Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 10, 2023

Navigating geopolitical headwinds

Geopolitics is no longer reserved for dinner-party conversation. We find ourselves simultaneously in a pandemic recovery, an ongoing conflict in Ukraine, and a reorientation of global partnerships amidst strategic competition. A period out of equilibrium as the world rebalances. The contours of global risk today and in the years ahead are unlikely to be narrowly delineated by an arms race, space race or nuclear threat forcing countries to choose sides, as countries are instead pursuing pragmatism: collaborating across spheres of mutual interest while simultaneously competing elsewhere across spheres of national interest.

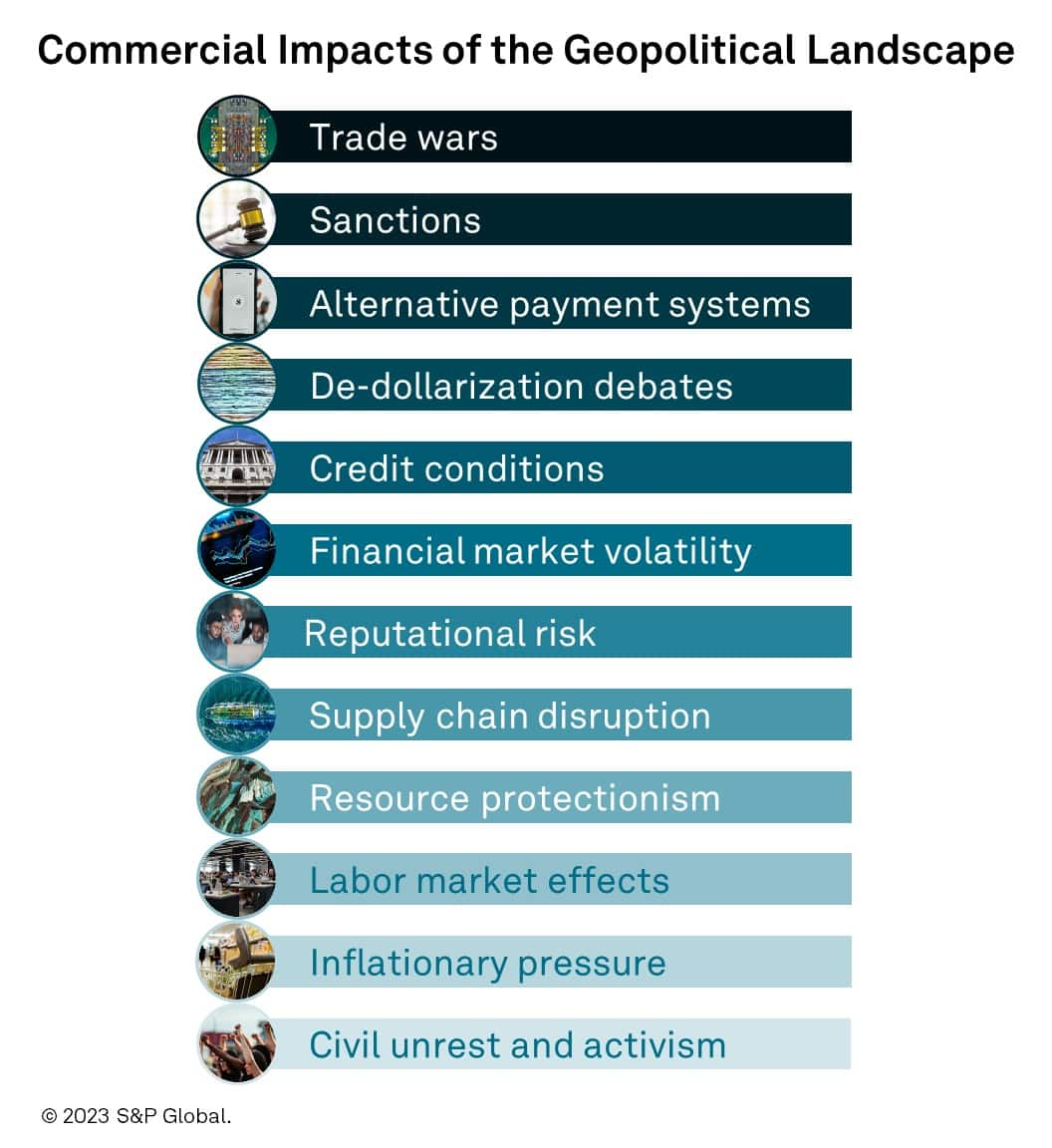

The defining feature of the geopolitical era unfolding around us is an accelerating interdependence between economic and security spheres. Economic levers are being deployed to advance national security and geopolitical priorities. Already this decade we have seen tariffs, export restrictions, local content requirements, entity lists, license requirements, investment screening mechanisms and sanctions - each with commercial impact.

Speaking at Chatham House in January 2020, then-United States Secretary of Treasury Steven T. Mnuchin reflected on the future of the global order. In his remarks, he estimated that half of his time as head of the US agency tasked with maintaining the US economy was spent on national security. The years since provide further evidence of the intensifying nexus between the economic and security space. A global pandemic roiled our access to everything, prompting government stimulus programmes and setting us on an inflationary course. An increasingly entrenched conflict in the centre of Europe renewed concerns of commodity overreliance, particularly on Russian energy, initiating a reconfiguring of global energy markets.

In fact, a direct line can

between drawn from the pandemic and Russia-Ukraine war to historic

inflation rates onto monetary policy tightening and interest rate

hikes to banking sector vulnerability and an even brighter

spotlight on private markets.

Persistent inflation and increasing interest rates raise not only a

banking sector story, these forces are likely to have implications

for cost of capital across sectors, raising the spectre of risks

including defaults and sovereign defaults, social unrest and

political instability.

Supply chains provide perhaps the most revealing example of this trendline. What was once the domain of supply chain managers, port authorities, beneficial cargo owners and logistics teams, has over the last several years gained exponentially more attention across industry and by policymakers. From the acute shock of the Ever Given stuck in the Suez Canal in March 2021, the protracted grain security concerns of the Russia-Ukraine war, shortages of semiconductors constraining manufacturing in computing, communications, automotive and capital goods industries; and the demands for critical minerals needed for the energy transition, has emerged an understanding of the potential vulnerabilities in the current global supply chain.

