Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 19, 2022

MENA region’s economic growth to slow after strong 2022

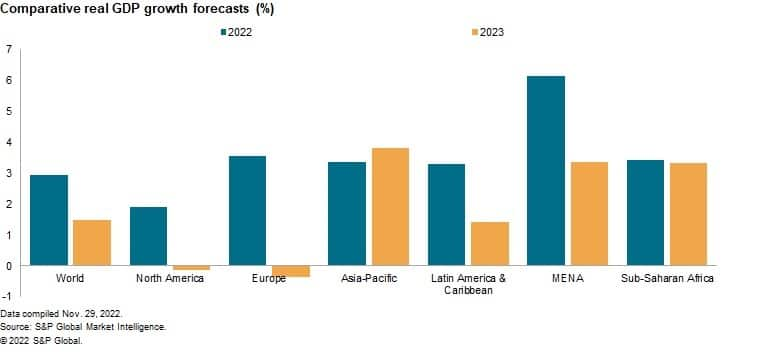

Economic activity in the Middle East and North Africa (MENA) region is expected to sharply decelerate in 2023 after strong growth in 2022.

Real GDP growth is forecast to decline to around 3.5% in 2023-24 from an 18-year high of 6.1% in 2022, outpacing the broad performance of the global economy over the same period.

Hydrocarbon exporters vs importers

The headline growth figure masks a stark contrast between two groups of countries: the net energy exporters and the net energy importers. For the MENA hydrocarbon exporters group, we forecast real GDP growth will move down from 6.7% in 2022 to around 3.5% in 2023-24. For the MENA hydrocarbon importers group, we anticipate a real GDP growth slowdown from 4.2% in 2022 to 2.9% in 2023 and 3.1% in 2024.

Energy exporters will register less revenue from oil and gas while maintaining healthy external and fiscal surpluses. The energy importers will benefit from relatively lower energy prices, slightly curbing their external imbalances and allowing fiscal gaps to remain contained as a percentage of GDP. Both groups will feel the pinch of reduced trade flows during 2023.

The OPEC+ alliance has already announced oil output cuts, meaning that major MENA energy producers will sell less oil in the near term than during a large part of 2022. Brent oil prices are expected to drop from about USD102 per barrel in 2022 to USD87-88 per barrel in 2023 and 2024, reducing the petrodollar inflows into MENA oil-exporting countries when compared to 2022.

Similarly, although demand for gas remains strong, production capacity remains limited in the near term. Gas prices are peaking and should moderate somewhat during 2023-24, suggesting that gas revenues will follow a largely similar pattern.

Lower energy revenues will translate into less firepower to kick-start new ventures and embark upon fixed investment spending for MENA economies, having adverse repercussions on real GDP growth momentum. The 2023-24 period is one that is more ripe for the non-hydrocarbon economy than for oil and gas (but less so in the first half of 2023 due to global growth concerns), assuming COVID-19 cases will continue but have a lesser impact on the real economy due to decent - albeit varying - vaccination rates and acquired immunity.

Gulf oil exporters' currencies remain strong, in line with their anchor currency, the US dollar, amid an aggressive monetary policy tightening on behalf of the US Federal Reserve. Construction and services — particularly real estate and tourism that will continue to benefit from a recovery from pandemic-related lows — will likely outperform other sectors of the economy. In particular, we do not see higher interest rates as a major impediment to construction-related activity, given that state-driven construction and infrastructure projects are likely to remain dominant in the market.

Inflation pressures

What has been preoccupying the world perhaps more than growth of the real economy is inflation. This is mostly due to a strong increase in global commodity prices — oil, gas, wheat, and other basic commodities — after Russia's invasion of Ukraine and the ensuing international sanctions against Russia.

We estimate consumer price inflation in the MENA region to have peaked in the second half of 2022, with gradual easing throughout 2023. Our latest forecasts point to a decline of average annual consumer price index growth from 10.5% in 2022 to 7.1% in 2023 and 4.0% in 2024.

Large oil and gas exporters have greater ability to contain the pass-through of global commodity prices to consumers, for instance by capping energy prices. Average inflation in the Gulf Cooperation Council (GCC) is projected to fall from a contained 3.6% in 2022 to 2.8% in 2023 and then 2.1% in 2024. MENA hydrocarbon importers will see average consumer price inflation rise to 8.1% in 2022 before moderating to 5.0% in 2023 and 2.1% in 2024.

Higher interest rates will also contribute to the expected economic slowdown in the MENA region. Some of the region's major economies maintain a long-standing currency peg to the US dollar and are therefore raising domestic interest rates in line with the US Federal Reserve's moves. In MENA countries where currencies are not pegged to the dollar, concerned monetary authorities are raising rates to avoid capital flight to the US.

Given that US inflation is still high, we expect further US Fed tightening in the next few months, leading to additional interest rate hikes across MENA economies.

Top risks for MENA in 2023

The MENA region's aggregated real GDP growth in 2023 could surprise on the upside if the Russia-Ukraine war ends earlier than foreseen, positively affecting the global economy and easing food security concerns. An upside surprise may also occur if an energy supply shock materializes and ensures a windfall of revenues for the region's hydrocarbon exporters. However, we believe that near-term risks are heavily skewed to the downside.

These are the five key risks ahead for the MENA region:

• Deterioration of political-security conditions in the Gulf, for instance in the event of a collapse of talks between Iran and the UN Security Council's five permanent members plus Germany (P5+1), which would raise risks of military escalation.

• Pandemic-related disruptions exacerbating supply chain risks and possibly creating further food security issues for some MENA economies. The latter could be worsened by a serious escalation of the Russia-Ukraine war shutting down grain and food exports again and by the increasing frequency of extreme weather events across different parts of the world.

• A sharp slowdown in global demand constraining exports from the MENA region, be it hydrocarbon importers in North Africa reliant on demand from the European Union or hydrocarbon exporters that would suffer from a slump in energy-derived revenues.

• Further aggressive monetary policy tightening on behalf of the US Fed and spillover effects on domestic consumption and investment spending, Gulf tourism inflows, exports and sovereign debt servicing.

• Protests due to weakened purchasing power and deteriorating socioeconomic conditions, especially in MENA hydrocarbon-importing countries.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmena-regions-economic-growth-to-slow-after-strong-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmena-regions-economic-growth-to-slow-after-strong-2022.html&text=MENA+region%e2%80%99s+economic+growth+to+slow+after+strong+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmena-regions-economic-growth-to-slow-after-strong-2022.html","enabled":true},{"name":"email","url":"?subject=MENA region’s economic growth to slow after strong 2022 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmena-regions-economic-growth-to-slow-after-strong-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=MENA+region%e2%80%99s+economic+growth+to+slow+after+strong+2022+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmena-regions-economic-growth-to-slow-after-strong-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}