Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 12, 2024

Monthly PMI Bulletin: January 2024

The following is an extract from S&P Global Market Intelligence's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

Global growth accelerates amid sector divergences at end of 2023

The global economic expansion accelerated in December, though divergences between sectors and regions were observed. At the same time, inflation remained sticky, staying elevated by historical standards as risks of supply chain constraints emerged.

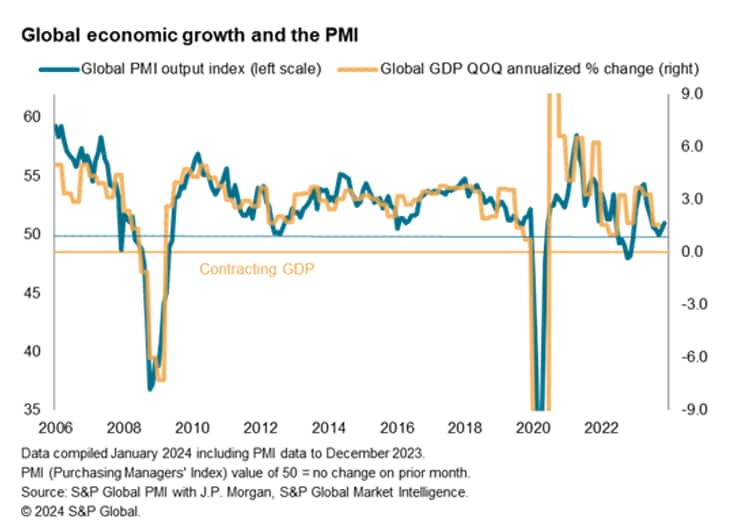

The J.P.Morgan Global PMI Composite Output Index - produced by S&P Global - rose to 51.0 in December, up from 50.5 in November. This marked a second consecutive month of growth, with the pace of expansion the fastest since July 2023. The headline PMI remains well below the survey's long-run average of 53.2, however, and is consistent with an annualized quarterly global GDP growth of approximately 1.5%, a relatively modest rate of growth in comparison with the pre-pandemic ten-year average of 3.0%. Growth in activity remained exclusive to the service sector, as manufacturing output contracted for a seventh straight month.

Faster service sector growth contrasted with a quicker, albeit still mild, decline in manufacturing output. At the same time, expansions in business activity were driven by emerging markets as developed markets saw a fifth monthly fall in output. The impact of high interest rates remained a key factor dampening growth, though there were some signs of improvement in service sector new business at the end of the year.

Meanwhile, input cost inflation quickened at the end of 2023, though the pace in which selling prices increased was unchanged from November. Both manufacturing and service sectors recorded stronger rates of cost inflation at the end of the year amid signs of rising shipping costs on the back of increased supply chain risks. With selling prices showing some signs of stickiness at around the 3.0% level in the months to come, any risks of further price rises, especially stemming from supply constraints, will be worth watching out for as we await the next release of flash PMI on January 24.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-january-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-january-2024.html&text=Monthly+PMI+Bulletin%3a+January+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-january-2024.html","enabled":true},{"name":"email","url":"?subject=Monthly PMI Bulletin: January 2024 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-january-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Monthly+PMI+Bulletin%3a+January+2024+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-january-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}