Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 04, 2021

Multi-speed COVID-19 vaccine rollouts likely to drive greater divergence in eurozone economic activity

Many factors may influence a vaccination programs success. Across the Eurozone roll-out plans will lead to a greater divergence in economic performance. Let's take a look at what we are seeing acros the region.

- Despite having its credibility on the line, the European Commission's handling of COVID-19 vaccine procurement has drifted from crisis to crisis and shows no signs of having a firm hand at the tiller.

- The European Commission's vaccination targets are achievable, but the stop-start nature of some national vaccination strategies injects substantial risks.

- Diverging vaccination rates may lead to a two-speed Europe developing, one in which some countries are able to reopen their economies and ease COVID-19 containment measures gradually during the late second and third quarters, while others stay mired in healthcare crisis and lockdown.

- The relative success in vaccine rollouts among countries could also result in a higher divergence in eurozone countries' economic performance, particularly during the second half of 2021.

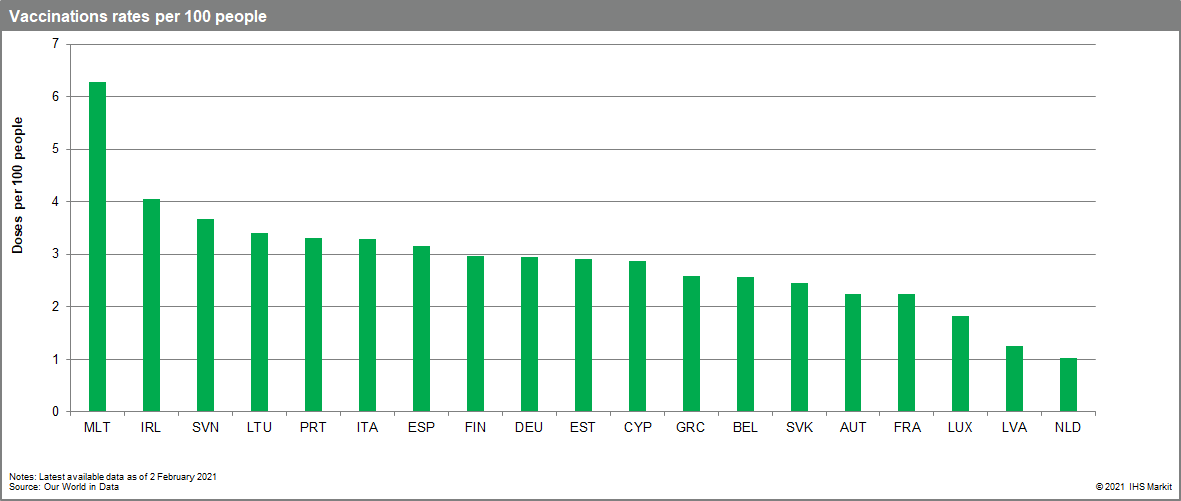

The challenges faced are illustrated by uneven daily vaccination rates across the EU bloc, with some countries having more supplies that they can use effectively and others forced by logistical bottlenecks to limit the number of new first dose administrations given in favour of prioritising second doses. A defence for the slow rollout which seeks to claim that EU vaccination campaigns are not "a race for the largest numbers at the quickest speed" is flimsy. The deployment of COVID-19 vaccine programs in the region has always been about a numbers game.

The short-term objective set by European Commission of vaccinating 80% of national populations over the age of 80 years and 80% of healthcare workers by March 2021 is deliverable. However, the stop-start nature of some national vaccination strategies - characterised by uncertainty about the volumes of vaccine that will be available next week or next month because of ongoing disruption to manufacturing delivery schedules - mean that the EU vaccination programme appears to the most observers to be at risk.

Realistically, the eight-month mission objective appears to already be in jeopardy in some countries. There is therefore a real risk this could lead to a two-speed Europe developing, one in which some countries are able to reopen their economies and ease COVID-19 containment measures gradually during the late second and third quarters, while others stay mired in healthcare crisis and lockdown.

The implication is that large-scale vaccination is probably unlikely to result in a rapid return to "normal" for the EU. While vaccination should gradually lead to decreases in deaths, probably observable by in the second quarter, pressure on healthcare systems is likely to remain intense until larger swathes of the population can be immunised. As a result, some EU countries are bracing for the prospect of maintaining longer phases of COVID-19 containment measures and more months vaccinating.

Broadly speaking, the criteria for relaxing lockdown restrictions will require continued falls in the average number of secondary infections caused by a single infected COVID-19 case, analysis showing declining death and hospitalisation rates from COVID-19, and also no new major virus mutation in circulation, evidence that vaccine rollout is beginning up speed and reduced pressure on health systems.

The course that the COVID-19 pandemic takes in the EU is at this point highly uncertain. The implementation risks for national vaccination strategies are elevated and the prospects that the European Commission can quickly restore confidence in its failing vaccine procurement programme poor. Political infighting within the EU and disputes with non-EU partners, such as the UK, are a worrying signal of mounting criticism of the European Commission's handling of the situation. If unchecked, this could also give an opening to populist political parties to exploit in national elections due in 2021.

