Ghana's economic downturn moderates amid debt deal

The economic downturn in Ghana's private sector softened at the start of 2023 as inflationary pressures showed signs of easing. This, allied with an agreement with the IMF and a deal on a debt exchange programme, provides hope that the economy can move into recovery mode in the coming months. Indeed, companies were at their most optimistic for a year in January.

Softest decline in output since last August

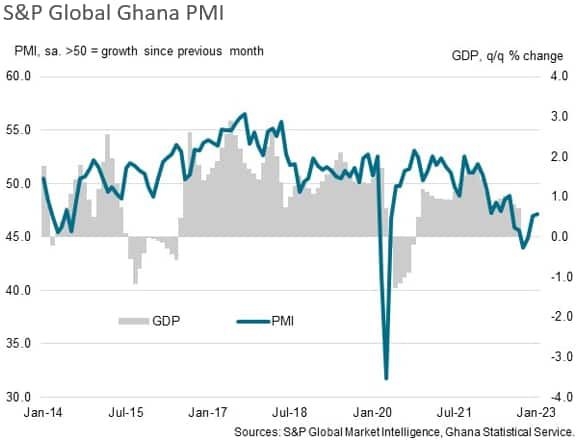

The January S&P Global Ghana PMI survey signalled a further marked reduction in business activity in the private sector as intense inflationary pressures again acted to restrict customer demand. That said, the latest fall in output was the softest since August last year, suggesting that the worst of the downturn may have passed.

After pointing to a decline in GDP in the final quarter of 2022, the latest data are consistent with an increase for the first quarter of 2023, should the picture in January be maintained through February and March. This would thereby reduce the risk of the economy falling into a technical recession.

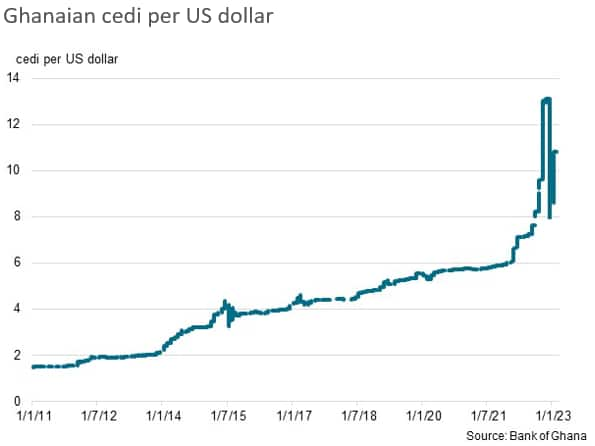

In November we highlighted the impact that public finance issues and currency depreciation were having on businesses. Since then, there have been some more positive developments. A staff-level agreement with the IMF was achieved, while recently further agreements on debt exchange plans with financial-sector trade bodies have been made, keeping those plans on track.

These deals have provided some respite for the cedi, which appreciated against the US dollar in December before losing some of that ground again in January.

Meanwhile, Ghana's central bank has been on a sustained cycle of interest rate hikes, with the main policy rate now standing at 28%, almost double the level from a year ago.

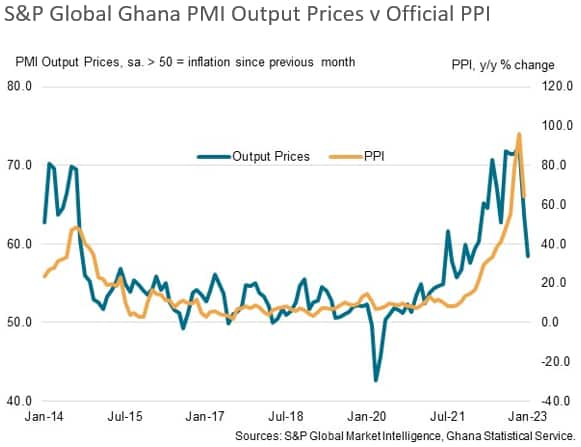

Interest rate rises and an improved currency position have alleviated cost pressures to some extent, according to PMI data. January saw purchase price inflation ease to the weakest since February 2021, well down on the rates seen late last year. In turn, output prices increased at the slowest pace in just over a year.

The PMI price trends are consistent with official data on producer prices, where the rate of year-on-year inflation came off November's high to a still elevated, but softer, 64.1% in December. This should subsequently help consumer price inflation to moderate as it feeds through the system.

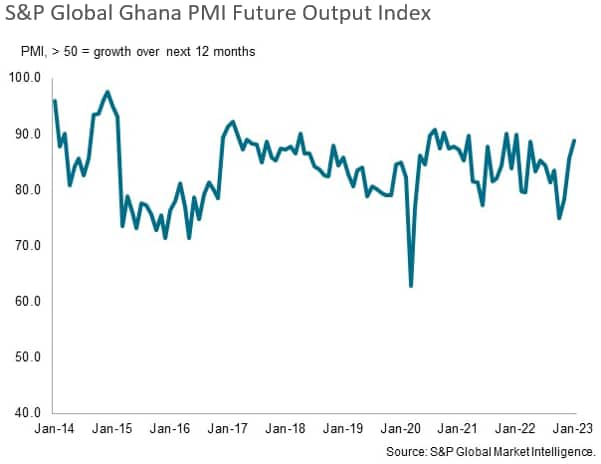

Business confidence at one-year high

Signs that the worst of the downturn has passed fueled optimism among companies that 2023 will prove to be a positive year. PMI data showed business sentiment rising for the third month running in January to the highest for a year. Some 81% of respondents predicted an increase in activity in the coming year to signal one of the most positive pictures seen over the past five years.

While there could be further turbulent times ahead, firms will be hoping that recent improvements can be sustained as the year progresses.

Andrew Harker, Economics Director, S&P Global Market Intelligence

Tel: +44 1491 461 016

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.