Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 19, 2021

Most MENA banking sectors equipped for energy transition

Although the oil-price outlook has improved significantly in 2021, this report considers increased banking risks expected in hydrocarbon-exporting markets in the Middle East and North Africa (MENA) region in a scenario of transition to alternative energy production. However, strong asset quality and high capital buffers will provide the necessary support for most banking sectors.

Beyond the near term, IHS Markit analyses the impact of shifts to new energy sources and economic diversification on global economic structures in our Emphasising Energy Efficiency and Fuel Switching Post-COVID-19 scenario.

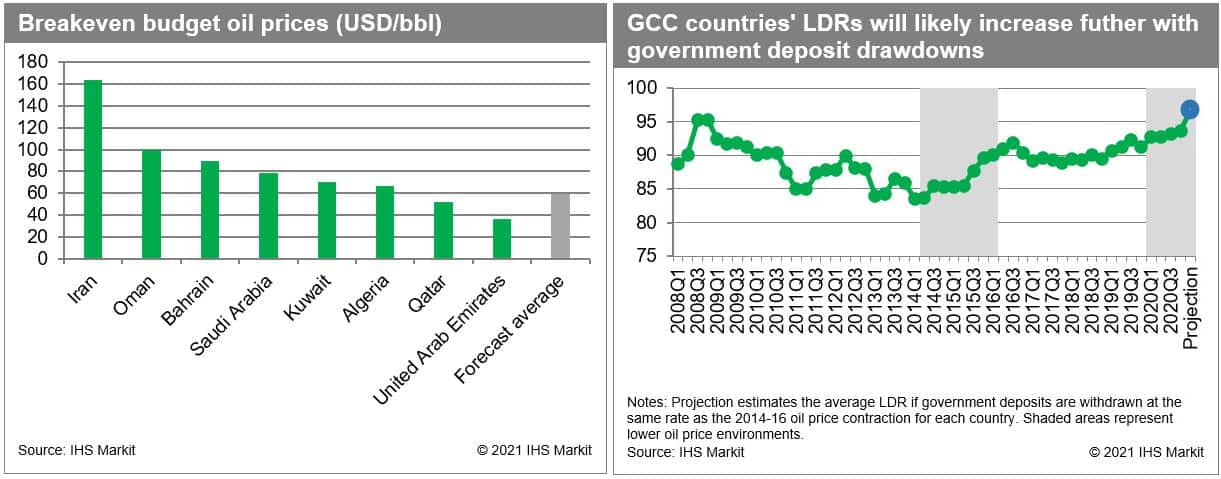

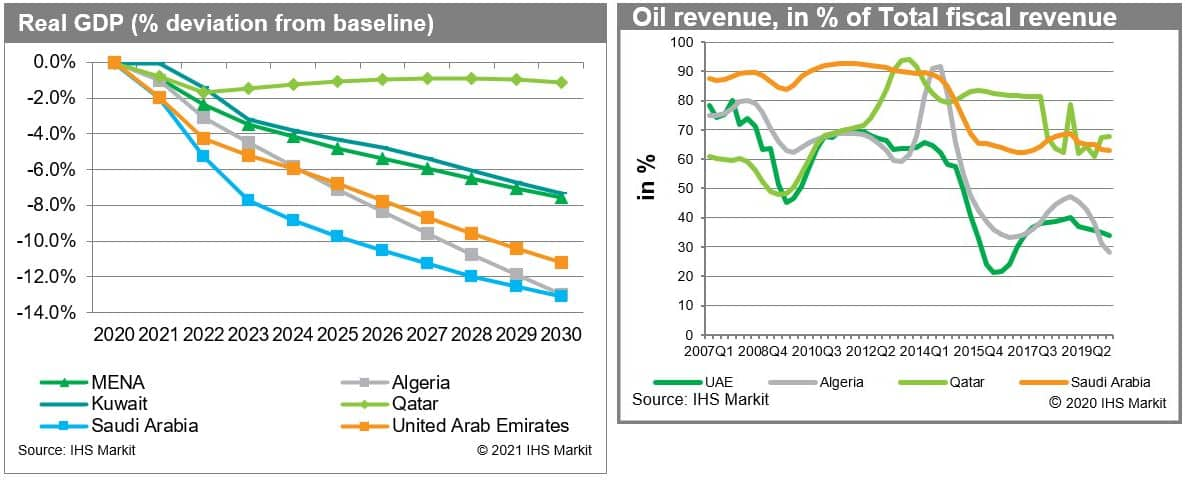

The longer-term outlook is fraught with risks. The increasing emphasis on climate change mitigation efforts amongst policymakers will drive a desire to shift away from high-carbon-content fuels, lowering the long-term trend in oil demand. This scenario lays out the two key impacts of durably low oil prices: economic deterioration stemming from the weak oil price itself and the structural shift to alternative energy sources. This scenario assumes that Brent oil prices will average below USD80/barrel through 2050, driving inflation and other commodity prices down via passthrough to domestic prices. Lower energy costs and fuel switching will then reduce economies' oil dependence. In oil-producing economies, this puts pressure on governments' internal and external balances - reducing revenues and swinging longstanding current-account surpluses to deficits. As a result, oil-producing governments must make significant policy changes, including through tax increases, changes in sovereign wealth fund allocation, and cuts to fiscal spending. These reforms will be imperative as governments will need to simultaneously invest in the development of alternative energy.

