Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 26, 2021

Global real GDP will reach a new peak in the second quarter of 2021

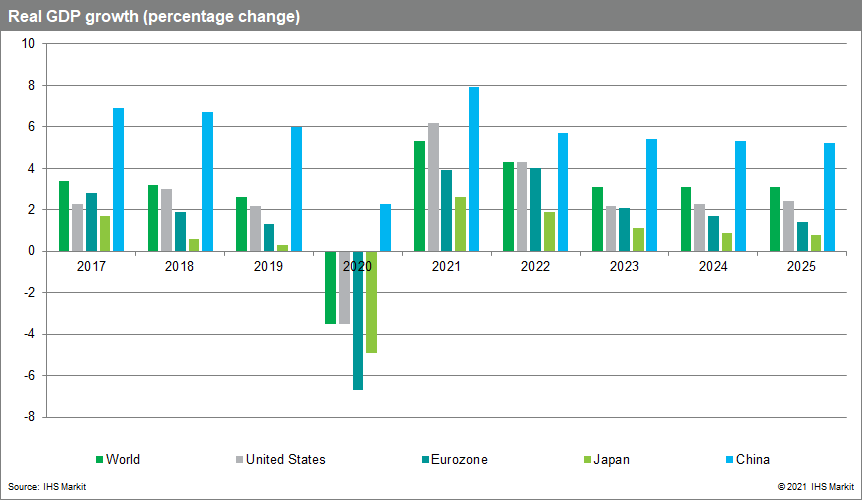

After a pause in the first quarter of 2021, the global economic expansion has resumed in the second quarter, lifting output above its pre-pandemic high. Recovery from the recession—which saw world real GDP plunge nearly 10% from the fourth quarter of 2019 to the second quarter of 2020—has taken four quarters. Robust growth in the United States and mainland China led the recovery. After a contraction of 3.5% in 2020, global real GDP is projected to increase 5.3% in 2021 and 4.3% in 2022 before settling to a 3.1% growth pace in 2023-25. However, performances will vary across regions, with Asia-Pacific and North America leading and Europe and Latin America lagging.

Yet, this recovery milestone comes as the World Health Organization reports a record high in the weekly incidence of COVID-19 cases in mid-April, underscoring the reality that the pandemic continues to suppress economic activity in many parts of the world. About 90% of new infections are spread evenly across Europe, southeast Asia, and the Americas. Indeed, new lockdowns of nonessential activity pose a downside risk to India's outlook.

Consumer spending will drive global expansion forward.

During the pandemic, household spending shifted from services to information technology, home furnishings, food at home, and recreational equipment. As COVID-19-related restrictions are eased and more people are vaccinated, spending on travel, sporting, and cultural events, dining out, and personal services will revive. In many advanced countries, household finances, on average, have strengthened as a result of fiscal stimulus payments and rising equity and home prices. After a 5.2% global decline in 2020, real private consumption is projected to advance 5.3% in 2021 and 4.9% in 2022.

Fixed investment displays divergent regional and sectoral patterns.

Globally, real fixed investment fell 3.0% in 2020, a milder decline than the 4.4% drop in 2009 during the Global Financial Crisis. Aggressive monetary easing by major central banks resulted in an ample supply of credit at relatively low interest rates. Residential investment benefitted from low mortgage rates and migration from cities to suburbs. Businesses invested heavily in information processing equipment. In contrast, commercial construction was hit hard by lockdowns and the accelerated trend toward working from home. The collapse in oil and other commodity prices during the early stages of the pandemic contributed to sharp 2020 declines in fixed investment in Latin America, the Middle East, and Africa.

A broadening economic recovery, buoyant equity markets, firming output prices, and increased risk tolerance will lead to resilience in capital spending. Global real fixed investment is projected to rise 6.2% in 2021 and 4.6% in 2022 due to strong North America and Asia-Pacific gains.

Global trade and tourism will revive as the pandemic subsides and consumer spending picks up.

After a 7.8% drop in 2020, global real exports of goods and services are projected to rise 7.1% in 2021 and 5.1% in 2022. With stability in real exchange rates, export gains should be broadly based. The strongest growth rate in import demand will come from the United States, Asia-Pacific, and the Middle East. The recovery in international travel and tourism will proceed gradually, gaining momentum in 2022.

The US economy is heating up—2021 growth will be the fastest since 1984.

IHS Markit economists have raised the forecast of US real GDP growth to 6.2% (from 5.7%) in 2021 and to 4.3% (from 4.1%) in 2022 in response to strong data on consumer spending, an acceleration in the vaccination campaign, and the relaxation of containment measures by many states. This improvement will push real GDP to a new peak in the current quarter and eliminate the gap between potential and actual output in 2022. The previous employment peak will be regained in late 2022, and the unemployment rate is projected to decline to 3.5% by mid-2023.

COVID-19 is delaying Europe's economic recovery, but consumer spending is ready to surge.

While several European countries (including Germany, Russia, and the Netherlands) will regain pre-pandemic output levels in late 2021, a full recovery will take until late 2022 in the United Kingdom and France and mid-2023 in Italy and Spain. Signs of a rebound are emerging as vaccination rollouts progress, sentiment improves, and exports and manufacturing post strong gains. After activity restrictions are eased, growth in services consumption should surge. IHS Markit economists estimate that excess savings of eurozone households amounted to 3.8% of GDP in the final three quarters of 2020. Saving rates are expected to decline sharply in the second half of 2021, fueling robust economic growth.

After an initial surge, mainland China's economy faces a protracted slowdown.

Real GDP growth is projected to pick up from 2.3% in 2020 to 7.9% in 2021 as momentum shifts from exports and real estate investment to consumer spending and investment in manufacturing. Growth will slow to 5.7% in 2022, resuming a downward trend in response to deleveraging, an aging population, and diminishing productivity gains.

Real estate-related activities, which account for about 29% of mainland China's GDP, are a vulnerability. Since mid-2020, signs of renewed speculation have prompted regulators to reintroduce purchase and sale restrictions on households and tighten sources of developer financing. Long-term headwinds to economic growth increase the urgency of de-risking policies to promote financial stability.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-real-gdp-will-reach-new-peak-q2-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-real-gdp-will-reach-new-peak-q2-2021.html&text=Global+real+GDP+will+reach+a+new+peak+in+the+second+quarter+of+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-real-gdp-will-reach-new-peak-q2-2021.html","enabled":true},{"name":"email","url":"?subject=Global real GDP will reach a new peak in the second quarter of 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-real-gdp-will-reach-new-peak-q2-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+real+GDP+will+reach+a+new+peak+in+the+second+quarter+of+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-real-gdp-will-reach-new-peak-q2-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}