Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 16, 2021

IPO Lock-Up Agreements

This report IPO Lock-Up Agreements explores the role of lock-ups and examines the key differences in lock-up conventions between the U.S. and China (including Hong Kong).

This report looks into the following areas:

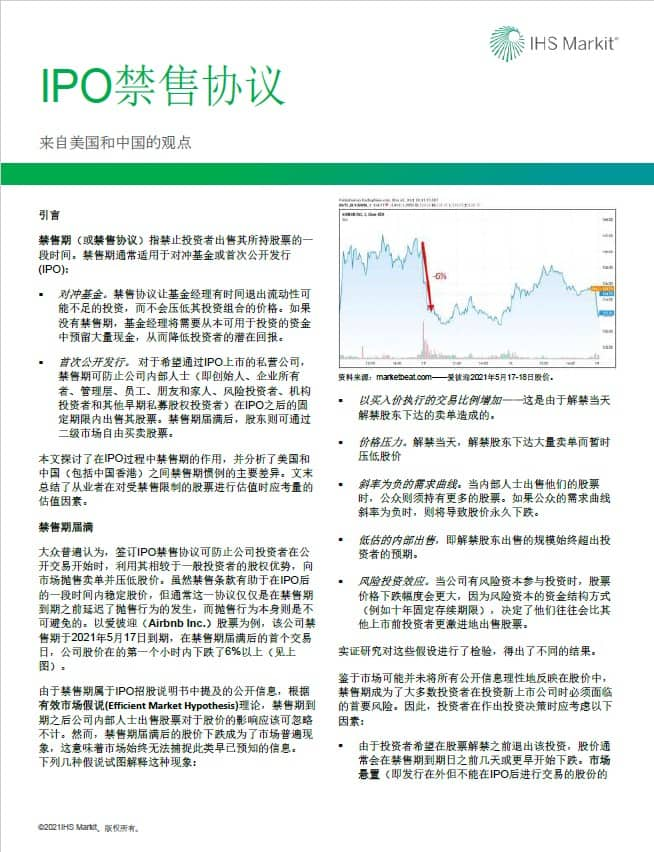

- The impact of lock-up expiration on share prices and implications for investors in newly-public companies

- How lock-up periods are determined, underwriter vs statutory lock-ups

- How to find company #IPO #lockup agreements in the U.S., China and Hong Kong markets

- Investor types affected by lock-ups, including the importance of cornerstone investors in Asian IPOs

- Examples from Airbnb Facebook and Alibaba

- Valuation considerations

| Download the report (English) | |

|  |

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fipo-lockup-agreements.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fipo-lockup-agreements.html&text=IPO+Lock-Up+Agreements+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fipo-lockup-agreements.html","enabled":true},{"name":"email","url":"?subject=IPO Lock-Up Agreements | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fipo-lockup-agreements.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=IPO+Lock-Up+Agreements+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fipo-lockup-agreements.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}