Global PMI selling price inflation remains elevated in April, led by higher service sector charges

Average prices charged for goods and services rose worldwide at a rate broadly in line with the average seen over much of the past year, thereby remaining elevated by pre-pandemic standards. Service sector inflation in particular remained stubbornly higher, with rates of inflation most elevated in Spain, Italy, Japan and the United Kingdom.

Global prices rise at elevated rate

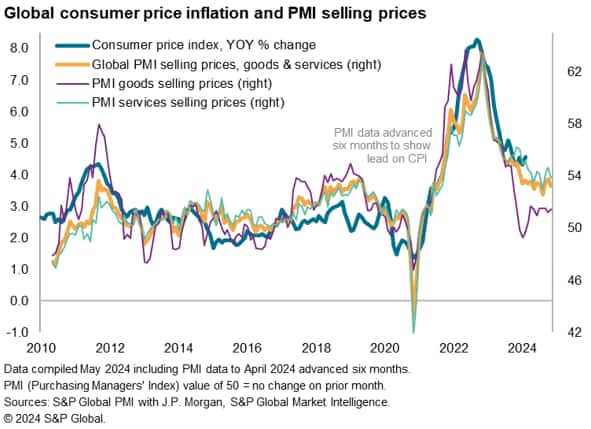

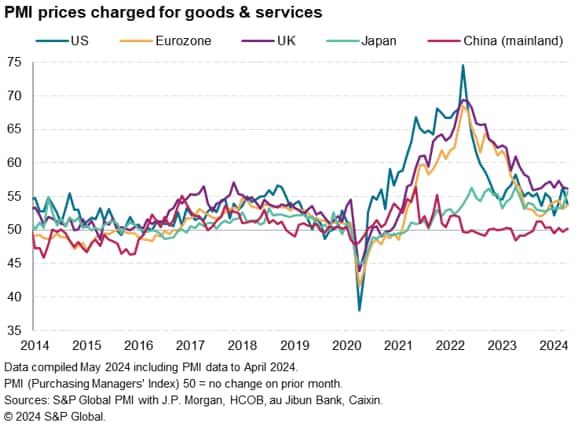

Worldwide PMI survey data compiled by S&P Global showed average prices charged for goods and services having risen globally at the slowest rate for three months in April, the rate of inflation cooling from March's ten-month high. The composite PMI Prices Charged Index fell from 53.8 in March to 53.2 in April. However, the rate of increase remains only marginally below the average seen over the past 11 months, a period which has seen the index stuck in a close range between 52.6 and 53.8. By comparison, this index averaged just 51.2 in the decade preceding the pandemic; a time when global consumer price inflation averaged 2.7%. The recent PMI readings are consistent with global inflation running at 3.5-4.0%.

With the PMI data tending to lead changes in the annual rate of global consumer price inflation by around six months, provides a valuable steer on the likely near-term path of inflation. The suggestion from the PMI is that global inflation looks likely to remain sticky at an elevated level by historical standards as we head into the second half of 2024.

Stubborn service sector inflation

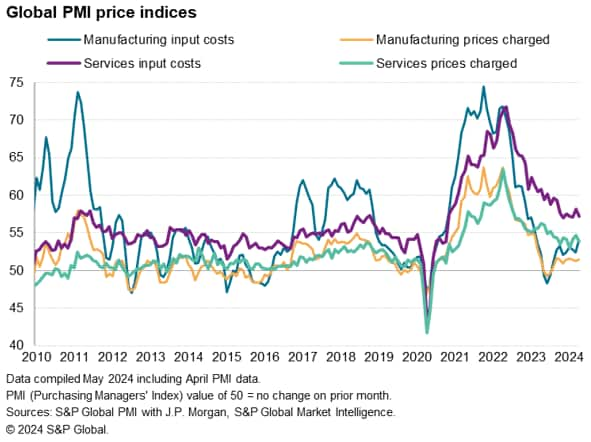

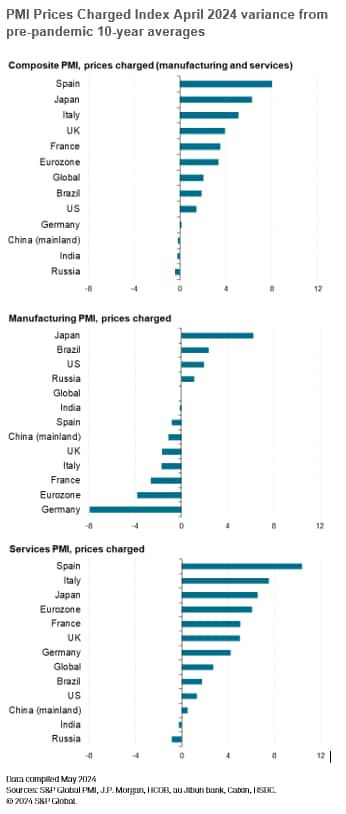

The main area of stubborn global price pressure remains the service sector where, despite the rate of inflation cooling globally in April, price growth remained well above the pre-pandemic average. By contrast, the rate of inflation for manufactured goods was only marginally above the pre-pandemic decade average, albeit ticking higher from March. The increase in the latter was driven by increased input cost growth, which picked up to a 14-month high. Service sector input costs, in contrast, rose at a reduced rate.