Diverging vaccination rollouts likely to have an impact on the pace of the economic recovery

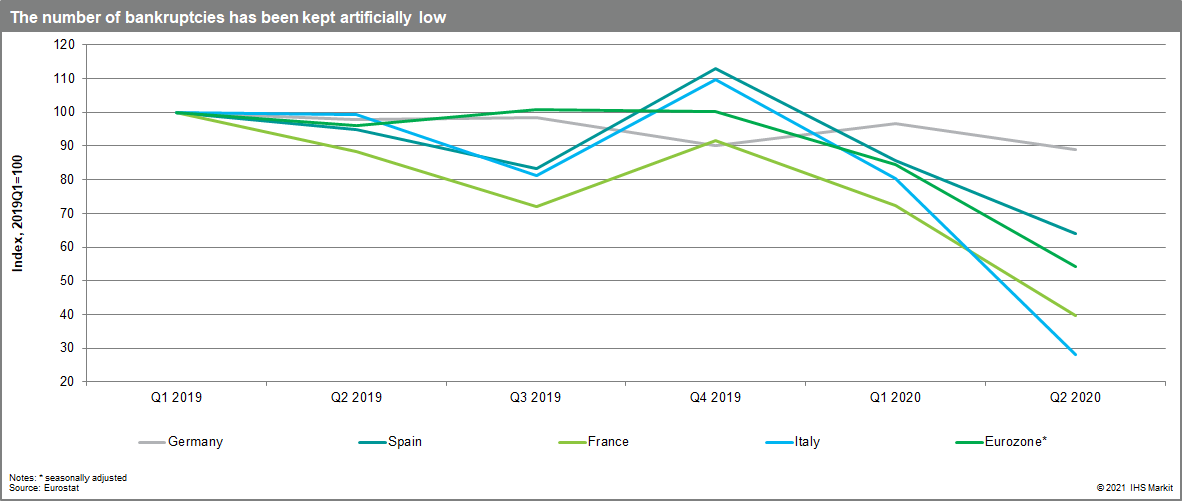

The underwhelming start of the vaccination campaigns in most eurozone countries, alongside the risks related to the vaccine rollouts outlined above, also injects some uncertainty regarding the expected economic rebound, particularly during the second half of 2021. The relative success of vaccine rollouts among countries could also result in a higher divergence in eurozone member states' economic performance. The failure to successfully roll out vaccinations may also have major implications for the sectors that are being particularly hit by the pandemic, such as hospitality, transport, and tourism. These sectors are also likely to be the ones suffering more damage if restrictions will have to be reintroduced at a later stage this year. On the other hand, they are also the ones that are poised to gain the most once restrictions are lifted, as long as the recovery does not occur too late to avoid a large number of business failures in these sectors.

Indeed, fiscal policy's effectiveness in limiting the negative structural economic impact of the recession is likely to diminish the longer the pandemic lasts. Although most eurozone governments have pledged to keep supporting the economy for 'as long as it takes', the strong fiscal support is unlikely to prevent a large number of business failures, especially in the most affected sectors. This effect has been delayed owing to several factors, including tax deferrals, fiscal handouts, and insolvency filing suspensions, but business failures are likely to pick up steam during the second quarter of 2021.

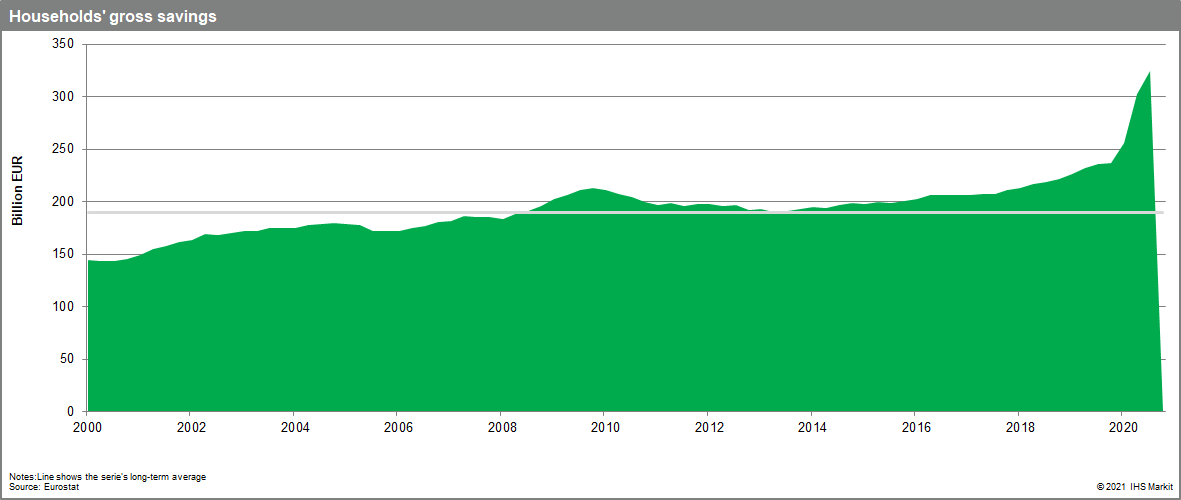

It is also possible that the success or failure of vaccination programs may have an impact on sentiment levels. A strong acceleration in the number of vaccinations may lead to a substantial improvement in sentiment. In turn, this could help unleash some of the large build-up in savings that has been accumulated during the pandemic. This would very likely drive a strong pick-up in consumer spending and, at a lesser degree, capital investment during the second half of 2021.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmultispeed-covid19-vaccine-rollouts-divergence.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmultispeed-covid19-vaccine-rollouts-divergence.html&text=Multi-speed+COVID-19+vaccine+rollouts+likely+to+drive+greater+divergence+in+eurozone+economic+activity+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmultispeed-covid19-vaccine-rollouts-divergence.html","enabled":true},{"name":"email","url":"?subject=Multi-speed COVID-19 vaccine rollouts likely to drive greater divergence in eurozone economic activity | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmultispeed-covid19-vaccine-rollouts-divergence.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Multi-speed+COVID-19+vaccine+rollouts+likely+to+drive+greater+divergence+in+eurozone+economic+activity+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmultispeed-covid19-vaccine-rollouts-divergence.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}