Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 28, 2024

Monetary policy FAQs: Eurozone interest rates

Learn more about our Global Forecasting and Analysis

Understanding the trajectory of interest rates is essential for businesses and investors to make informed decisions. We explore the factors influencing interest rates, the European Central Bank's (ECB) monetary policy decisions, and the indicators to watch for future rate movements.

Q: Where are eurozone interest rates going?

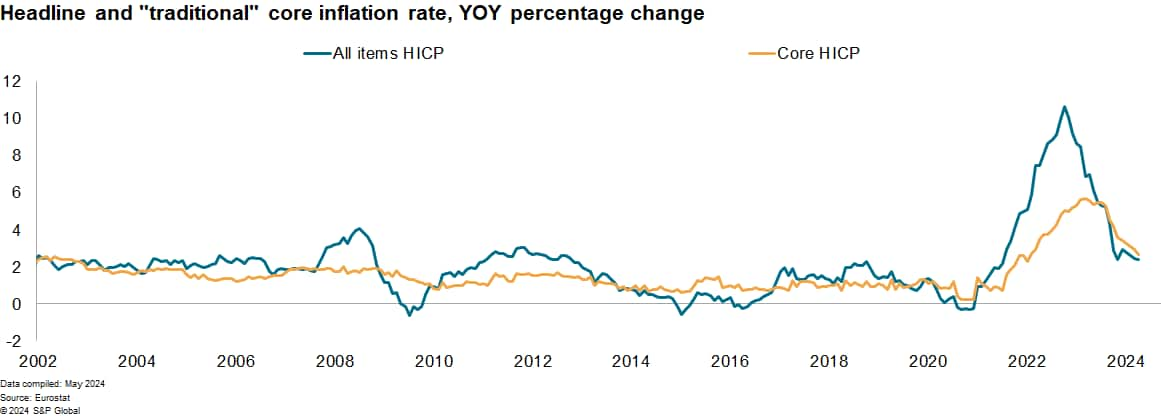

A: While interest rates are subject to various factors, progress on inflation has been significant enough to allow the ECB to start easing policy. Eurozone headline inflation has declined substantially, and core inflation has also fallen. We expect further declines in core inflation in 2024 due to slowing nominal wage inflation and moderated firm profit margins.

Q: When does S&P Global Market Intelligence expect the ECB to start cutting interest rates?

Market Intelligence expects the ECB to cut its policy interest rates by 25 bps in its June meeting. We have been projecting a June cut for almost a year, and the market's consensus, which had previously priced in an earlier cut at the start of 2024, also recently shifted to this position.

Q: Will the ECB continue to cut interest rates after June?

A: The monetary policy path after June is more uncertain. The ECB has emphasized a data-dependent and meeting-by-meeting approach. The policy rates will stay sufficiently restrictive for as long as necessary. Our May update shows the ECB cutting rates by 75 bps in 2024 - down from 100 bps in our April forecast - 125 bps in 2025, and a further 50 bps in 2026.

This uncertainty is partly due to the persistence of service price inflation. We expect the increase in service prices to moderate during the rest of 2024 and in 2025. Still relatively solid labor market conditions mean that there is a risk that service price inflation will remain uncomfortably high during the second half of 2024. It is likely that the disinflationary trend in both headline and core inflation will stall without a moderation in service prices. This is particularly a risk between April and July, when higher oil prices, compared with their level in 2023, are expected to boost energy price inflation, even without a further escalation of the conflict in the Middle East.

Q: What are the implications of lower interest rates for economic conditions and activity?

A: We still expect lower interest rates to provide some support to economic activity, but not until late 2024. The impact will be modest at first, particularly as some borrowers will still face higher interest rates when they refinance loans taken before interest rates started to increase.

Markets' expectations on the upcoming interest rate cuts have already led to a decline in interbank lending rates (Euribor), generally used as a benchmark for pricing short-term commercial loans. Their decline has already driven falls in borrowing costs, particularly mortgage rates. Interest rates for bank loans to nonfinancial corporations, which have increased sharply as the ECB hiked rates, will take longer to react to lower policy rates. Still, corporate spreads are already narrowing because of a combination of lower rate expectations and some improvement in economic conditions.

Lower policy rates will also be translated into lower deposit rates for both households and firms. Although this is an important transmission channel, deposit rates reacted less strongly to higher policy rates since 2022, limiting the impact of their expected decline.

Q: What indicators are we following to ensure our forecasts are on track?

A: We closely watch service price inflation and nominal wage growth. Forward-looking indicators such as the HCOB PMI survey and the monthly Indeed wage tracker provide valuable insights into price pressures and wage inflation.

Q: Will the expected later pivot by the US Federal Reserve influence the ECB's monetary policy decisions?

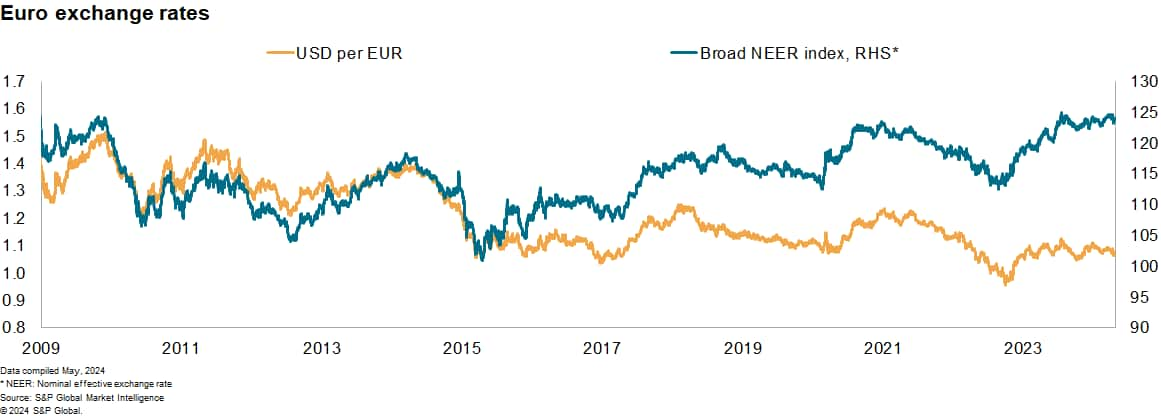

A: The Fed's rate cut outlook has diminished, and we expect the first and only rate cut in 2024 to be made at the December meeting. The ECB has stressed its independence, and while there may be some influence, the ECB and the Fed have diverged in the past. The ECB will consider various factors, including core inflation, labor market conditions, and potential risks.

Hear our global economist reveal our top 10 economic predictions for 2024

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonetary-policy-faq-eurozone-interest-rates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonetary-policy-faq-eurozone-interest-rates.html&text=Monetary+policy+FAQs%3a+Eurozone+interest+rates+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonetary-policy-faq-eurozone-interest-rates.html","enabled":true},{"name":"email","url":"?subject=Monetary policy FAQs: Eurozone interest rates | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonetary-policy-faq-eurozone-interest-rates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Monetary+policy+FAQs%3a+Eurozone+interest+rates+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonetary-policy-faq-eurozone-interest-rates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}