Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 10, 2021

Reverse Stress Testing: A critical assessment tool for risk managers and regulators

Do you know under which scenarios your financial institution faces the risk of failure? Is it likely to be a result of scenarios that lead to physical risks to your institution? Which scenarios would lead to the highest losses on exposures to sectors exposed to transition risks from climate change policies?

Reverse stress testing is one of the most powerful scenario analysis tools available to risk managers and regulators. Like typical stress testing exercises, reverse stress testing also encourages institutions to explore the fault lines in their business models and vulnerabilities in their risk exposures. However, there are key differences in the process and the scenarios between the two approaches for stress testing.

Typical financial stress testing

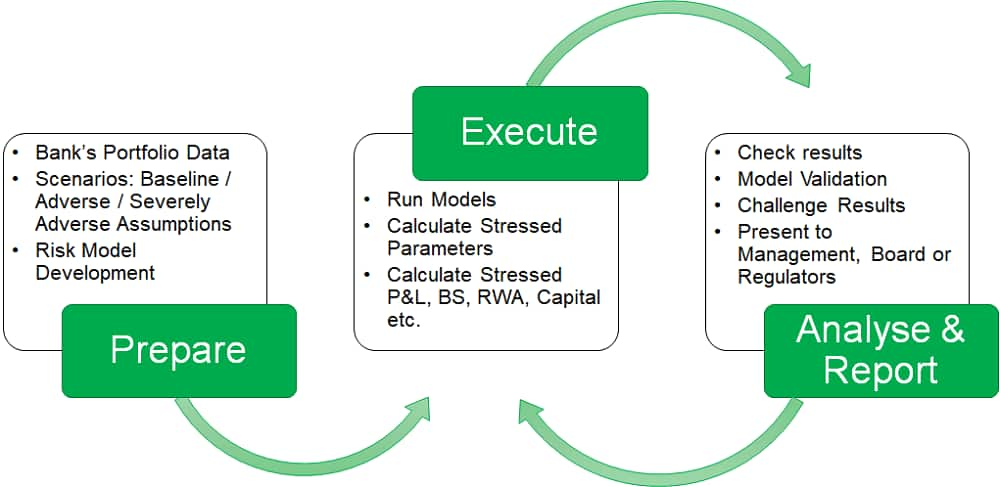

In a typical stress testing exercise (link: https://ihsmarkit.com/products/alternative-us-global-scenarios.html), the process starts with a macro-financial scenario designed to test the bank's resilience to a shock in one or more key drivers of the risks undertaken. Models and scenarios designed in the preparatory phase of the exercise are linked to exposure data to estimate losses, capital depletion, or liquidity shortfalls.

Depending on the purpose and outcome of the exercise, the institution or the regulator can take a range of actions from increasing capital buffers, to enhancing risk modeling methodologies, processes, or governance of the financial institution.

A simplified flow of a typical stress testing exercise

Reverse stress testing

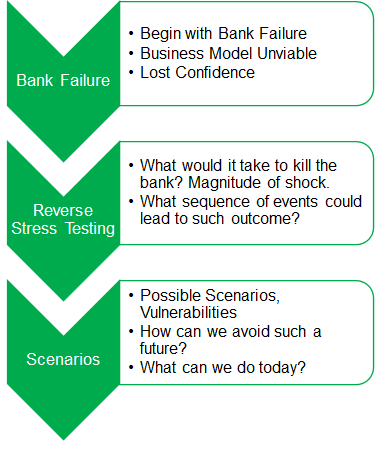

On the other hand, reverse stress testing requires the risk team to identify and assess circumstances that would lead a firm's business model to become unviable or its counterparties to lose confidence to a critical point. This may be a point at which all or a significant portion of the firm's counterparties become unwilling to continue transacting with it. It could also be a point at which the firm's shareholders are unwilling to provide new capital.

As such, the reverse stress testing exercise motivates risk managers to focus on a select few scenarios amongst many possibilities to identify events or series of events, which lead to failure. If the probability of such a scenario is unacceptably high, the exercise reveals a significant risk of failure. In this situation, realistic measures and action plans must be devised to mitigate or avoid the risk of failure. It is worth highlighting that this point of non-viability may be reached well before the firm's financial resources are exhausted.

The reverse stress testing process

Regulatory guidance on reverse stress testing

While regulators and institutions have placed renewed focus on stress testing in the aftermath of the Great Financial Crisis, reverse stress testing has found its place in the guidance provided to financial institutions by various regulators from around 2015.

Since then, Bank of England's Prudential Regulation Authority (PRA) has included a section on reverse stress testing in its supervisory statement on Internal Capital Adequacy Assessment Process (ICAAP) and the Supervisory Review and Evaluation Process (SREP). The latest version of the statement notes that "… a firm could consider scenarios in which the failure of one or more of its major counterparties or a significant market disruption arising from the failure of a major market participant... would cause the firm's business to fail."

European Banking Authority (EBA) also notes in its 2018 final report on Guidelines on Institutions' Stress Testing that few competent authorities required the institutions under their supervision to conduct reverse stress testing, and when they did, often only as part of recovery planning. In the same report, EBA established the requirements from institutions to perform adequate reverse stress tests as part of their stress testing programs. The guidance highlighted the importance of reverse stress testing efforts to have the same governance, effective infrastructure, and quality standards also considering the principle of proportionality that applies to entire stress testing across the enterprise.

