Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 07, 2021

Impact of Delta variant on major manufacturing industries

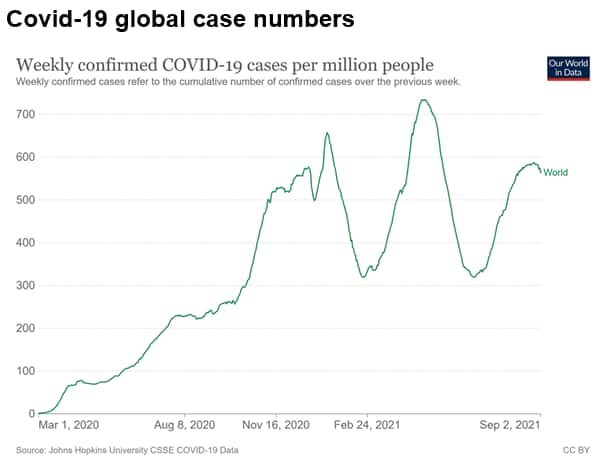

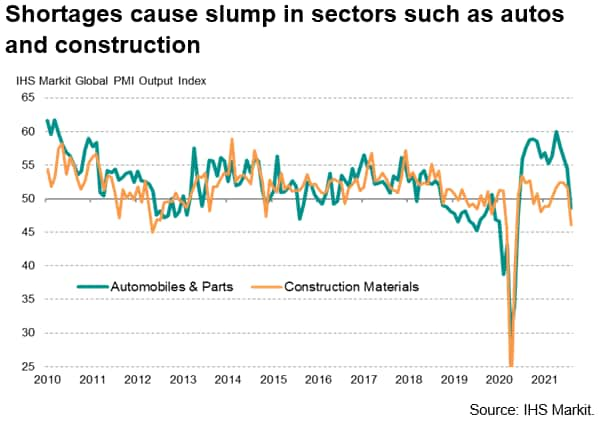

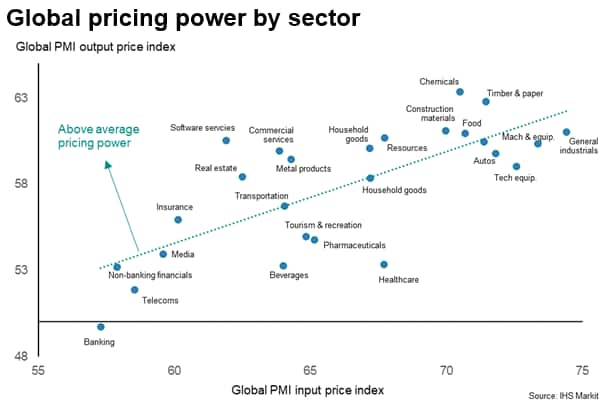

With August seeing a rise in COVID-19 case numbers globally due to the spread of the Delta variant, it was no surprise to see healthcare lead the Purchasing Managers' IndexTM (PMITM) growth rankings and hospitality slump. Similarly, growing pandemic related shortages have increasingly hit many manufacturing sectors, such as automotive and construction materials, with spill-overs to some service sectors such as IT services. Price pressures are most concentrated in those sectors reporting the greatest constraints.

IHS Markit's global PMI data, based on information collected directly from over 28,000 companies around the world, showed the pace of global economic growth slipping in August to the lowest since January. The slowdown occurred alongside a further wave of COVID-19 infections as the more contagious Delta variant spread across increasing numbers of countries, notably in Asia but also in the United States (US) and parts of Europe.

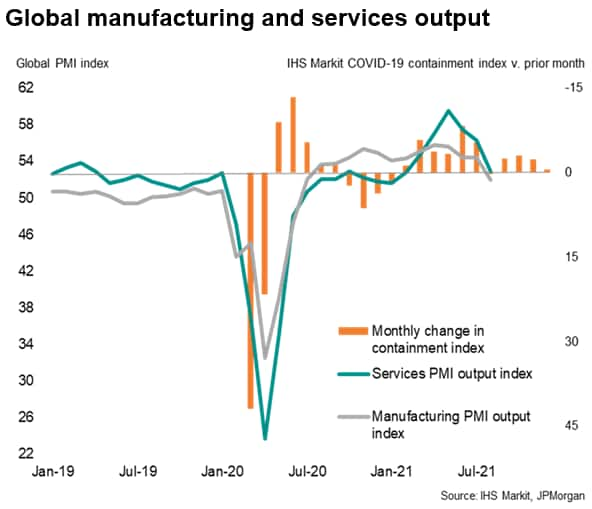

Manufacturing and service sectors output under pressure from COVID-19 spread

The manufacturing and service sectors output consequently fell in mainland China as well as a number of other smaller Asia Pacific economies, and growth slowed in the US and Europe. In 2020, the service sector output growth dropped worldwide to the lowest since February, led by the first fall in global services exports since March, and manufacturing grew at the lowest rate since the sector's recovery began in July of the same year.