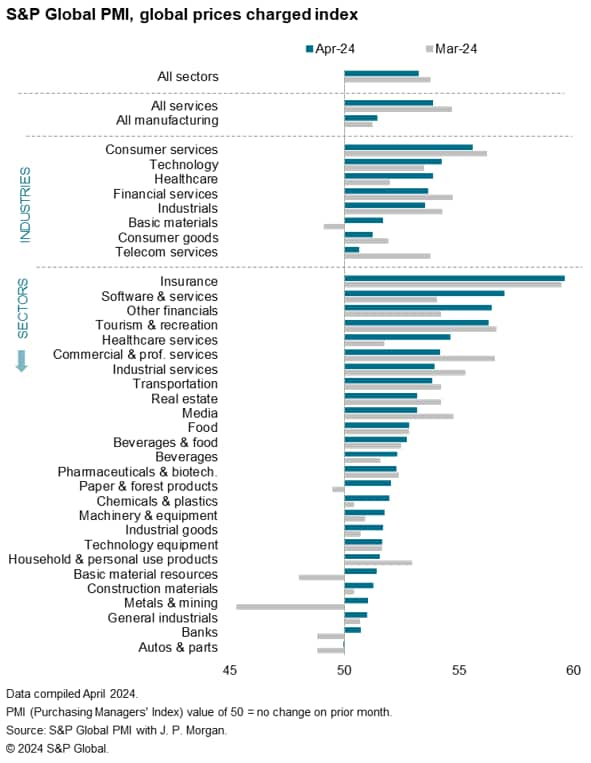

Drilling further into the sector detail of selling price inflation, the steepest rises worldwide were seen for consumer services in April, followed by technology, healthcare and financial services. Relatively modest price growth was meanwhile reported for telecom services, consumer goods and basic materials.

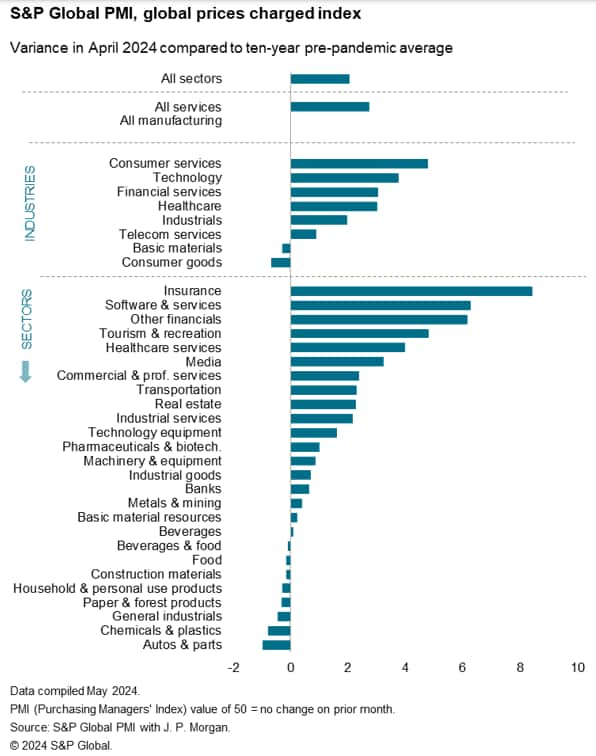

At a more detailed sector level, insurance led the global price increase rankings, which is also the sector where price growth is the most elevated by historical standards, as measured by comparisons against the pre-pandemic average.

UK, Spain and Japan see steepest price hikes

Geographically, especially steep rates of selling price inflation were recorded in the UK, Spain and Japan in April. However, the rate of increase slowed to a seven-month low in the UK and a four-month low in Spain, and also fell to a three-month low in the US, contrasting with a 12-month high in Japan. The rate of selling price inflation in the eurozone as a whole picked up but remained below levels seen earlier in the year.

To assess how elevated the rates of inflation are by historical standards, we can compare with pre-pandemic ten-year averages. This shows especially elevated inflation rates in the southern eurozone members states of Spain and Italy, as well as in the UK and Japan.

PMI selling price indices are currently running 8.0 points higher than pre-pandemic levels in Spain, and 6.3, 5.1 and 3.9 points higher in Japan, Italy and the UK respectively. For the eurozone as a whole, the Prices Charged Index was 3.3 points above the pre-pandemic average, which compared with just 1.4 in the US. Selling price gauges for Russia, India and mainland China were notably below their pre-pandemic ten-year averages in April.

Access the Global Composite PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.