For banking sectors in all oil-producing markets, this scenario signals that governments will need to rely more on banks to finance diversification projects and that government support for regional banking sectors will be reduced during the transition.

In most oil-exporting economies, as governments shift focus to other sectors, employment in public-sector-dominated hydrocarbon production will dwindle. In this scenario, IHS Markit expects that unemployment is likely to increase in the region in the long run, as Cooperation Council for the Arab States of the Gulf (Gulf Cooperation Council: GCC) diversification plans are not fully implemented as written and labor-market rigidities are slow to adjust to the "new normal" of alternative energy sources. Under this scenario, Algeria and Saudi Arabia would see the largest rise in the long-term average unemployment rate, with an increase of nearly 10 percentage points compared with our baseline forecast. Increased unemployment, as well as tax increases resulting from government efforts to fund budget deficits and investment in diversification, will drive asset-quality deterioration in the household portion of banks' loan books.

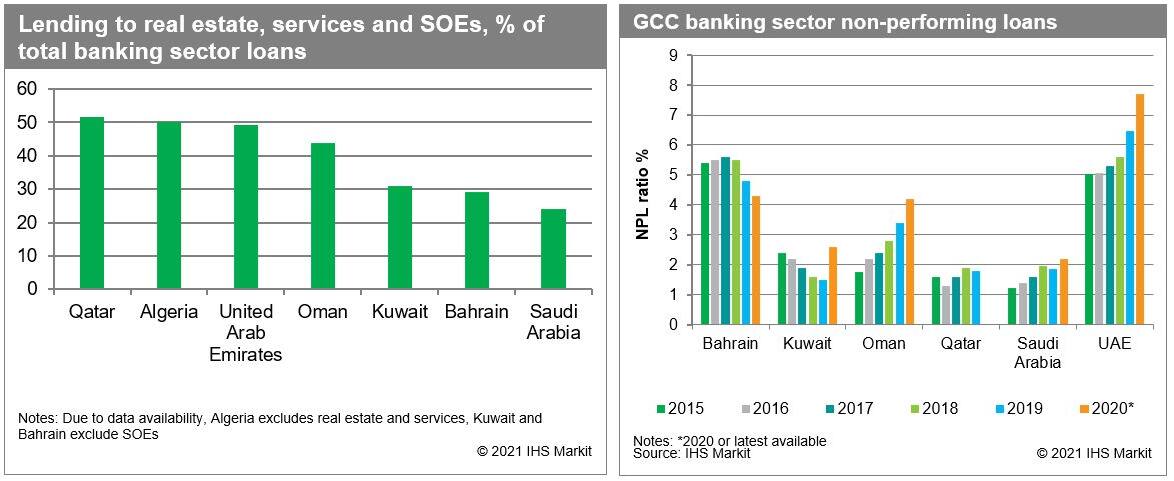

Banks in Kuwait, Bahrain, Saudi Arabia, and Oman are the most vulnerable to higher unemployment rates as their banking sectors provide over 30% of their credit to households.