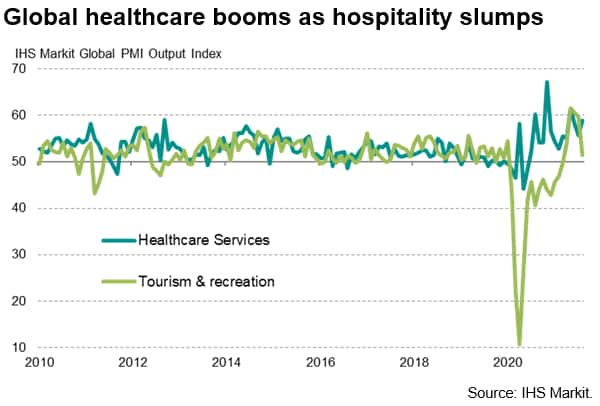

Global healthcare booms as hospitality slumps

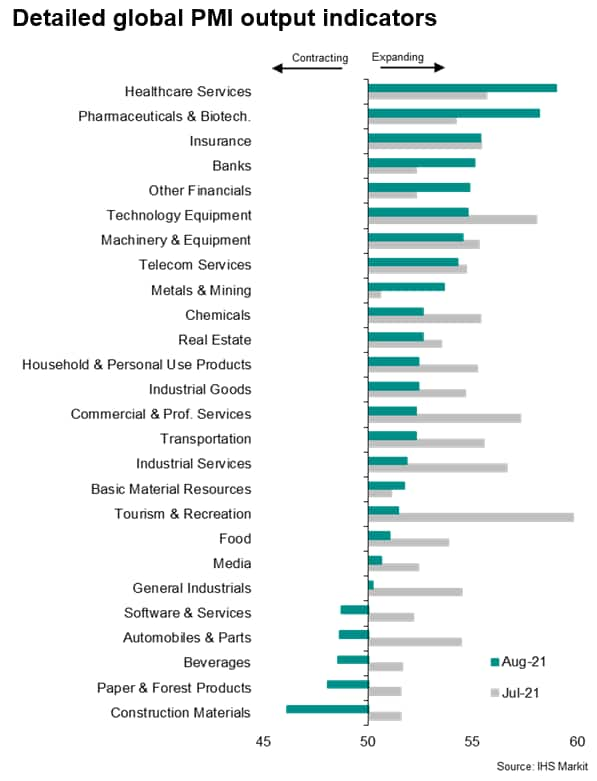

Looking deeper into the PMI data by detailed sector, the strongest expansion in August 2021 was recorded in healthcare services, reflecting the resurgence of the pandemic caused by the Delta wave. Growth of business activity in this sector was among the highest ever recorded by the survey, albeit below prior peaks seen during the pandemic.

Growth also surged higher in the pharmaceuticals and biotech sector, resulting in the joint-third-fastest overall healthcare industry growth seen since data were first available in 2009. The unusual synchronicity in the growth of healthcare and pharmaceutical sectors is driven by the combination of COVID-19 related healthcare and increasing demand for other treatments.

In contrast, growth deteriorated to the greatest extent in the tourism and recreation sector, as many economies reimposed COVID-19 restrictions and concerns over the spread of the Delta variant dampened demand for travel and other hospitality activities.

Supply issues hit manufacturing

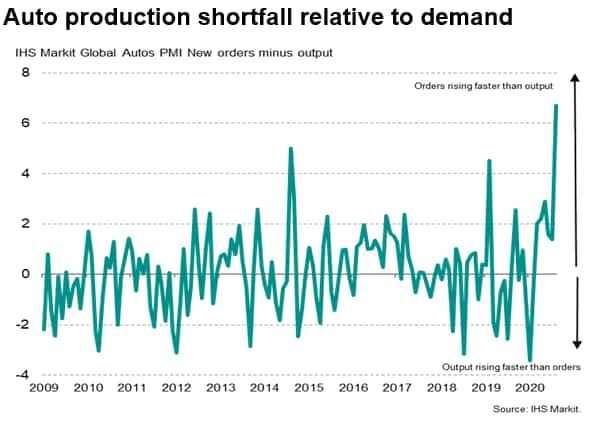

Steep slowdowns were also seen in many manufacturing sectors, most notably automotive production and construction materials, linked in many cases to supply shortages curbing production capacity.

