Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 01, 2024

Ocean carriers curb trans-Pacific blank sailings while boosting capacity

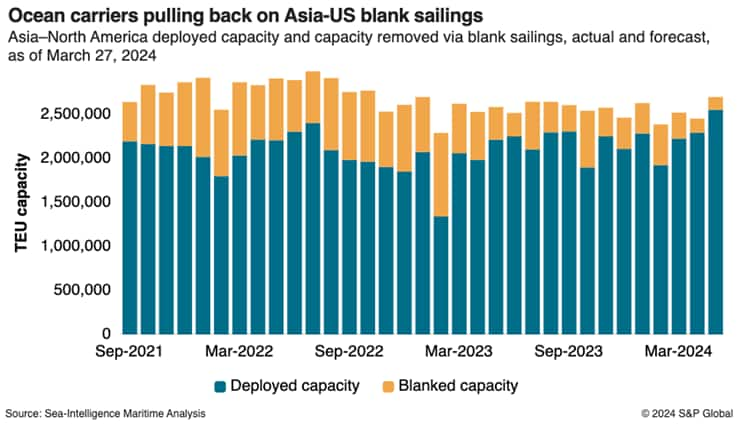

Container carriers are blanking fewer trans-Pacific sailings than they did the previous two years as the longer voyages around the southern tip of Africa during the Red Sea hostilities continue to pull capacity from global trade lanes. They're on track to increase capacity in the Asia-US trades to the highest level in 17 months in May.

"The carriers are blanking much less this year, across the board, as the Red Sea crisis is very conveniently soaking up a large share of their excess capacity," Alan Murphy, CEO and founder of Sea-Intelligence Maritime Analysis, told the Journal of Commerce Monday.

Carriers in March blanked sailings equal to 11.7% of total vessel capacity from Asia to the US West and East coasts, down from 21.5% in the same month last year and 29% in March 2022, according to Sea-Intelligence data. In February, carriers blanked 19.4% of capacity, down from 41.5% in 2023 and 29.6% in 2022.

Although container lines have scheduled even fewer blank sailings for April and May, Murphy cautioned that trusting such projections is risky because carriers are giving less advanced notice of canceled sailings than they did in the past. At present, the announced blank sailings amount to only a 6.6% reduction in total deployed capacity to the US in April and 5.4% in May, according to Sea-Intelligence.

"We caution putting too much faith in data six weeks out," Murphy said. "And with the ongoing Red Sea crisis, I would be cautious trusting figures four to five weeks out, as the carriers are making more and more short-term adjustments," he said.

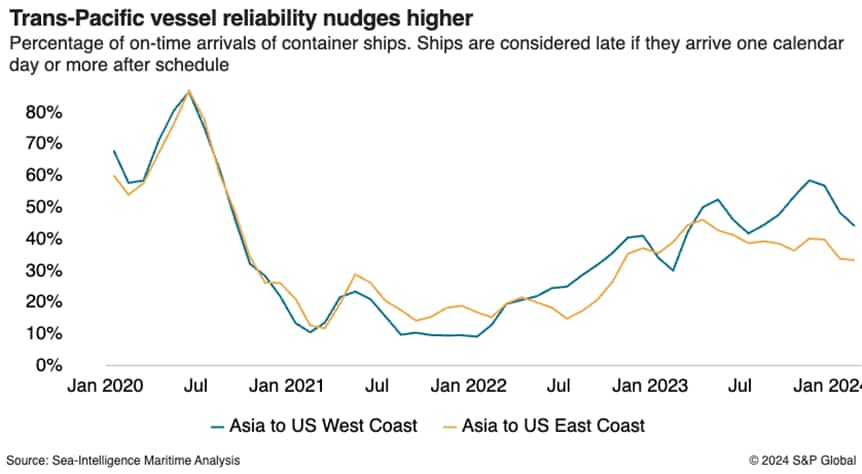

Meanwhile, on-time vessel performance from Asia to the US West and East coasts declined in February. According to Sea-Intelligence's Global Liner Performance Report, schedule reliability from Asia to the US West Coast fell to 44.2% from 48.5% in January, while Asia-US East Coast on-time performance slipped to 33.4% from 33.9%. Globally, schedule reliability improved marginally, rising to 53.3% from 51.6%.

Capacity hikes amid growing imports

Carriers plan to deploy a massive amount of capacity in the Asia-US trades in May: 2.69 million TEUs. That is up from 2.58 million TEUs in May 2023 and the largest amount of deployed capacity since October 2022, during the height of the pandemic-induced import boom, according to Sea-Intelligence.

US imports from Asia surged 18.1% year over year in January and 39.7% in February, according to PIERS, a sister product of the Journal of Commerce within S&P Global. The National Retail Federation in March raised its projections for imports every month through July based on strong retail sales and a growing economy. S&P Global, parent company of the Journal of Commerce, has expanded its forecast for GDP growth in 2024 to 2.4% from its earlier projection of 1.7%.

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly InsightsNewsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2focean-carriers-curb-transpacific-blank-sailings-while-boosting.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2focean-carriers-curb-transpacific-blank-sailings-while-boosting.html&text=Ocean+carriers+curb+trans-Pacific+blank+sailings+while+boosting+capacity+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2focean-carriers-curb-transpacific-blank-sailings-while-boosting.html","enabled":true},{"name":"email","url":"?subject=Ocean carriers curb trans-Pacific blank sailings while boosting capacity | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2focean-carriers-curb-transpacific-blank-sailings-while-boosting.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Ocean+carriers+curb+trans-Pacific+blank+sailings+while+boosting+capacity+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2focean-carriers-curb-transpacific-blank-sailings-while-boosting.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}