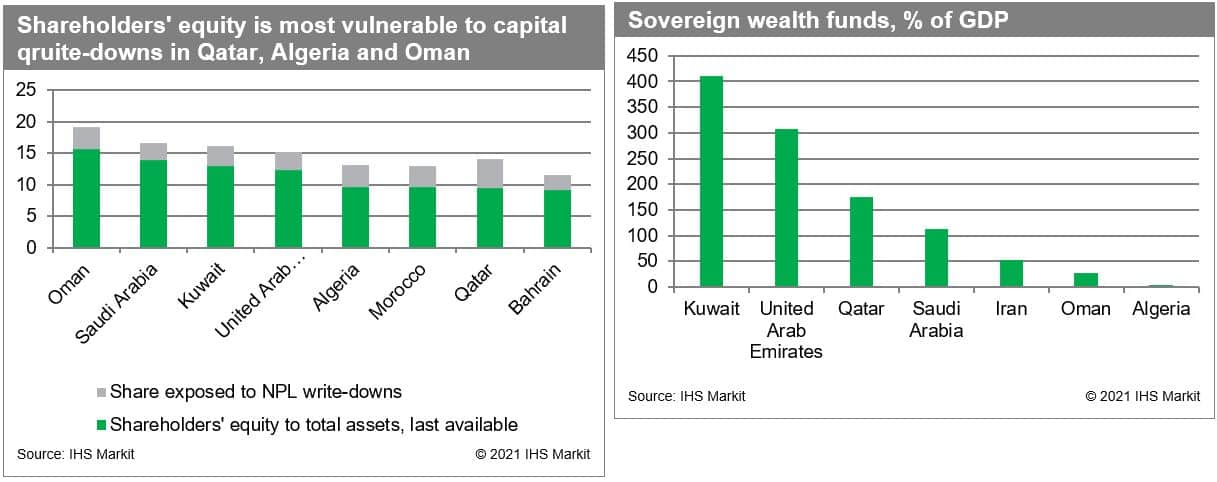

However, overall exposure to vulnerable sectors including households, services, real estate, and state-owned enterprises (SOEs) is highest in Oman, the UAE, and Kuwait. During the 2014-16 oil-price downturn, most GCC countries were able to use their ample provisions to limit the impact of NPLs on capital. In the face of a durable decline in oil prices, however, rising NPLs will require more provisioning that will eat into profits. Excluding provisioning, every 1% increase in NPLs from the household, real estate, services, and SOE sectors would expose capital buffers to write-downs of 3.2% on average. Shareholders' equity is most vulnerable to NPL write-downs in Qatar (4.7%), Algeria (3.8%), and Oman (3.4%) given these banking sectors' elevated exposure to vulnerable loan categories.

Under our scenario, pre-existing liquidity strains will be exacerbated during the transition to lower hydrocarbon fuels, as banks will be expected to lend to diversification projects.

This lending need will be most prevalent in Algeria, Saudi Arabia, and Qatar, where diversification needs are elevated, given those governments' current reliance on oil revenues. Although oil revenues are a smaller share of total fiscal revenues in Oman and Bahrain, fiscal strains including reduced sovereign wealth funds will limit prospects for internal investment and drive reliance on bank lending during the energy transition in these markets as well. In the long term, the combination of government deposit drawdowns and directed lending may force banking sectors to turn to new sources of funding, as previously elevated savings rates signal limited prospects for additional deposit mobilization. In Bahrain, Qatar, and the UAE - where non-deposit funding already amounts to over 30% of total liabilities - structural liquidity risk is already elevated.

Banking sectors that frequently lend in foreign currency or have strong negative net open positions will face high exchange-rate risks over the long term.

Under our scenario, deteriorating sovereign wealth will put pressure on foreign exchange reserves and ultimately currency pegs and managed exchange-rate bands. For direct exchange-rate risks to channel through to the banking sector, banks must have a negative (short) net open position in foreign currency, as the intrinsic balance sheet adjustments associated with an increase in value of foreign currency positions will cause liabilities to increase more significantly than assets. Additionally, banking sectors with high shares of foreign currency lending will face deteriorating asset quality if exchange rate pegs are abandoned or adjusted and borrowers struggle to service their debts. Pressure to devalue will be most severe in Algeria, where the annual exchange rate is projected to increase by an average of 58% more compared with our baseline through 2030. However, the Algerian government's tight foreign exchange controls will prevent foreign exchange rate risks from channeling through to the banking sector. A devaluation or abandonment of the peg is also likely in Oman, where banks also maintain a negative - though very small - net open foreign exchange position at -0.2%, and foreign currency lending amounts to 16% of total loans. As such, banks in Oman will face more significant-though manageable- pressure if the peg is adjusted.

Overall, Algeria, Oman, and Qatar stand out as banking sectors that will be significantly affected by the low oil prices and diversification scenario in both the near and long terms.

However, Omani and Qatari banks have strong capital buffers and more prospects for government support, significantly reducing the immediate-term risk of financial distress. Conversely, banks in Algeria face additional risks because of more limited capital and liquidity buffers and related-party lending risks stemming from government ownership and are thus most vulnerable in both the near and longer terms.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmost-mena-banking-sectors-equipped-for-energy-transition.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmost-mena-banking-sectors-equipped-for-energy-transition.html&text=Most+MENA+banking+sectors+equipped+for+energy+transition+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmost-mena-banking-sectors-equipped-for-energy-transition.html","enabled":true},{"name":"email","url":"?subject=Most MENA banking sectors equipped for energy transition | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmost-mena-banking-sectors-equipped-for-energy-transition.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+MENA+banking+sectors+equipped+for+energy+transition+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmost-mena-banking-sectors-equipped-for-energy-transition.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}