Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 07, 2022

Momentum shares avoid some pain despite stocks’ struggles

Research Signals - August 2022

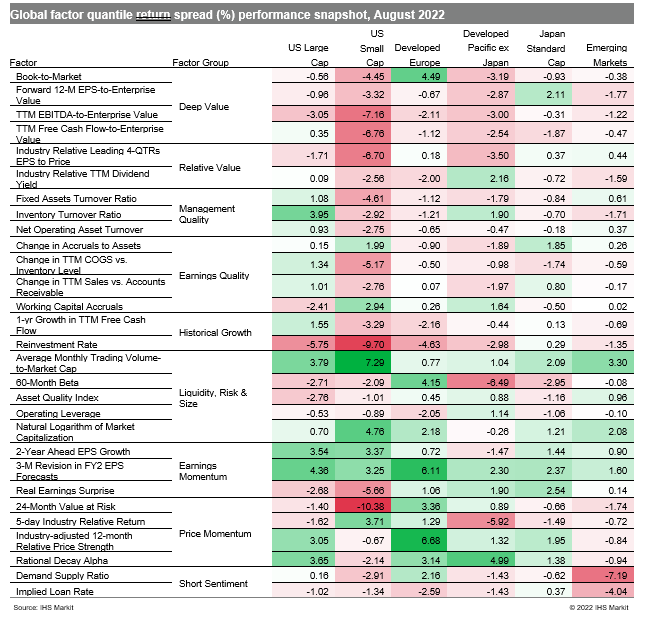

Central banks remained center stage, as Federal Reserve Chair Jerome Powell, in his speech at a central bank symposium in Jackson Hole, warned of 'some pain' to households and businesses in their fight against inflation. While stocks reacted negatively, and as global economic activity contracted for the first time since June 2020, according to the J.P.Morgan Global Composite PMI™, momentum shares extended gains into August (Table 1).

- US: Earnings Momentum measures gained traction last month, as confirmed by factors such as 3-M Revision in FY2 EPS Forecasts and 2-Year Ahead EPS Growth

- Developed Europe: Price Momentum was a highly favored theme again in August, as captured by Industry-adjusted 12-month Relative Price Strength

- Developed Pacific: High momentum and high risk shares outperformed across the region, as gauged respectively by Rational Decay Alpha and 60-Month Beta

- Emerging markets: Average Monthly Trading Volume-to-Market Cap and 3-M Revision in FY2 EPS Forecasts were positively rewarded last month

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmomentum-shares-avoid-some-pain-despite-stocks-struggles.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmomentum-shares-avoid-some-pain-despite-stocks-struggles.html&text=Momentum+shares+avoid+some+pain+despite+stocks%e2%80%99+struggles+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmomentum-shares-avoid-some-pain-despite-stocks-struggles.html","enabled":true},{"name":"email","url":"?subject=Momentum shares avoid some pain despite stocks’ struggles | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmomentum-shares-avoid-some-pain-despite-stocks-struggles.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Momentum+shares+avoid+some+pain+despite+stocks%e2%80%99+struggles+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmomentum-shares-avoid-some-pain-despite-stocks-struggles.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}