H1 revenues were close to an all-time high

DOWNLOAD PDF VERSION

Securities lending specials revenues climbed to an all-time high during H1 2023, pushing total revenues to the second-best half year ever.

During the first half of the year, securities finance revenues reached levels not seen since 2008. Whilst being a little way off 2008 levels, the best year on record for revenues (H1 2008 $8.4B), securities lending generated $7.02B during H1 2023.

During Q1, $3.414B was generated (+27% YoY) and during Q2 $3.605B (+7% YoY) was generated. Over the period, strong average fees helped to push revenues higher. Across all equities, H1 average fees were 87bps (+19% YoY) whilst across government bonds average fees stood at 18bps (+34% YoY). Corporate bonds continued to experience strong demand and commanded an average fee of 46% (+47% YoY).

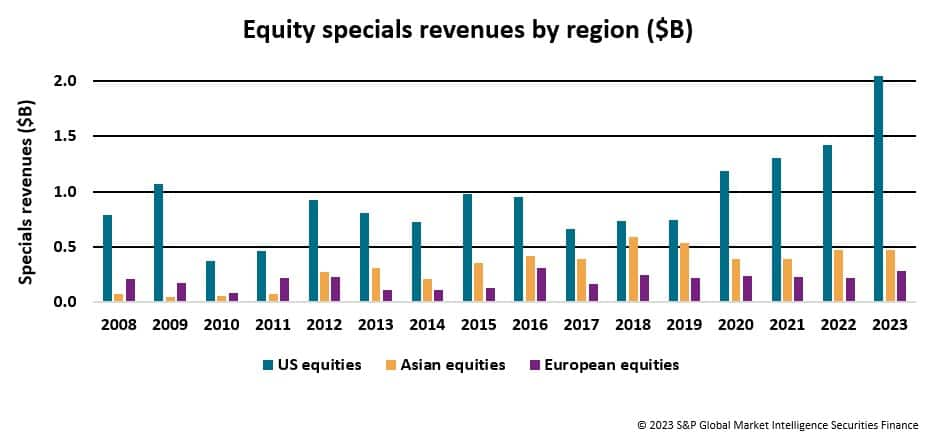

One of the strongest drivers of revenues throughout H1 was seen in the specials market (loan agreed with a fee > 500bps). US equity specials experienced their best half year period ever, generating $2.049B in revenues. This represents a 44% increase YoY.

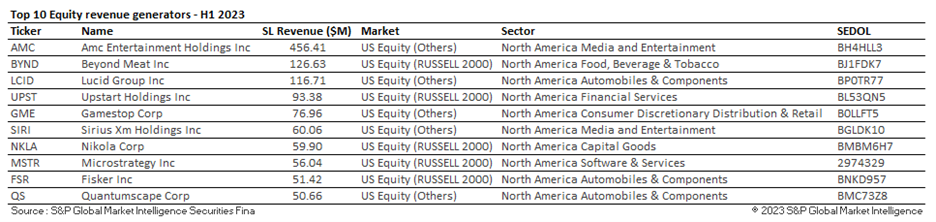

All the top ten generating stocks over the H1 period were US equities. AMC alone generated in excess of $450M over the first six months of the year as the arbitrage opportunity between the preference and ordinary shares sent utilization and average fees higher.

Heading into the second half of the year, elevated average fees continue to produce healthy returns. As the economic situation starts to evolve with a decline in the pace of interest rate hikes, a reduction in inflation and ever-increasing equity markets driven higher by the interest in artificial intelligence, H2 is shaping up to be just as interesting as H1.

For more information on how to access this data set, please contact the sales team at:

Global-EquitySalesSpecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.