Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 16, 2023

Different strokes in economic growth

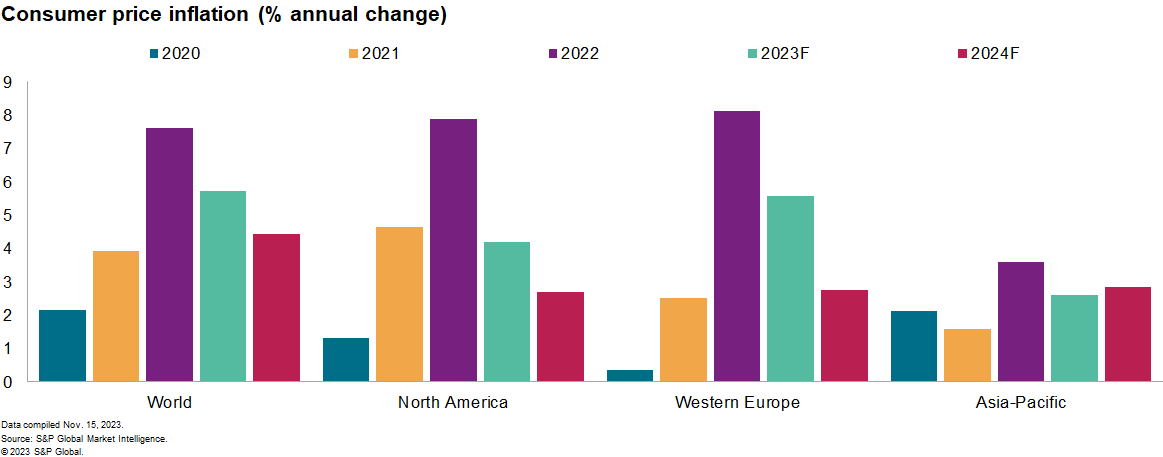

Recent news on inflation has been more encouraging. The latest consumer price inflation releases in the US, the eurozone and the UK all surprised market consensus expectations to the downside to varying degrees. Crude oil prices have also fallen back from their recent conflict-related peaks, while Purchasing Managers' Index TM (PMITM) data compiled by S&P Global have been showing a welcome moderation in service-sector price indexes. On the other hand, our in-house Materials Price Index has continued its recent rebound, albeit from levels way below the peaks in 2022, as have manufacturing PMI price indexes. Our forecast for global consumer price inflation in 2024 has edged up to 4.4%, driven primarily by upward revisions in the Americas. This compares with an estimated 5.7% average in 2023, with a further moderation to 3.1% forecast in 2025.

We continue to expect monetary policy pivots in advanced economies from mid-2024. Consistent with the improving signs from recent inflation data, futures markets now discount a stream of policy rate cuts across advanced economies during 2024. An initial 25-basis-point rate cut by the European Central Bank is almost fully priced in by April, with close to 100 basis points of cumulative cuts factored in by end-2024. This looks a little overdone in our view. While the eurozone's economic performance has disappointed consensus expectations, validating our expectation of downward surprises, lingering concerns over underlying price pressures in the eurozone will lean in favor of a somewhat more cautious approach from the ECB.

The outlook for US monetary policy is less clear-cut. Although the US Federal Reserve has maintained a tightening bias, markets have concluded that the hiking cycle is over. Consequently, term yields have fallen, equity prices have rebounded and the dollar has depreciated. The net result is a reversal of some of the tightening in US financial conditions since August, which we had considered a potential substitute for additional rate hikes. Given this and still-tight labor market conditions, our base case remains for the Fed to raise its policy rates one last time in December to a peak of 5.50%-5.75%, with a reversal forecast to follow from June 2024 onward. This call is dependent on incoming data, however, and so remains under review.