Of the 26 detailed sectors covered by the global PMI, falling output was in fact seen in 5 sectors, 4 of which were manufacturing oriented and a fifth - IT software and services - saw activity fall in part due to a lack of tech equipment.

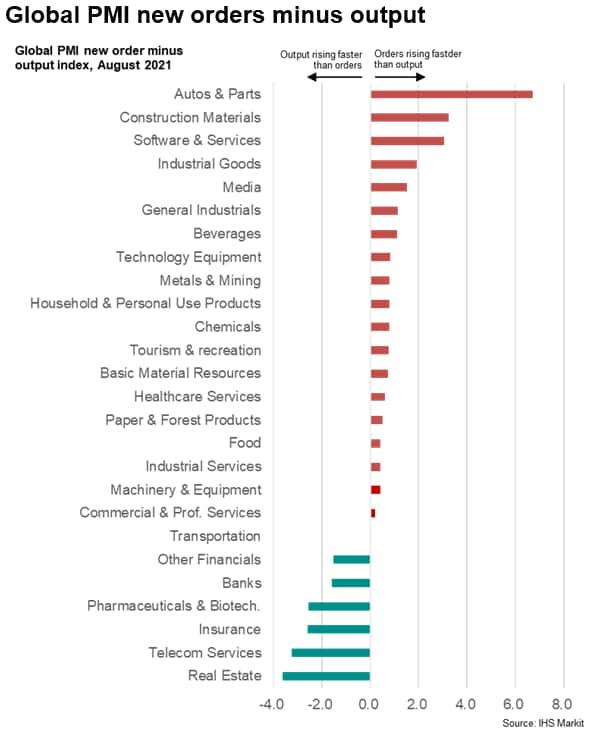

The constraints on production caused by a lack of inputs were further highlighted by certain sectors seeing output lag new orders growth. Automotive and construction materials manufacturing, for example, reported that output had fallen short of new orders to the greatest extent of the sectors covered, followed by the software and services as well as industrial goods manufacturing.

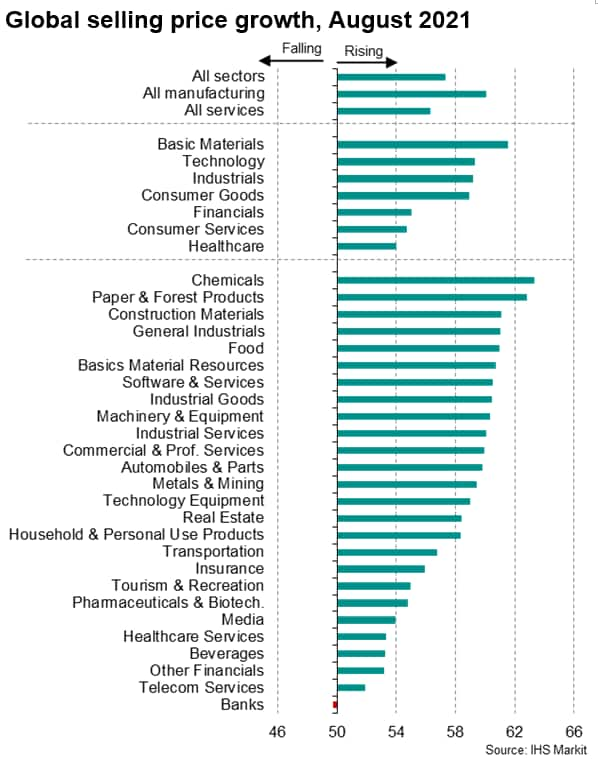

Shortages drive prices higher

Price hikes were most prevalent in sectors reporting the greatest constraints and shortages relative to demand. The steepest rise in average selling prices globally in August 2021 was therefore recorded in the chemicals (including plastics) sector, followed closely by timber and paper producers.

Only banking services reported lower selling prices in August.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fimpact-of-delta-variant-on-major-manufacturing-industries.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fimpact-of-delta-variant-on-major-manufacturing-industries.html&text=Impact+of+Delta+variant+on+major+manufacturing+industries+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fimpact-of-delta-variant-on-major-manufacturing-industries.html","enabled":true},{"name":"email","url":"?subject=Impact of Delta variant on major manufacturing industries | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fimpact-of-delta-variant-on-major-manufacturing-industries.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Impact+of+Delta+variant+on+major+manufacturing+industries+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fimpact-of-delta-variant-on-major-manufacturing-industries.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}