Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ARTICLES & REPORTS

May 24, 2022

Portfolio risk management is evolving – how can your tech stack keep up?

This article was first published in our complimentary ebook: 'Buy Side Risktech 2.0: Solving the challenges of a risk manager'. Access the full eBook here.

In order for Risk teams to continue to meet market and regulatory pressures while also adding value to the front office, they need to become more sophisticated from a technology and data standpoint.

In the past, risk systems almost acted like risk managers. The managers themselves spent time supporting their systems. This model has been upended, with the modern risk manager requiring a system that supports them—rather than the other way around.

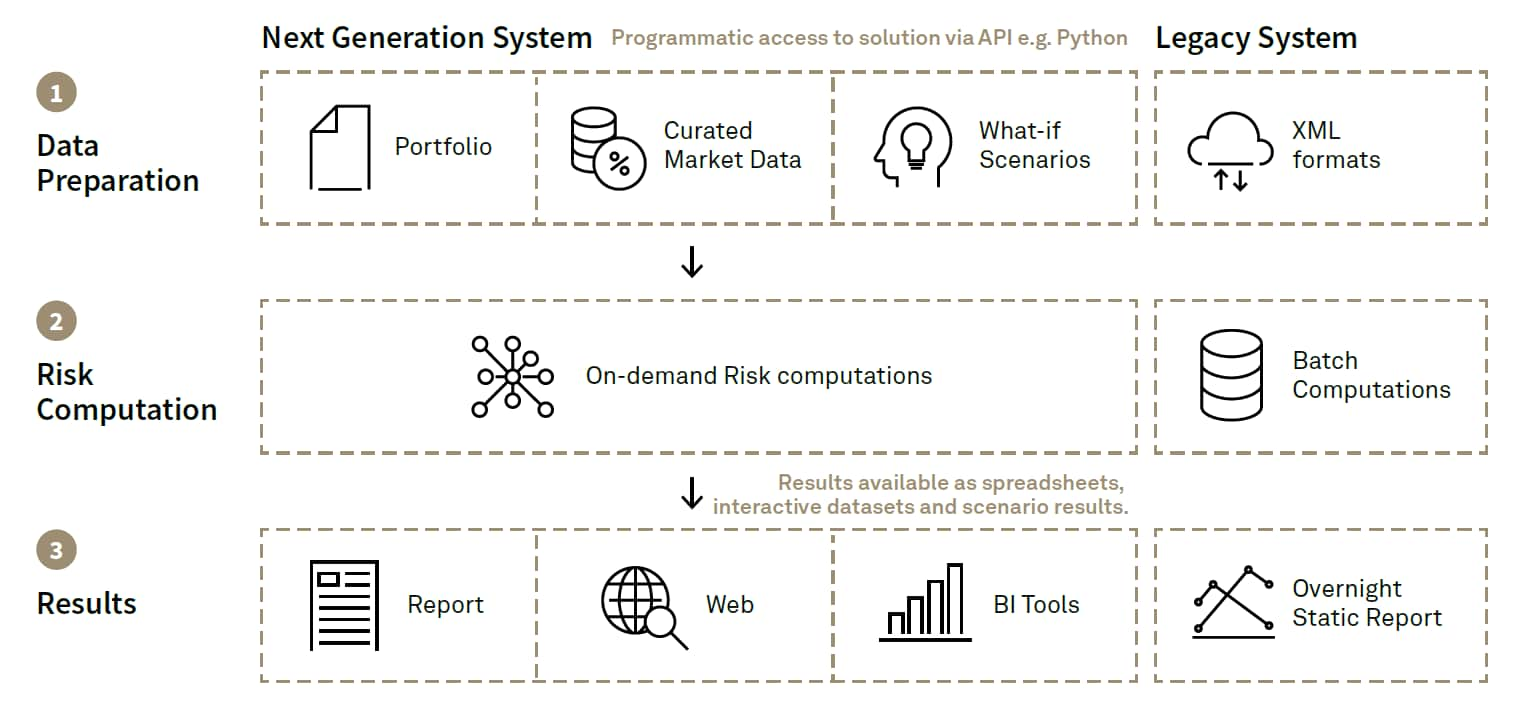

Fig 1: A modern approach to risk technology

Off-the-shelf limitations

Many risk systems rely on clients to upload portfolio and

benchmark data. When uploading complicated-format benchmarks with

more than twenty thousand positions, files can become cumbersome

and impossible to query when issues arise. Furthermore, there is

reliance on clients to provide extensive reference data to ensure

their positions are modelled correctly. Firms also find themselves

uploading a single security multiple times, due to holdings in more

than one portfolio or benchmark.