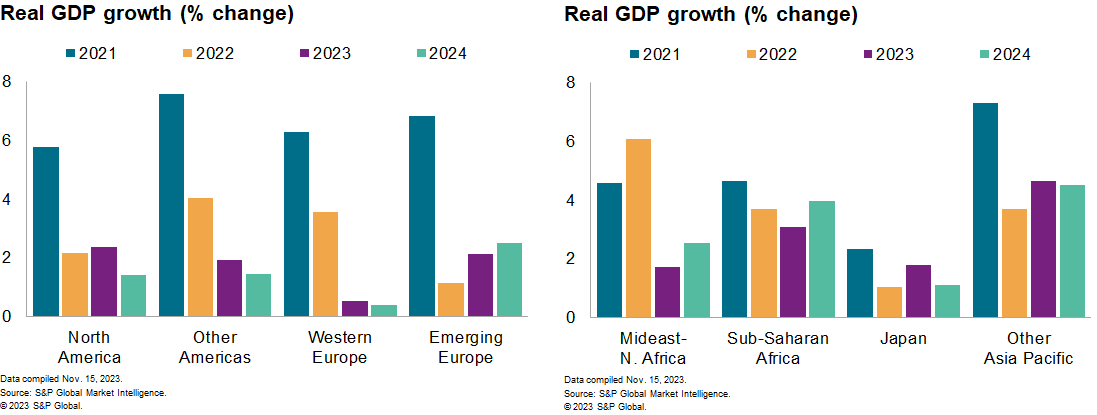

Our global growth forecast for 2024 remains at a subpotential 2.3%. November's annual global real GDP growth forecast for 2024 is unchanged from October, although this masks significant revisions at the national level. Downward adjustments to growth forecasts for the US, Canada and eurozone, for example, have been offset by upward revisions elsewhere, including for mainland China and Japan. As the net result, we continue to forecast a marked slowdown in quarter-over-quarter global real GDP growth rates over the coming quarters compared with the first half of 2023. Downside risks include escalation of conflicts in Eastern Europe and the Middle East, related disruptions to energy supply and prices, sticky core inflation rates, and tighter-for-longer financial conditions.

Global PMI data continue to flag a broad-based loss of momentum. The JPMorgan Global Composite PMI by S&P slipped to 50.0 in October, its lowest reading since January. The manufacturing output index contracted for the fifth straight month, with weakness also evident in new orders, purchases, inventories and employment. The rate of expansion in services weakened for the fifth month running, with the slowdown also broad-based across subcomponents.

Recent growth divergence in the US and Western Europe will not last. We continue to forecast "technical" recessions across many parts of Western Europe during the second half of 2023, including the eurozone and UK. In tandem with weakness in initial third-quarter GDP prints, high-frequency activity data and sentiment surveys have generally remained soft heading into the final quarter of the year. Echoing our long-standing view, the Bank of England's latest analysis of downbeat UK economic prospects has emphasized that the full effects of tighter financial conditions are yet to be felt.

Growth prospects in North America are set to weaken markedly in 2024. We have revised down our forecast of US real GDP growth in 2023, to 2.4%, and in 2024, to 1.4%. This year's revision reflects third-quarter growth that, while remarkably robust at almost 5% annualized, fell a little short of our forecast. In addition, the mix of growth, with final sales weaker and inventory investment stronger than expected, led to a markdown of expected fourth-quarter growth to a well below-potential rate of 1.1%. More of the same is expected during 2024 as tighter financial conditions work through. Our forecasts for Canadian growth have also been revised markedly downward in 2023 and particularly 2024. This is largely due to weakness in household consumption, reflecting the impact of high borrowing costs and tight credit conditions.

The growth outlook across and within other regions is mixed. We have revised up our growth forecasts for mainland China in 2023 and 2024 to 5.2% and 4.7%, respectively. This primarily reflects stronger-than-expected growth in the third quarter, the improvement in some of August's and September's data, and unexpected fiscal stimulus. Elsewhere in the Asia-Pacific region, India remains a hot spot, with its robust industrial sector continuing to buck the global trend, while Japan's upward revisions for 2024 and 2025 growth partly reflect the government's recently announced stimulus measures. The Israel-Hamas conflict has led to various adjustments to our forecasts for the Middle Eastern and North African region, with expected overall annual growth in the region lowered for 2023-25. The forecast growth rates for Latin America have also been pared back for 2024-25.

Learn more about our economic data and insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-2023-november-different-strokes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-2023-november-different-strokes.html&text=Different+strokes+in+economic+growth+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-2023-november-different-strokes.html","enabled":true},{"name":"email","url":"?subject=Different strokes in economic growth | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-2023-november-different-strokes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Different+strokes+in+economic+growth+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-2023-november-different-strokes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}