Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 22, 2021

Global economic outlook: Will faster economic growth bring higher price inflation?

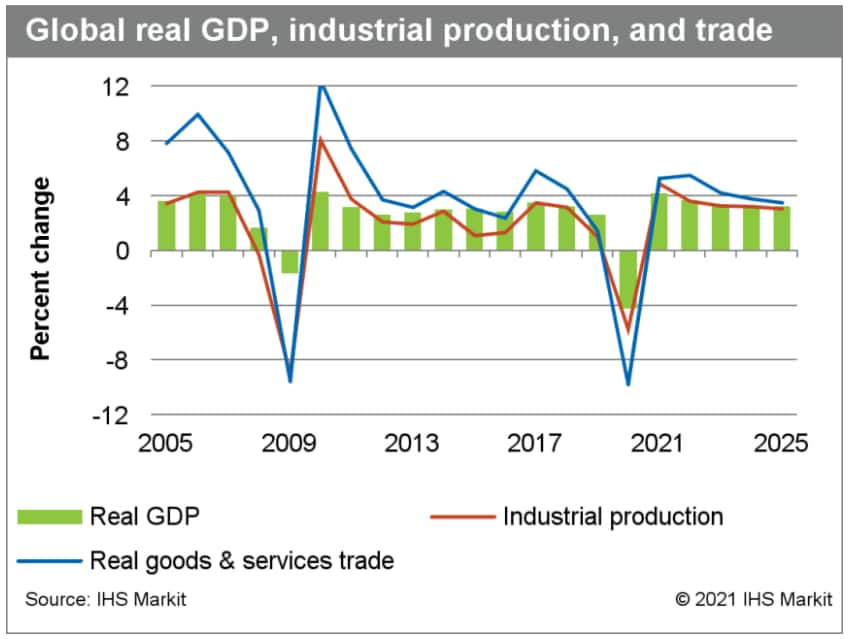

The global economy showed resilience in the second half of 2020, exceeding expectations set during the darkest days of the COVID-19 pandemic. Aggressive monetary and fiscal stimuli, improving confidence, and the end of the strictest government-mandated lockdowns contributed to buoyant financial markets and recoveries in consumer and business demand. World real GDP fell 3.6% in 2020, a better outcome than the 5.5-6.0% declines predicted last May to July, but still the worst outcome since 1946. Western Europe, Latin America, India, the Middle East, and North Africa were hit particularly hard by the pandemic, lockdowns, and plummeting export revenues. Yet, several economies managed to grow in 2020, including mainland China, Taiwan, Vietnam, Egypt, Ireland, and Turkey.

Global economic growth will strengthen in the second quarter.

The global recovery has paused temporarily in the first quarter of 2021 as another wave of COVID-19 virus infections and new lockdowns dealt much of Western Europe a setback. As vaccinations accelerate and activity restrictions are eased, consumer spending will revive, lifting global output to a new peak by the third quarter of 2021. Businesses will gain confidence in the recovery's durability and move forward with new investments. World real GDP is projected to advance 5.1% in 2021 and 4.3% in 2022 before settling to a more sustainable 3.1% growth pace in 2023-25.

The United States and mainland China are leading the global expansion. US real GDP is projected to increase 5.7% in 2021 and 4.1% in 2022, as the lift from the new USD1.9-trillion fiscal stimulus package is partially offset by headwinds from rising long-term interest rates. Mainland China's economy is expected to grow a robust 7.8% in 2021 as the recovery in consumer demand gains traction with effective COVID-19 virus containment. Growth will slow to 5.7% in 2022, resuming a downward trend in response to deleveraging and diminishing productivity gains.

As the global economy recovers, inflationary pressures are building.

In several markets, strengthening demand is colliding with pandemic-constrained supply, driving up prices. The IHS Markit Materials Price Index has surged 44% since early November 2020, standing 75% above its year-earlier level during the week ended 12 March. Price increases have been broadly based, encompassing metals, lumber, energy, chemicals, fibers, and semiconductors. As these price increases move downstream, prices of finished goods and services are accelerating. Led by accelerations in the United States and other advanced economies, global consumer price inflation is projected to pick up from 2.1% in 2020 to 2.8% in 2021.

A full year into the pandemic, global supply chains remain disrupted. In February, the IHS Markit Purchasing Managers' Index™ (PMI™) surveys found that manufacturing delivery times were the second longest in history (after April 2020) owing to materials shortages and shipping delays. Logistics are challenged by shortages of shipping containers, air cargo capacity reductions, and the shift to online retail sales. Consumer spending has shifted from travel, hospitality, and personal services to information and communications technology, home furnishings, and recreational goods. Shortages of semiconductors have constrained production of vehicles and electronics. The persistence of commodity price pressures will depend largely on how quickly supply bottlenecks are resolved. Although semiconductor markets will remain tight in 2021, available capacity in most industries looks sufficient to meet projected demand in 2021 and 2022 if operating rates improve.

Policy stimulus and the resilience of consumer demand as economies reopen will be primary forces affecting inflation. Household savings surged in 2020 in response to government stimulus payments and COVID-19 containment measures. Accumulated "excess" savings during the pandemic are estimated at over USD3 trillion globally and could drive a faster resurgence in consumer demand than the forecast anticipates. Monetary policies are expected to remain highly accommodative, resulting in ample credit availability.

Using the IHS Markit Global Link Model, we developed an alternative scenario in which stronger global demand growth and more persistent supply bottlenecks lead to a sharper acceleration in wages and prices than in the baseline forecast. The stimulus in the American Rescue Plan Act rapidly pushes the US economy to full employment and its potential output limit. Under stronger demand conditions, cost increases are readily passed downstream. With central banks initially tolerating above-target inflation, inflation expectations rise. Ultimately, higher inflation requires a more aggressive tightening of monetary policies, restraining economic growth. In the high-inflation scenario, global consumer price inflation averages 0.7 percentage point higher in 2022-25. Although global real GDP growth is 0.8 percentage point higher this year, the incremental gains are quickly reversed in 2022 and growth remains slower than in the baseline forecast through 2025.

While inflation is clearly an upside risk to the forecast, a return to the double-digit inflation rates seen in the mid-1970s and early 1980s is unlikely. Many of the current supply disruptions are temporary. Indeed, as supply conditions improve, IHS Markit analysts expect a significant correction in industrial materials prices in the remainder of 2021. Outside of North America, gaps between potential and actual output remain large in many economies. It will be several years before the global unemployment rate—estimated at 8.1% in 2021—returns to its 2018 cyclical low of 6.5%. Since the 1980s, inflation targeting has become conventional policy for central banks in developing, emerging, and advanced countries. Policy vigilance has kept global inflation in single digits during the past three decades and anchored inflation expectations around 2% in the advanced countries. Meanwhile, cost-of-living escalators that fueled wage-price spirals in the past are much less prevalent. International price competition facilitated by the rise of global trade has also restrained inflation.

Bottom line

The global economy will achieve solid growth in 2021 and 2022 as the COVID-19 pandemic subsides. Price inflation will pick up in the months ahead, but the pace is likely to be moderate rather than high as supply conditions improve.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-economic-growth-inflation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-economic-growth-inflation.html&text=Global+economic+outlook%3a+Will+faster+economic+growth+bring+higher+price+inflation%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-economic-growth-inflation.html","enabled":true},{"name":"email","url":"?subject=Global economic outlook: Will faster economic growth bring higher price inflation? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-economic-growth-inflation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economic+outlook%3a+Will+faster+economic+growth+bring+higher+price+inflation%3f+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-economic-growth-inflation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}