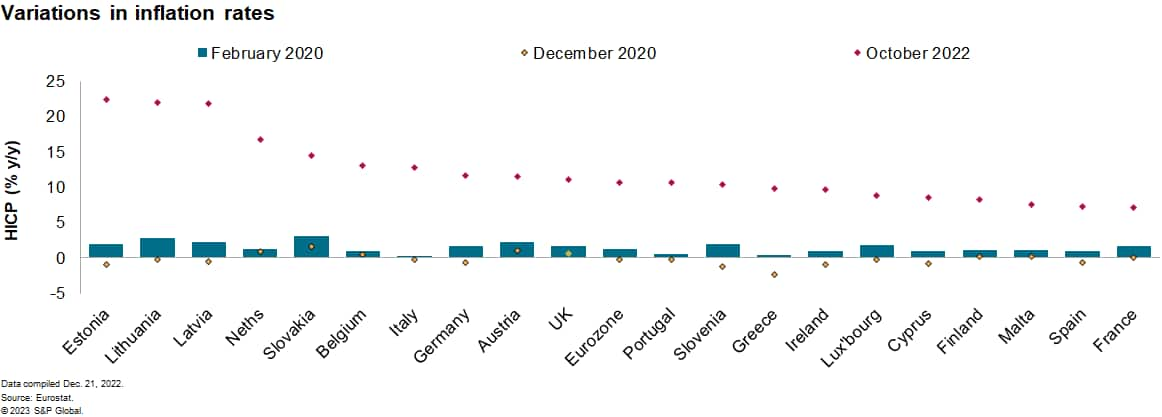

Consumer price inflation has been reducing households' purchasing

power in the eurozone.

Labor unions will remain among the key organizers of economically driven protests, particularly in combination with general or sectoral strikes. These protests, as seen in Belgium, Finland, France, and Greece during 2022, will have the potential to attract up to hundreds of thousands of workers. Industrial action, including rallies, will be more likely in the case of layoffs or during wage negotiation periods and after the end of parliaments' summer recess, making an uptick in protests in September more likely.

Energy supply and prices will have a substantial impact on the resilience of European economies. If European countries manage to avoid gas shortages during the first half of 2023 and mitigate the impact of increased energy prices this year, cost-of-living protests in Europe would be unlikely to pose a threat to domestic stability.

National governments, even among EU member states, have adopted divergent energy saving and diversification strategies and are offering markedly different subsidies and support schemes for households and businesses. That makes the formation of a solid and co-ordinated transnational protest movement over cost-of-living concerns unlikely at the regional level.

Migration

Opposition-led anti-government protests over contested domestic issues such as migration or in the

context of weak governments will remain a significant feature of country-level protest landscapes.

Far-right groups would be likely to trigger protests over migration and refugee flows both from Ukraine and non-EU countries, particularly in countries receiving high numbers of Ukrainian refugees (Poland, Germany, and Slovakia). This raises the risk of anti-migrant protests attracting several thousand people as well as physical assault or arson attacks and vandalism to refugee accommodation centers.

Opposition-led protests are also likely to be elevated in countries with fragile ruling parties, coalitions, or caretaker governments, and in countries holding elections in 2023. These include Bulgaria, Slovakia, Poland, Greece, and Spain. A strong presence of far-right/far-left groups or political parties, like in Czechia, increases this risk.

Property damage risk

Property damage will be highest in countries with protest dynamics that result in the frequent breakout of riots or violent scuffles between demonstrators, counter-demonstrators, and the police including France, Belgium, the Netherlands, and Germany. Protests in these countries, as well as Greece, Italy, and Spain, frequently lead to property damage through vandalism and arson.

In countries such as Poland, Portugal, Romania, Slovenia, or Croatia, protests are likely to remain largely peaceful, even if attended by tens of thousands.

Environmental activism

Amid Europe's energy challenges, environmental activists will continue to point to fossil fuel dependence as a key factor behind energy price increases. Activist groups will maintain a focus on the return to greater coal usage in countries like Poland, the United Kingdom, or Germany to mobilize large crowds during protests in European cities, including in London, Rome, Paris, and Berlin.

Environmental activists continue to expand their targets to a widening set of business sectors, either due to their high consumption of fossil fuels (automotive, aviation, chemicals, and fertilizers), or investments in fossil fuels (the financial sector).

Indicators of a changing risk environment

A protracted economic downturn would likely exacerbate grievances, leading to an intensification of protests, staged with greater frequency and higher turnouts in the tens of thousands of participants.

The probable lowering of energy prices after winter 2023 or decreasing consumer price inflation would likely ease pressures on European households, marginally reducing the drive for cost-of-living protests.

An increase in regional unemployment in strongly unionized sectors including transport, manufacturing, and the civil service would likely trigger more frequent labor strikes.

Greater synergy between environmental activists and the organizers of cost-of-living protests would likely increase the size of protests.

Governments adopting plans with timelines for the phase-out of the temporary "switch back" to the use of coal in countries such as Germany, Italy, or Poland would reduce the risk of environmental protests.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frising-cost-of-living-is-likely-to-fuel-protests-in-europe-in-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frising-cost-of-living-is-likely-to-fuel-protests-in-europe-in-.html&text=Rising+cost+of+living+is+likely+to+fuel+protests+in+Europe+in+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frising-cost-of-living-is-likely-to-fuel-protests-in-europe-in-.html","enabled":true},{"name":"email","url":"?subject=Rising cost of living is likely to fuel protests in Europe in 2023 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frising-cost-of-living-is-likely-to-fuel-protests-in-europe-in-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Rising+cost+of+living+is+likely+to+fuel+protests+in+Europe+in+2023+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frising-cost-of-living-is-likely-to-fuel-protests-in-europe-in-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}