Basel Committee on Banking Supervision (BCBS) also published a report on Supervisory and Bank Stress Testing: Range of practices in 2017. According to this publication, reverse stress testing is conducted as a complementary stress test by two-thirds of the institutions despite only a few supervisors conducting or mandating such stress tests.

Financial Conduct Authority in the UK has also included reverse stress testing in its June 2020 Finalised Guidance (FG 20/1 Our framework: assessing adequate financial resources). In this guidance, FCA provided the following scenarios as examples of reaching the point of non-viability:

- The market loses confidence in a firm, resulting in the loss of a substantial portion of counterparties or clients

- Complications arising because of material dependencies on group entities (e.g. services, funding, reputation, etc.)

- Existing shareholders are unwilling to provide new capital to the firm

Scenario development for reverse stress testing:

The nature of the reverse stress testing exercise implies its starting point is an exploration of an institution's known potential vulnerabilities. Therefore, risk managers should conduct comprehensive fact-finding exercises on a regular basis to identify internal and external factors that can exacerbate the potential weaknesses of their specific institution, bearing in mind the changing operating environment and marketplace over time. In assessing these potential weaknesses, risk managers should systematically review and carefully consider (amongst others) trading and loan book exposures, counterparties, sector, product or geographical concentrations, involvement in complex financial instruments, liquidity position, operational vulnerabilities (e.g. fraud, cyber-attacks, violence risks), and reputational risks.

An institution may want to conduct a reverse stress test focused on weakness(es) that have been revealed because of a previous stress testing exercise carried out as part of a regulatory requirement or internal capital adequacy assessment process. Institutions can also use their historical loss experience to identify specific areas where a disastrous event could cause failure or loss of confidence. The historical losses can also draw upon the circumstances which led to failures of other financial institutions such as those the during Great Financial Crisis (2007-2009), the Savings and Loan Crisis (1986-1995), or the collapse of Long Term Capital Management (1998).

Once the vulnerabilities have been identified, the scenarios are constructed to stress these to the point where bank failure would occur, with the likelihood of these scenarios determining the measures and action plan that needs to be taken by the management. The academic literature also includes various quantitative and algorithmic approaches that institutions can use to come up with scenarios suitable for reverse stress testing particular financial risks.

Therefore, the necessary ingredients for a meaningful and useful reverse stress testing exercise include inter alia:

- Knowledge of the institution, its business model, exposures, and potential weaknesses

- Information and data across a range of industries and countries, as well as experts including social and political scientists, economists, mathematicians, data scientists, cyber risk specialists, and a wide range of industry risk professionals.

- Data and comprehensive models that link the global economy, price changes, industry impacts, and risk factors.

- Expertise (and imagination) to devise the most challenging "what-if" scenarios

One of the ways we model risk is to identify realistic and high impact scenarios to assist in planning against credible futures, without necessarily re-running the past. For example in recent realistic disaster scenarios, our analysts have explored two difficult "what if" questions: What if a regional war breaks out in the Middle East? considered what it would look like if, instead of our current view, nuclear negotiations were to stall amid escalating retaliatory attacks, culminating in Iran, the US, and Israel entering into a regional war.

Similarly, in another realistic disaster scenario, our analysts explored the scenario in which Latin America enters the second year of economic recession, is hit by a third wave of COVID-19 with a surge in the number of COVID-19 cases overwhelming hospital facilities, all of which triggers a surge in violent unrest across the region.

Economists can use these scenarios to quantify their impacts in macroeconomic terms to provide an array of macroeconomic and financial risk drivers. Furthermore, risk models can translate those drivers to stressed risk parameters, stressed loss, capital or liquidity projections. Risk experts can evaluate the outcomes against the vulnerabilities of the institution to see if thresholds are breached. The narrative and severity of the scenarios could be adjusted in case additional stress is required to push the bank vulnerabilities to the "breaking" point. Ultimately this would help to identify scenario(s) under which bank business model becomes unviable.

Best practice stress testing exercises incorporate historical experience with forward-looking insights and projections. To this end, quantitative financial modeling and expert judgment are equally necessary to identify the potentially ruinous events and their impact on the solvency, liquidity, and reputation of the institution. Failure of a financial institution can be caused by a multitude of causes and combinations. Hence institutions need to consider a broad range of scenarios including realistic disasters for their reverse stress testing. This is also one of the reasons why financial regulators around the world are incorporating environmental, social, and governance (ESG) factors into their stress testing frameworks with particular focus on the impact of policies to contain climate change, carbon emissions, and global warming.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freverse-stress-testing-assessment-tool-risk-managers-regulators.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freverse-stress-testing-assessment-tool-risk-managers-regulators.html&text=Reverse+Stress+Testing%3a+A+critical+assessment+tool+for+risk+managers+and+regulators+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freverse-stress-testing-assessment-tool-risk-managers-regulators.html","enabled":true},{"name":"email","url":"?subject=Reverse Stress Testing: A critical assessment tool for risk managers and regulators | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freverse-stress-testing-assessment-tool-risk-managers-regulators.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Reverse+Stress+Testing%3a+A+critical+assessment+tool+for+risk+managers+and+regulators+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freverse-stress-testing-assessment-tool-risk-managers-regulators.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}