As the world contemplates a shift from a purely value-based model of supply chains to a security-based model, countries are seeking to align their economic and security spheres. Governments are pursuing interventionist strategies and industrial policies, including encouraging the return of manufacturing from abroad, to address economic, labor, political and national security priorities. The United States, for instance, has launched the multinational Minerals Security Partnership abroad while attempting to secure a "Made in America" supply chain for those same critical minerals, passing the Inflation Reduction Act and its companion the CHIPS Act. The European Commission responded with the Green Deal Industrial Plan, leveraging prior initiatives like the European Green Deal and REPowerEU, and intended to "enhance the competitiveness of Europe's net-zero industry… and [scale] up the EU's manufacturing capacity." Elsewhere, in Mexico the USD48billion Sonora Plan would aim to establish an advanced manufacturing capability in the state to process Sonora's vast lithium reserves and enhance Mexico's position as a hub for the energy transition supply chain.

For business, the impact of these policies is that companies can no longer sit on the geopolitical sidelines. Geopolitics is happening in government buildings and boardrooms.

A set of challenges will keep us interlinked: climate risk and sustainability, the energy transition, disruptive technology and cybersecurity, pandemics, and inequities. These shared challenges will require shared solutions.

Even still, we can expect

more rather than less volatility ahead. Our economic forecasts for

2023 and Purchasing Managers' Index underscore that headwinds

remain. With the geopolitical landscape being shaped by an

accelerating interdependence between economic and security spheres,

business finds itself at the center of this growing union.

Navigating the way forward is tricker than ever before.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnavigating-geopolitical-headwinds-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnavigating-geopolitical-headwinds-.html&text=Navigating+geopolitical+headwinds++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnavigating-geopolitical-headwinds-.html","enabled":true},{"name":"email","url":"?subject=Navigating geopolitical headwinds | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnavigating-geopolitical-headwinds-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Navigating+geopolitical+headwinds++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnavigating-geopolitical-headwinds-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}