Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 24, 2022

Municipal Calendar Week of January 24th 2022

Calendar Week of 1/24/2022

New issue activity will remain stable amidst heightened volatility across macro markets fueled by rising geopolitical tensions coupled with general market concerns surrounding economic activity across the nation. Market participants continue to direct focus towards monetary and fiscal policy outcomes ahead of the Federal Reserve's two-day meeting launching tomorrow which is slated to provide further guidance on the central bank outlook for the remainder of 2022. As investors await further clarification surrounding rate hikes and government-led measures to combat surging inflation via asset repurchases, recent market turbulence has propelled greater demand for safe-haven investment vehicles resulting in greater appetite for muni new issue paper coming to market. Macro market volatility continues to drive exaggerated fluctuations across yields after US Treasuries widened across the curve with muni benchmarks following suit, widening by 6-12bps with the largest cuts noted in the short end durations. As investors seek windows of opportunity to deploy capital across various tenors, Muni/UST ratios gained momentum after the 10YR ratio rose +6% WoW, standing at 73% with the 30YR ratio hovering at 84% as institutional accounts seek value across long-dated bonds. As the market braces for higher yields across the board, issuers are consistently evaluating timelines to issue debt in order to mitigate the uptick of true interest cost associated with climbing yields; playing a factor in potential primary issuance acceleration throughout the remainder of the first quarter. Despite the uptick in political cross currents and market-wide preparation for climbing interest rates, institutional and retail activity across the primary arena remains strong, supported by risk-adverse investors seeking to preserve capital while putting cash to work across various state and local credits.

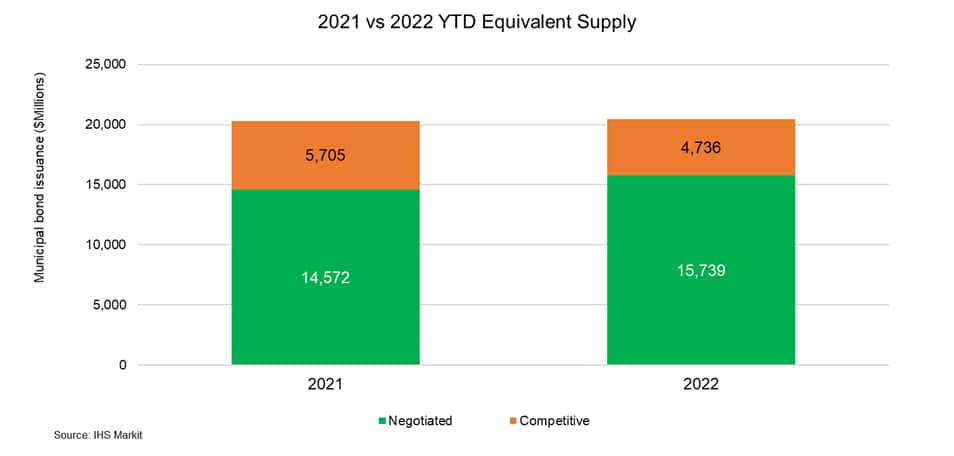

Persistent demand for primary paper supported last week's calendar which supplied $9.5Bn of par ($) size for a host of market players, complementing investor demand with a greater focus geared towards longer dated maturities providing greater yield returns. The New York City Transitional Finance Authority (Aa1/AAA/AAA) led last week's negotiated calendar, selling $950mm of future tax secured subordinate bonds, spanning across 02/2024-02/2051, with cuts of 1-3bps noted across the scale given the overarching interest rate volatility registered throughout the market. The New Jersey Transportation Trust Fund Authority (Baa1/BBB/BBB+/A-) also tapped into the negotiated space to offer $750mm of transportation program bonds spanning 06/2031-06/2050 with MAC spreads of +72bps registered in the 10YR maturity, and bumps of 2-3bps noted across the intermediate range of the scale. This week's calendar is primed to supply $9.1Bn of new issue deals spanning across 162 new issues with the Brightline West Passenger Rail Project (Aaa/-/-) leading the negotiated calendar to provide $894mm of passenger railroad bonds across two maturities, 01/2023 and 01/2036; senior managed by Morgan Stanley and selling on Thursday 01/27. The Ohio Housing Finance Agency (Aaa/-/-) will also tap into the negotiated arena to sell $175mm of residential mortgage revenue (social bonds) with maturities spanning 09/2022-09/2052; senior managed by Citigroup. This week's competitive calendar will span across 86 new issues for a total of $2.1Bn, led by the School District No. 5 of Spartanburg County, SC (Aa2/AA-/-) auctioning $100mm of general obligation bonds across 03/2023-03/2046, selling on Thursday 01/27.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-january-24th-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-january-24th-2022.html&text=Municipal+Calendar+Week+of+January+24th+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-january-24th-2022.html","enabled":true},{"name":"email","url":"?subject=Municipal Calendar Week of January 24th 2022 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-january-24th-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Municipal+Calendar+Week+of+January+24th+2022+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-january-24th-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}