Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 02, 2023

Global manufacturing remains in the doldrums as demand continues to weaken

The JPMorgan Global Manufacturing Purchasing Managers' Index™ (PMI™) compiled by S&P Global, signalled a largely stalled factory sector in September, the PMI registering 49.1 compared to 49.0 in August. The latest reading indicated a marginal deterioration in business conditions for a thirteenth successive month.

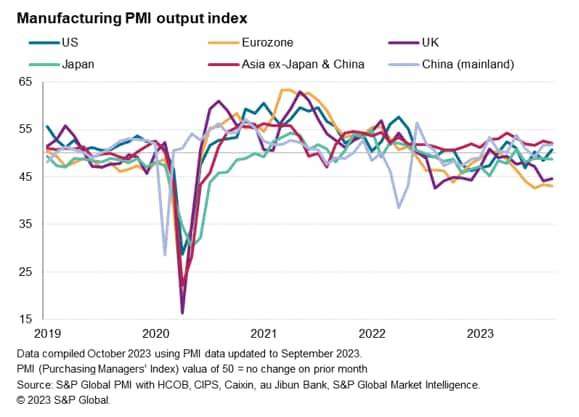

Europe continued to see the steepest downturn, followed by Japan, leaving the rest of Asia and the US as key areas of growth.

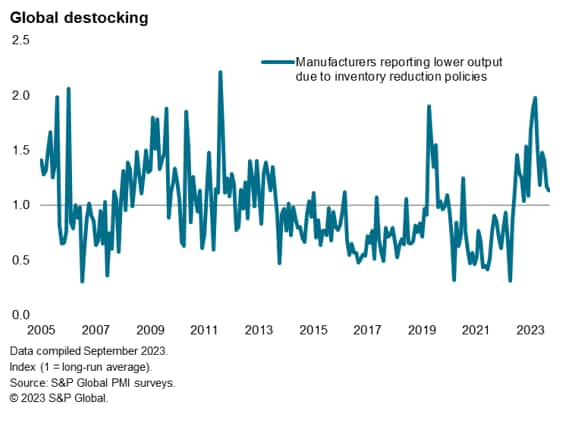

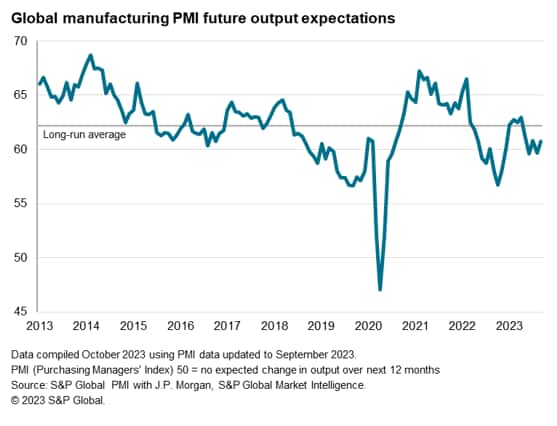

While improved supply helped producers fulfil backlogs of orders, a lack of new orders led to a further marginal decline in production. Falling global trade flows and ongoing inventory reduction policies remained key drags on factory output, though the latter is showing some signs of having peaked. Companies expectations of output in the year ahead nevertheless remained in the doldrums, running well below the survey average despite lifting slightly higher compared to August, to hint at no imminent improvement.

