Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 07, 2023

Monthly PMI Bulletin: March 2023

The following is an extract from S&P Global Market Intelligence's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

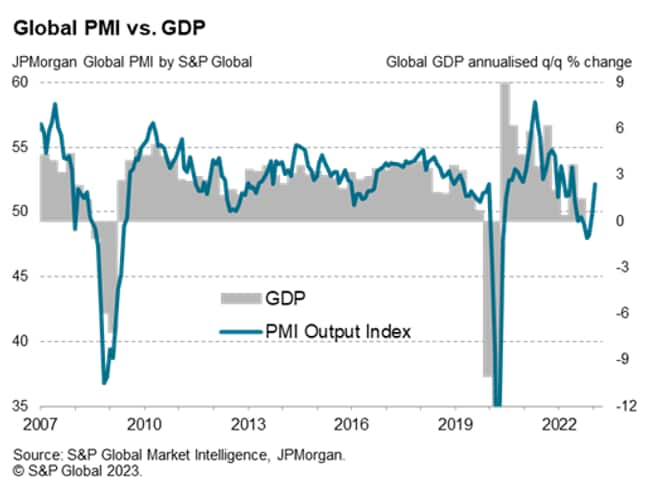

The global economy saw a turnaround in February as activity rose for the first time in seven months, concluding the sequence of downturn. Service sector improvements, particularly in the consumer sector, coupled with a renewed global manufacturing production expansion, underpinned the latest positive change in global PMI readings.

The J.P.Morgan Global Composite Output Index - produced by S&P Global - posted 52.1 in February, up from 49.7 in January. This marked the third consecutive rise in the index and the first expansion in global activity since last July, indicative of global GDP rising at a quarterly annualized rate of approximately 2.5%.

Leading the improvement in February was again the services sector, where solid growth in business activity was recorded and supported by expansions in major developed economies, including a return to expansion for the US. Mainland China's services activity meanwhile continued to improve following the easing of COVID-19 restrictions, posting the steepest increase since last August.

Concurrently, the global manufacturing sector saw its first expansion of output in seven months, supported primarily by upticks in Asian production. The easing of supply chain constraints and China's reopening were also linked to renewed growth in manufacturing output in February, and also helped further reduce global raw material price pressures.

Finally, business confidence rose alongside the better PMI indications, owing to brighter prospects, diminished recession fears, better supply conditions and signs of inflation peaking. That said, still-elevated price pressures and tight labour market conditions remain outstanding issues to consider going deeper into 2023.

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-march-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-march-2023.html&text=Monthly+PMI+Bulletin%3a+March+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-march-2023.html","enabled":true},{"name":"email","url":"?subject=Monthly PMI Bulletin: March 2023 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-march-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Monthly+PMI+Bulletin%3a+March+2023+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-march-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}