Global recession risk eases as PMI climbs to six-month high in January

Global business activity fell for a sixth straight month in January, according to the S&P Global PMI surveys, based on data provided by over 30,000 companies, though the rate of decline was only marginal and the smallest seen over the past six months. As such the data helped allay concerns of near-terms global recessions risks.

The outlook has also brightened, as forward-looking business expectations data showed prospects to have brightened globally, rising sharply to reach the highest since last May. Brighter prospects were linked to lowered inflation expectations as well as the reopening of the Chinese economy.

Global business activity steadies in January

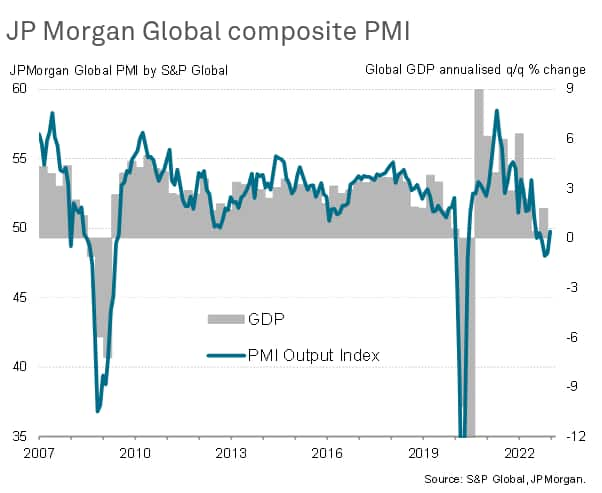

A second successive monthly rise in the global PMI's headline output index has helped to allay worries of a worldwide recession. At 49.8, up from 48.2 in December, the Global PMI - compiled by S&P Global across over 40 economies and sponsored by JPMorgan - signalled the smallest drop in output seen over the past six months.

By edging closer to the 50.0 no change level, the index points to a near-stabilisation of business activity after a downturn in the fourth quarter which had been the steepest recorded since the global financial crisis, if the initial pandemic lockdown months of early 2020 are excluded. In fact, model-based comparisons of the PMI with GDP suggest that January's survey index upturn is consistent with a marginal growth in global GDP.

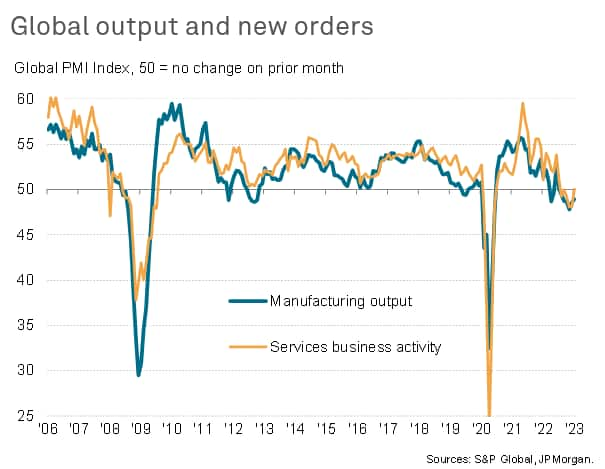

Particularly welcome news came from the service sector, where business activity edged back into growth territory for the first time since last July, albeit only registering a marginal expansion. However, there were also encouraging news from the manufacturing sector where, although output fell for a sixth straight month, the decline was only modest and the smallest recorded for five months.

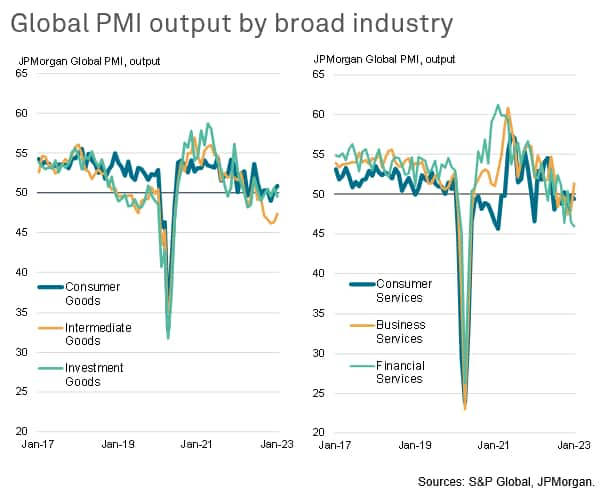

Weakness led by financial services

Broad industry data show the weakness of the global economy to have been again led by financial services and producers of intermediate goods (products sold to other manufacturers as inputs), respectively reflecting higher interest rates and destocking as manufacturers seek to adjust its inventory holdings in the face of weaker demand and fewer supply worries.

Lower output was recorded for consumer services and in the production of investment goods, but consumer goods output and business services activity both showed modest expansions. More detail on the sub-sectors will become available on 6th February.

