Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 05, 2019

PMI shows eurozone economy stuck in low gear and price pressures easing

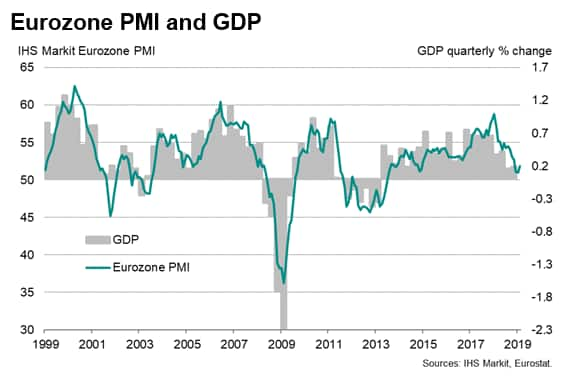

- Eurozone PMI indicative of modest 0.2% GDP growth in first quarter amid intensifying factory weakness

- Price pressures lowest for one-and-a-half years

- ECB set to adopt more dovish stance

The release of Eurozone PMI data indicating weak first quarter economic growth and a cooling of price pressures sets an uncomfortable stage for the European Central Bank's Governing Council meeting later in the week.

Economy stuck in low gear

The IHS Markit Composite PMI for the euro area strengthened to a three-month high of 51.9, up from 51.0 in January. Although rising, at these levels, the PMI shows the quarterly rate of GDP growth merely picking up to 0.2% in February from 0.1% in January. The first quarter could consequently see the economy struggle to beat the 0.2% expansion recorded in the fourth quarter of last year.

The improved performance in part reflected the easing of one-off dampening factors such as the 'yellow vest' protests in France and new auto sector emissions rules. However, other headwinds continued to constrain business activity, according to the anecdotal evidence from the survey. These included slowing global economic growth, rising geopolitical concerns, trade wars, Brexit and tightening financial conditions.

Manufacturing remained especially fragile, with an increased rate of decline of new orders and signs of excess capacity relative to sales boding ill for future production. Alongside disappointing official data, the survey suggests the factory sector is in a deepening downturn.

To underscore the plight of Eurozone producers, Germany reported the steepest decline in export orders of all 29 countries for which PMI data are available. Spain and France also saw falling exports.

While the service sector is showing greater resilience, with output growing at the fastest rate for three months in February, inflows of new business remained worryingly weak, providing little hope for any significant improvement in the overall performance of service sector firms in coming months.

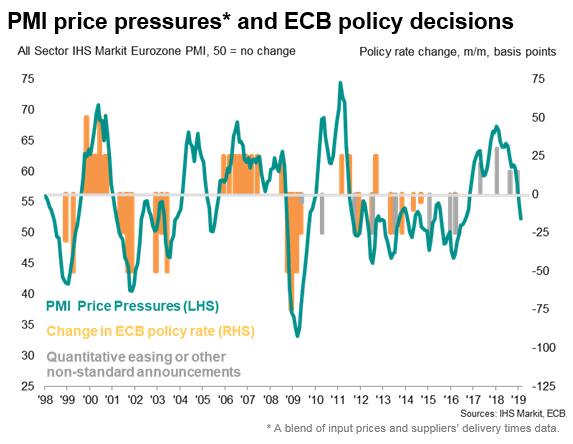

Price pressures at lowest for 1½ years

The survey also indicated that price pressures have meanwhile cooled to the lowest for a year-and-a-half. Reduced inflationary pressure in part reflected the feed-through of lower oil prices but was also attributable to supplier pricing power being inhibited amid the stagnation of demand recorded by the survey in February, notably in the goods-producing sector.

Easing bias

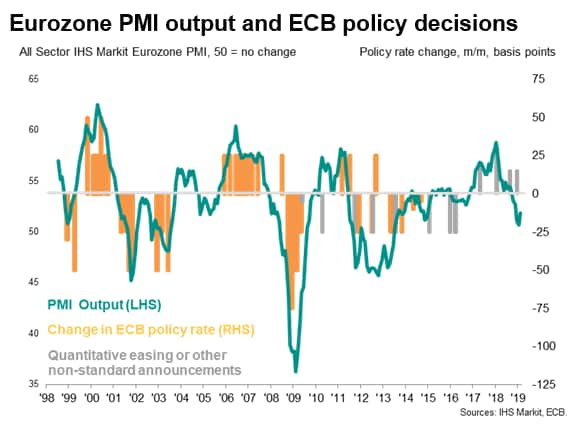

When looking at the implications for ECB policy, it is equally important to consider the PMI price indices as well as the output indicators. While the output indicators generally give a very good signal as to whether the central bank is likely to adopt a generally hawkish or dovish bias, there have been times when the ECB has altered policy purely in response to changing price signals, notably in July 2008.

Taking the output index first, the historical pattern of ECB policy changes suggests the index needs to be above 58 to be consistent with policy being tightened and below 50 to signal a loosening of policy. A reading of 54 is approximately the neutral level. At 51.9, the current reading is therefore consistent with policy being on hold albeit with a dovish bias.

In terms of price pressures, we use a blended gauge of manufacturing input costs and suppliers' delivery times (the latter inverted to signal the degree of capacity constraints) as our preferred guide to how changing price conditions are influencing ECB policy. In the past, readings above 62 have indicated scope for policy tightening, while a drop below 50 is conducive to looser policy. A reading of 56 is approximately the neutral level. In February, this index fell to 52.2, which is therefore well into dovish bias territory.

Both output and price gauges therefore add to the suggestion that policymaking will turn increasingly dovish when the ECB Governing Council next meets. Policymakers will need to tread a fine balance, however. On the one hand, the ECB will not want to be seen to be completely reversing its policy stance too quickly after recently announcing a halt to its asset purchase programme. On the other hand, policymakers will want to avoid being accused of not reacting quickly enough in the face of surprisingly soft data, thereby sounding too complacent.

At the March meeting, no policy action is therefore likely, but the increased downside risks to the outlook are expected to be brought more to the fore in the discussions. As such, the ECB is consequently likely to outline the options it has available in terms of policy tools to deploy in the event of further weak data in coming months.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-shows-eurozone-economy-stuck-in-low-gear-190305.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-shows-eurozone-economy-stuck-in-low-gear-190305.html&text=PMI+shows+eurozone+economy+stuck+in+low+gear+and+price+pressures+easing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-shows-eurozone-economy-stuck-in-low-gear-190305.html","enabled":true},{"name":"email","url":"?subject=PMI shows eurozone economy stuck in low gear and price pressures easing | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-shows-eurozone-economy-stuck-in-low-gear-190305.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+shows+eurozone+economy+stuck+in+low+gear+and+price+pressures+easing+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-shows-eurozone-economy-stuck-in-low-gear-190305.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}