Global factory output remains under pressure from falling demand

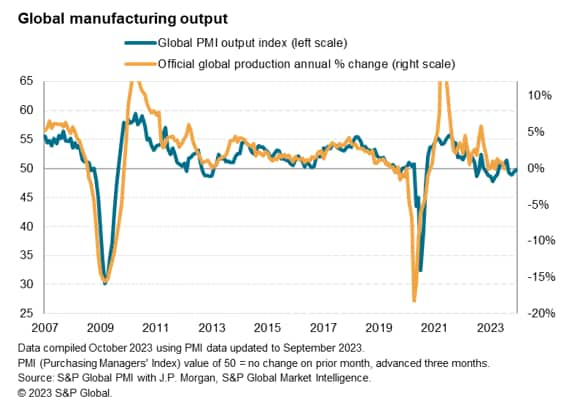

Global manufacturing output fell marginally for a fourth consecutive month in September, according to the latest PMI surveys compiled by S&P Global and sponsored by JP Morgan. At 49.7, up from 49.4 in August, the output index from the Global Manufacturing PMI - our preferred measure of current factory production - signalled a slight easing in the rate of contraction for a second successive month but has now indicated falling output in ten of the past 14 months.

Official data, compiled from various national statistical agencies, has shown a similar lacklustre performance over the past year, with global output consequently running 0.1% below that of a year ago in July (the latest month for which data are available for the major economies) based on our calculations.

Looking at the largest economies, production continued to fall at solid rates in both the eurozone and UK in September, and declined to a lesser extent in Japan. In contrast, output continued to rise in mainland China and in the rest of Asia, with a return to modest growth also recorded in the US.

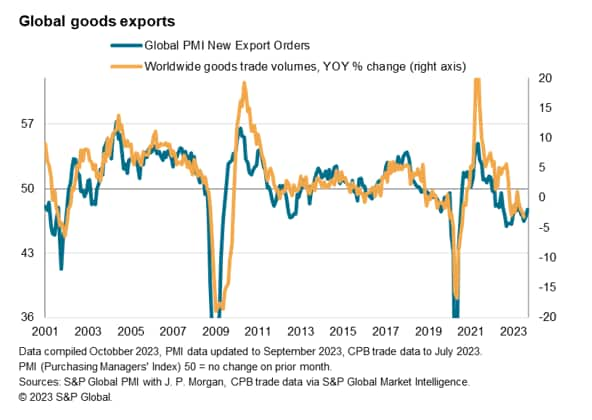

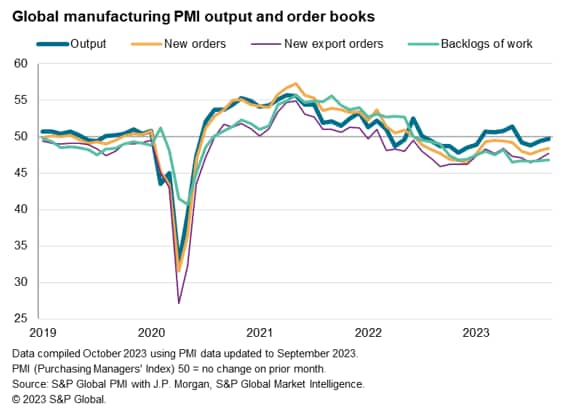

The recent manufacturing production malaise is attributable to an ongoing deterioration in demand, as indicated by a fifteenth successive monthly decline in new orders received by factories worldwide in September. Leading the downturn in orders was further marked drop in global trade, as measured by new export orders received by manufacturers around the world, which continued to fall at one of the steepest rates seen since the global financial crisis.

Some encouragement can be gleaned from the rate of loss of new orders moderating during the month, but the pace of decline remained greater than the decline in production, meaning producers once again had to eat into their backlogs of work to help sustain current production levels. Backlogs of orders, which had accumulated to an unpreceded degree during the supply constraints of the pandemic, consequently also fell for a fifteenth straight month in September.

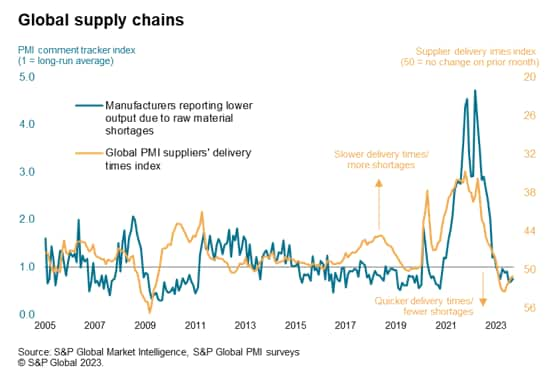

Improved supply chains

Improved delivery times have helped producers fulfil orders this year, with average supplier delivery times shortening on average in September for an eighth month in a row. These faster deliveries contrast with the unprecedented supply chain delays and shortages seen during the pandemic.