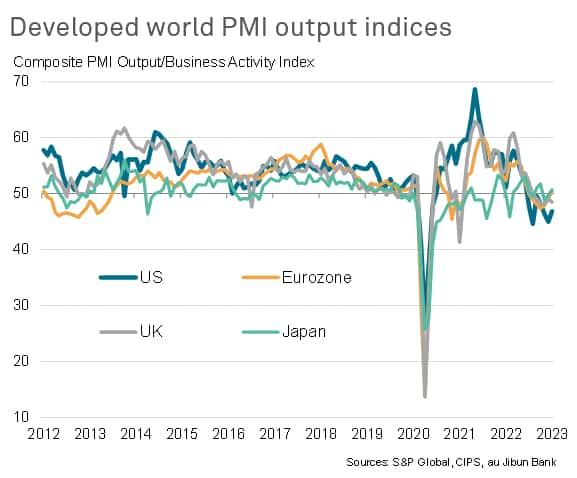

Eurozone and Japan show signs of reviving growth, US and UK downturns cool

Looking at the major developed economies, the most encouraging signals came from Europe. The eurozone edged back into growth territory, albeit only marginally, for the first time in seven months, while the UK reported only a minor drop in output, registering the smallest decline for six months. These data suggested that recessions could be avoided in Europe, or might at least be less severe than thought likely earlier in the winter.

While the S&P global PMI for the US meanwhile pointed to a sustained robust downturn, raising the possibility of GDP falling in the first quarter, the rate of contraction moderated to likewise encourage views that any recession may not necessarily be as deep as previously feared.

Business activity in Japan joined the eurozone in expansion territory, with output growing for the first time in three months as a robust expansion of service sector activity offset a substantial manufacturing decline. However, the overall rate of growth remained only modest.

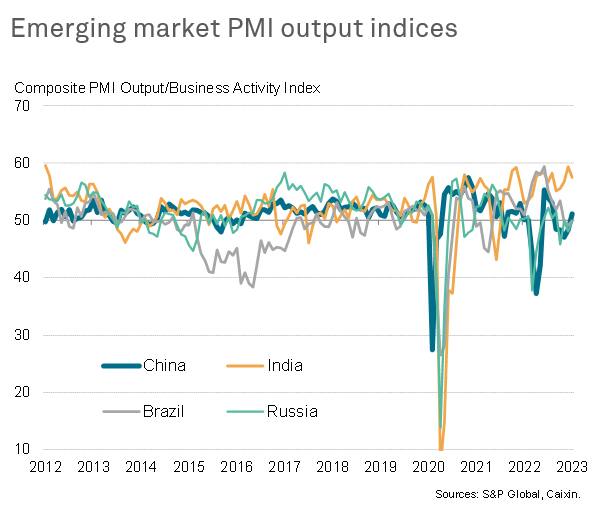

India leads emerging markets, China returns to growth

India meanwhile continued to lead the major emerging markets, its rate of expansion cooling but remaining among the highest seen over the past decade.

Growth was also reported in mainland China, with business activity rising for the first time since last August attributed to reviving spending amid the reopening of the economy. Leading the upturn in China was the service sector, though the manufacturing sector's recent decline also moderated.

While falling output was again reported in Brazil and Russia,

the contractions were very marginal, with the pace of deterioration

having moderated in both cases.

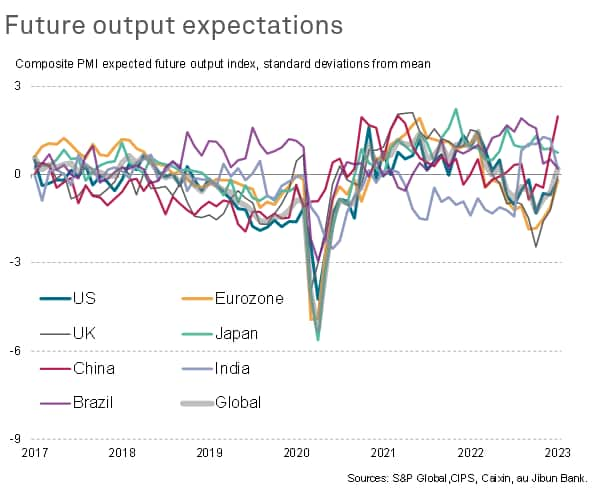

Confidence lifts higher

As for what the future holds, the PMI survey's gauge of companies' expectations of their own output in the coming year provides some source of encouragement. Business confidence lifted higher worldwide in January, rising to an eight-month high. The improvement had the noteworthy effect of pulling confidence above its long-run average for the first time since last May.

Sentiment was lifted by expectations of inflation to have peaked, meaning the cost of living squeeze and interest rates will also likely peak, though the anticipation of improved global demand and supply emanating from the relaxation of COVID-19 restrictions in mainland China was also often reported. Sentiment in China rose to the joint-highest for a decade, matched by a similar high in Hong Kong SAR. Improved confidence in the US, Eurozone and UK was not, however, matched by brighter outlooks in India, Japan and some other parts of Asia, in part reflecting some diversion of trade back to China.

Access the global PMI press release here

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.