Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 18, 2023

Rising uncertainty, rising risks

The Israel-Gaza war adds to already elevated uncertainty. A major escalation in the conflict would make a material difference to economic prospects and our forecasts. Impacts are already apparent via various channels, including higher energy prices. Having tumbled in early October amid worries about excess inventories and weak global demand, crude oil prices have rebounded markedly since,although the Brent price remains below its late September peak. Natural gas prices have also jumped, hitting six month-highs in Europe, although they are also still well below prior peaks. Energy price swings have contributed to recent volatility in S&P Global Market Intelligence's Material Price Index (MPI), although an upward trend is increasingly evident.

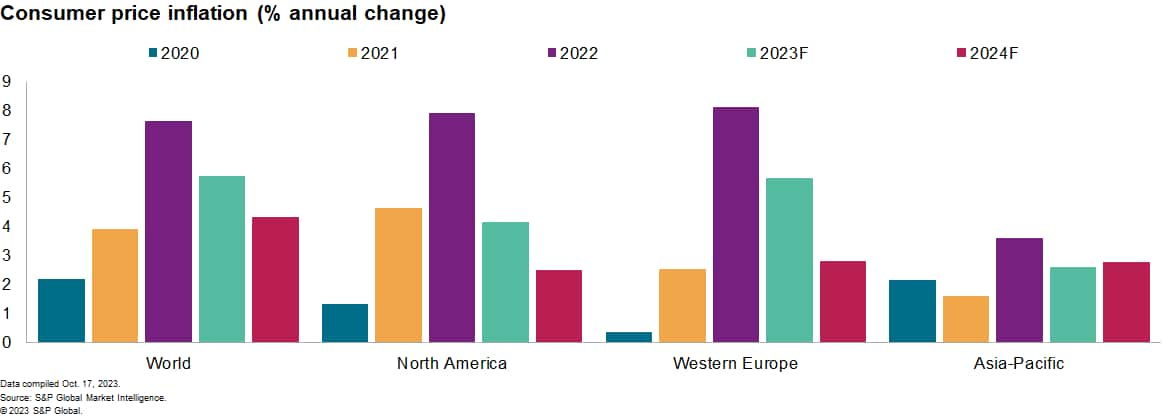

2024 inflation forecasts have been revised upward again across most regions. Having initially tumbled from the peak during autumn 2022, the moderation in global consumer price inflation is temporarily stalling given energy-related pressures. Our latest forecast of annual global consumer price inflation in 2024 of 4.3% — while still below the 2023 estimate of 5.7% — is more than a percentage point higher than our January forecast. Global producer price inflation will remain subzero in the near term. A return to positive territory is expected in early 2024 and our forecast has been lifted in line with recent rebounds in the MPI and surveys of industrial firms' pricing intentions. Purchasing Managers' Index™ (PMI™) data compiled by S&P Global show that manufacturing price indexes are on an upward trajectory since mid-2023 yet remain well below their 2021-22 highs.

Financial conditions are shaping up to be tighter for longer. Prior to the tensions in the Middle East, longer-term sovereign bond yields were soaring. Bear-steepening pressures in the US Treasury market partly reflect concerns over heavy supply, while watered down fiscal plans drove intra-eurozone yield spreads wider, particularly in Italy. Higher yields have been doing some of the tightening for central banks, reinforcing our view that peak policy rates have been reached already or are close at hand. Nonetheless, persistent concerns over underlying price pressures suggest rate cuts in advanced economies remain some way off. Equity markets have also suffered a setback, with demand for safe-haven assets keeping the US dollar stronger for longer.

Central bank easing expectations continue to shift. Increased uncertainty related to geopolitical developments is contributing to our forecast of a delay in the US Federal Reserve's final rate hike from November to December 2023, with the expected peak level unchanged at 5.50%-5.75%. Given the shift in the Fed's "dots plot," our forecast now incorporates a somewhat later and slower reversal of policy tightening, with the federal funds rate expected to return to 2.50%-2.75% only in late 2026. The forecast pace of easing from some other central banks is also being tempered accordingly. Futures markets have moved to discount policy rate cuts in the US and Western Europe only from the second half of 2024, in line with our forecast.

