Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 10, 2022

Global recession watch: Inflation at a fever pitch

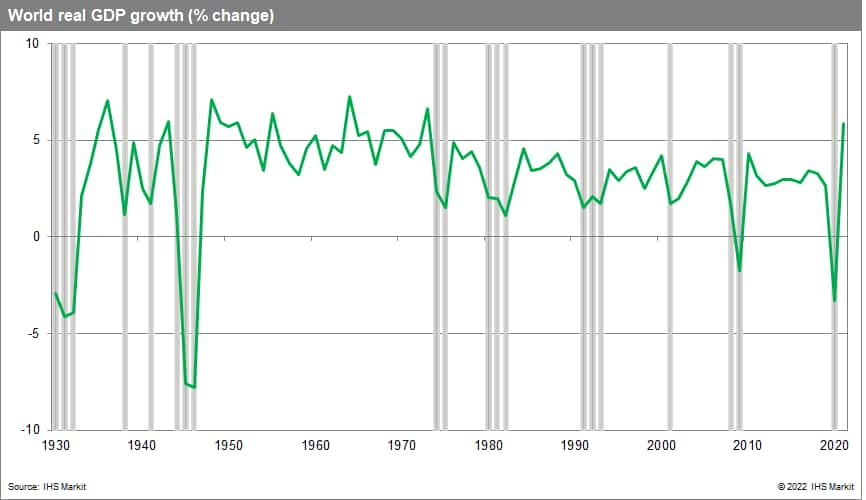

The global business climate is deteriorating in mid-2022, putting forecasters on recession watch. With inflation at a fever pitch, central banks are quickly raising interest rates, aiming to slow the growth of aggregate demand and achieve a better alignment with supply. It's a difficult balancing act, and recession risks are high amid Russia's brutal war with Ukraine, soaring energy prices, ongoing supply chain disruptions, endemic COVID-19, and financial market turbulence.

Real global GDP is likely to have declined in the second quarter of 2022, pulled down by contractions in emerging Europe, mainland China, and the United States (US). The downturn was largely the result of two shocks - Russia's invasion of Ukraine on 24 February, and lockdowns in mainland China in response to a March-April surge in COVID-19 cases.

Absent new shocks, the global economy can avert a recession and resume growth in the second half of 2022. Mainland China is cautiously recovering, and Asia Pacific's emerging markets are achieving solid growth even as European and US economies struggle.

Consumer spending has dominated the global business cycle in 2020-22 and will be pivotal in the year ahead. High inflation is eroding household purchasing power, sending consumer sentiment indicators to new lows in some regions. In advanced countries, household finances are bolstered by accumulated savings and asset appreciation in 2020-21. However, the withdrawal of fiscal stimulus and downturns in asset prices are new headwinds to growth. Recoveries in travel, tourism, and consumer services are offset by downturns in spending on goods.

Adverse financial conditions will pose downside risks to global growth, as the impacts of tightening monetary policies play out in late 2022 and 2023. Financing costs are rising for businesses, consumers, home buyers, and governments. Housing and commercial construction markets are especially vulnerable to rising interest rates. Investors' flight to safety will bring elevated risks for emerging and developing countries that depend on capital inflows to finance trade and fiscal deficits. A related concern is the rise in debt levels in recent years.

As in the global recessions of 1974-75 and the early 1980s, energy prices are a driving force in inflation and economic growth, given the key role of energy as an input across goods and services sectors. Lean inventories, limited spare capacity, and changes in supply dependencies following Russia's invasion of Ukraine could send prices higher, especially during seasonal peaks in demand. Europe is particularly vulnerable.

Recessions are typically characterized by the depth, breadth, and duration of a decline in economic activity. A concise definition of a global recession is an annual decrease in world real GDP per capita. Our current forecast does not meet this criterion in 2022 or 2023, since projected global real GDP growth is near 2.5% and global population growth is about 1%.

Recession signposts

- Declining new business orders, signaling future production cuts.

- Falling commodity prices, indicating softening demand.

- Deflation of housing market bubbles, especially in regions that saw in-migration as the pandemic accelerated the work-from-home trend.

- A further decline in equity prices, signaling a weak earnings prospects or increased uncertainty about economic outlook.

- Rising inventory-to-sales ratios, indicating the need for inventory drawdowns.

- New waves of COVID-19 virus infections, affecting labor supply, travel, and consumer spending on services.

Start making guided decisions today with end-to-end coverage of political, violent, sovereign, banking and investment risk worldwide offered by our geopolitical risk intelligence solutions.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recession-watch-inflation-at-a-fever-pitch.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recession-watch-inflation-at-a-fever-pitch.html&text=Global+recession+watch%3a+Inflation+at+a+fever+pitch+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recession-watch-inflation-at-a-fever-pitch.html","enabled":true},{"name":"email","url":"?subject=Global recession watch: Inflation at a fever pitch | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recession-watch-inflation-at-a-fever-pitch.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+recession+watch%3a+Inflation+at+a+fever+pitch+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recession-watch-inflation-at-a-fever-pitch.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}