However, some key components remain in short supply, and various other factors have acted as headwinds. According to PMI survey respondents, weak demand - notably from a disappointing mainland China recovery, high prices, and a post-pandemic switch in demand from goods to services, have all contributed to falling global order books this year, with deglobalisation acting as an additional drag on global trade flows.

Further destocking

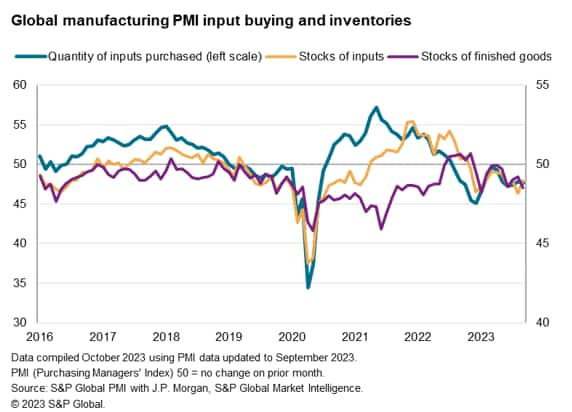

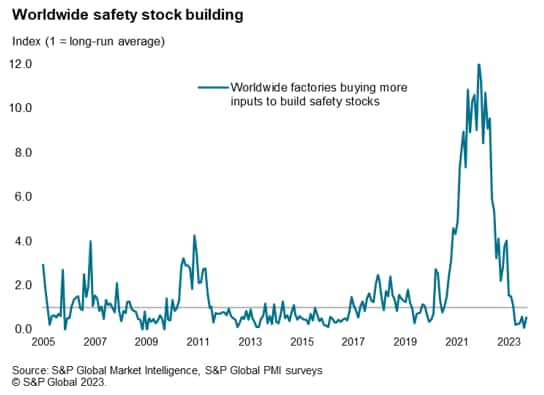

Destocking also continued to play a role in subduing global production and demand in September. The amount of inputs bought by manufacturers continued to fall sharply, dropping at a faster rate than production in a sign of widespread ongoing inventory management.

Stocks of raw materials fell accordingly, down for an eleventh successive month. Part of the raw material inventory decline was attributed to companies no longer needing to retain high levels of safety stocks, as witnessed during the pandemic.

Stocks of finished goods were also allowed to fall, dropping for the ninth time in the past ten months, often as a result of deliberate cost-cutting inventory reduction policies. However, the incidence of factories deliberately unwinding their stock holdings of finished goods due to destocking policies has fallen sharply since peaking back in March to hint that the drag on production from the inventory cycle may turn soon.

Outlook

Worries about recession risks and the impact of higher-for-longer interest rates were key factors denting optimism about production in the coming year. Future output expectations remained well below their long-run average in September despite picking up slightly on August, led by improved expectations in the US. The data suggest companies are not anticipating any imminent overall improvement in the global manufacturing situation, though we continue to watch the inventory cycle for signs that production may see some support from this area as we head into 2024.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-remains-in-the-doldrums-as-demand-continues-to-weaken-oct23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-remains-in-the-doldrums-as-demand-continues-to-weaken-oct23.html&text=Global+manufacturing+remains+in+the+doldrums+as+demand+continues+to+weaken+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-remains-in-the-doldrums-as-demand-continues-to-weaken-oct23.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing remains in the doldrums as demand continues to weaken | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-remains-in-the-doldrums-as-demand-continues-to-weaken-oct23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+remains+in+the+doldrums+as+demand+continues+to+weaken+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-remains-in-the-doldrums-as-demand-continues-to-weaken-oct23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}