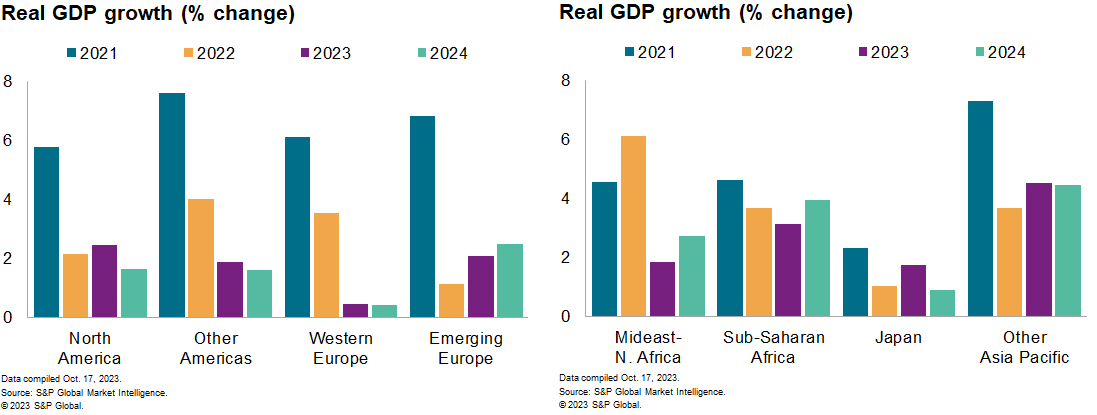

Global growth is forecast to slow over the coming quarters. Our annual global real GDP growth forecast for 2023 remains unchanged at 2.6% in October's update, although this masks an expected halving of average quarter-over- quarter growth rates during the second half of the year (0.4%) compared to the first. The global growth aggregate also masks significant regional differences; the contrast between continued strong US growth and Western Europe heading for recession is one, and has contributed to currency weakness in the latter. Annual global real GDP growth is forecast to slow to 2.3% in 2024, with the risk of a more prolonged period of weakness increasing.

Global PMI data continue to signal subdued growth. The J.P.Morgan Global Composite PMI by S&P Global has fallen for four straight months, although September's decline was marginal. The global manufacturing output index was sub-50 for the fourth month in a row, with services barely in expansion territory. While the rate of contraction in manufacturing output and orders has been moderating, October's flash PMI data could well show an adverse reaction to recent developments in the Middle East.

US annual growth rates have been revised up, although a slowdown is still on the cards. We have revised up our forecast of annual US real GDP growth for 2023 to 2.5% and for 2024 to 1.6%. The upward revision to the latter reflects carryover effects related to strength over the second half of 2023 and the third quarter particularly.

Western Europe is on track for mild recession, with a mixed picture elsewhere. We retain our below-consensus growth forecasts for the eurozone and the UK, with underperformance generally expected in the most industry-sensitive economies. Across most regions, the divergence of country-level growth performance is a key theme. Mainland China's real GDP growth forecasts for 2023 and 2024 are unchanged in October's update, with signs of stabilization following the recent policy stimulus.

Learn more about our economic data and insights

Listen to our Economics and Country Risk podcast

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-2023-october-rising-uncertainty-rising-risks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-2023-october-rising-uncertainty-rising-risks.html&text=Rising+uncertainty%2c+rising+risks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-2023-october-rising-uncertainty-rising-risks.html","enabled":true},{"name":"email","url":"?subject=Rising uncertainty, rising risks | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-2023-october-rising-uncertainty-rising-risks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Rising+uncertainty%2c+rising+risks+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-2023-october-rising-uncertainty-rising-risks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}