Additionally, some risk systems don't have specific upload

templates for more complicated instrument types, such as structured

products, contingent convertibles, term loans, and securitized

products. As these product types become ever more popular with

asset managers, it is imperative that their risk is properly

modelled.

Connecting the tools for success

One way to supercharge your risk team's output is to take advantage of the latest desktop technologies. For example, Python is an open source programming language that makes for rapid application development. Python is free, well-documented and has become popular in finance.

Many risk managers use tools such as Python to run their own

computations, but are unable to leverage their risk systems'

engines or data in their desktop calculations.

Why? Because, in order to run the risk computations, they need to

be able to create positions in specific formats and obtain

reference data to upload them into their systems. Building these

connections often requires valuable development resources to

manage, maintain, monitor, and update and cannot be run on-the-fly

without IT help. Even with the required support, running such

computations is so time-consuming it becomes impractical to do

on-demand.

The benefits of direct access to risk engines

Why not provide a user with a direct connection to the risk engine and its data to run ad-hoc computations?

By using flexible APIs (Application Programming Interface) instead of relying on integrations with vendor input formats, a risk manager can get their portfolio into the risk system quickly. APIs also allow them to dig into the data and submit queries into the risk system directly from programming languages such as Python or even Microsoft Excel. This insight has broader benefits for model validation and data quality assurance.

This direct access to the risk engine liberates risk managers from vendor-set batch calculation times, allowing them to spend more time on core risk management and ad-hoc analysis. Flexible and accessible APIs enable users to access results directly, avoiding large and complex downloads. Risk managers can use these APIs to directly access their results as well as the underlying data and engines.

Buy-side risk has evolved—but risk systems are still catching up

It is exciting to launch new products, allowing end clients to take advantage of new investment opportunities. And being the first to market has great reputational benefits to a firm. Yet, as investment strategies, products, and regulatory requirements continuously change, new product launches require the ability to calculate risk on various components of financial instruments that are the constituents of that product. A new product requires an entire team, from front- to back-office, to be ready to support offerings, with risk teams often at the center.

Risk management techniques and attitudes are also evolving and becoming more integrated into the investment process. Most risk teams are looking to move away from static T-1 risk reports in order to meet regulatory requirements to become real-time, market-driven risk responders. It could be argued that by the time risk numbers are reported, they are less meaningful from a portfolio management perspective as the market has already moved on. This is even more important in volatile market conditions, in which market risk can be very different from one day to the next. Risk teams need to be able to keep up from technological and output perspectives to continue adding firm-wide value.

Inflexibility erodes competitive edge

Risk systems lacking real-time calculation - or at least using the latest market data - become an immovable obstacle for risk managers in establishing themselves within the investment process.

Inflexible solutions hindering the implementation of new techniques and portfolios can impair a business's competitive edge. Risk managers have to wait for new enhancements to be made available and then wait for internal tech teams to deploy them. This can delay product offerings as well as the implementation of innovative risk-measurement techniques and bespoke client requirements.

A changing risk landscape needs a modern tech stack

For the portfolio risk management function to adapt and grow to meet the demands of institutions, they must embrace change and look to next-generation technology stacks.

Long delays in system updates are increasingly unacceptable. Tech stacks should be flexible enough to support new products, computations, and reports without large development costs. This can be achieved with a modern solution, following agile methods with continuous improvement.

Instead of infrequent and resource-heavy software updates, a modern approach uses development methodologies that continuously roll out improvements to a hosted cloud environment. This agile approach enables new instruments, reports, and methods to be deployed to all clients as they become available.

The use of JSON, a standard data format, allows for straightforward mapping to specific instrument types. In fact, by using flexible input formats, risk managers can allow for portfolio input files to be ingested using as little as an ISIN and a notional.

New interfaces such a JSON or a Python API reduce the need to conform to a risk system's specific requirements, allowing easier portfolio updates, more frequent risk calculations, and more detailed risk analysis.

As buy-side organizations consider their investments in future risk technology, there are clear trends that should be considered.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fportfolio-risk-management-is-evolving-how-can-your-tech-stack-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fportfolio-risk-management-is-evolving-how-can-your-tech-stack-.html&text=Portfolio+risk+management+is+evolving+%e2%80%93+how+can+your+tech+stack+keep+up%3f++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fportfolio-risk-management-is-evolving-how-can-your-tech-stack-.html","enabled":true},{"name":"email","url":"?subject=Portfolio risk management is evolving – how can your tech stack keep up? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fportfolio-risk-management-is-evolving-how-can-your-tech-stack-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Portfolio+risk+management+is+evolving+%e2%80%93+how+can+your+tech+stack+keep+up%3f++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fportfolio-risk-management-is-evolving-how-can-your-tech-stack-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}